G

lobal hedge funds and private equity firms are increasingly targeting Japanese companies in an effort to unlock potentially ¥25 trillion ($165 billion) in undervalued real estate assets. This trend is driven by a growing recognition of the hidden value of property held on corporate balance sheets, which has become a key theme behind several high-profile activist campaigns and mergers and acquisitions in Japan this year.

Elliott Investment Management's recent 5.03% stake in Tokyo Gas Co., for instance, highlights the potential for unrealized gains from real estate sales. The US firm estimates that Tokyo Gas's real estate portfolio is worth around ¥1.5 trillion, nearly equal to the utility company's entire market value. This discrepancy arises from an accounting quirk where Japanese companies record property values at book value, rather than market value.

As Japan's property prices have surged in recent years, particularly in metropolitan areas, companies can realize significant profits by selling their real estate holdings at market value. This strategy is now gaining traction among investors who see Japanese companies as undervalued. Private equity deals like the $4 billion buyout of Fuji Soft Inc. and activist stakes by Elliott, Palliser Capital, and 3D Investment Partners reflect this growing focus on unlocking real estate value.

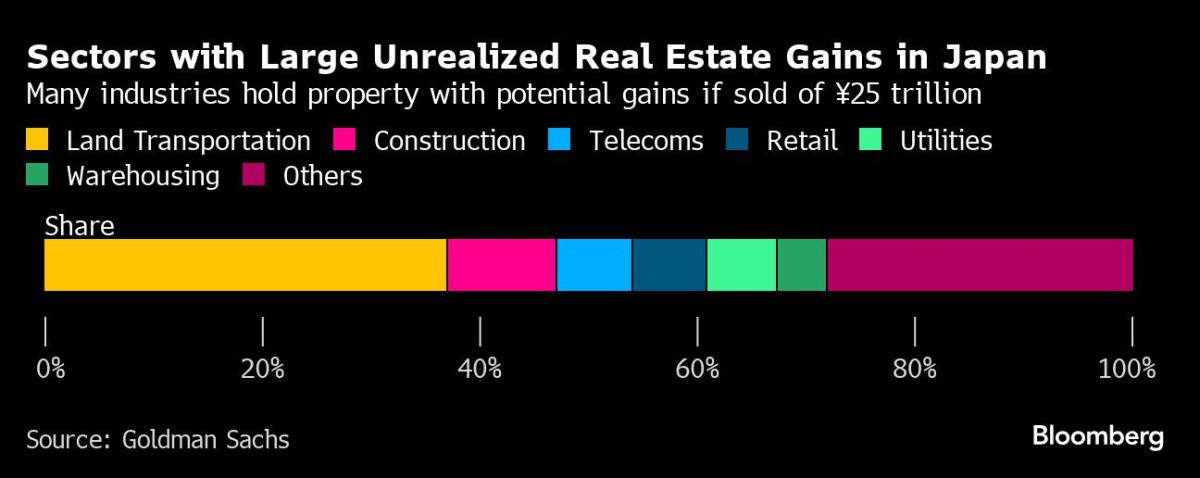

Goldman Sachs estimates that there could be at least ¥25 trillion in unrealized gains across more than 250 Japanese companies with significant real estate holdings. Companies in the railway, construction, and utility sectors hold some of the largest real estate assets. Elliott's stake in Tokyo Gas is centered around encouraging the company to sell its real estate holdings and allocate the proceeds more effectively.