L

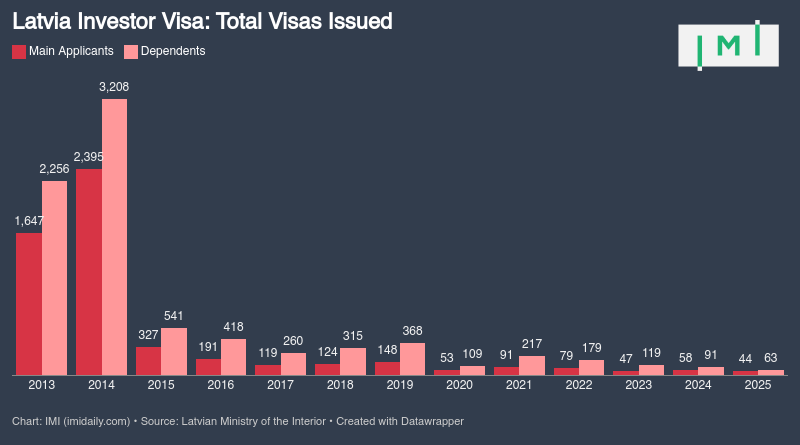

atvia's golden visa program is experiencing a strong rebound, with 44 main applicants processed in the first half of 2025. This represents 76% of last year's annual total and positions Latvia for its strongest performance since 2021. The country issued 107 visas overall, including dependents, compared to 149 for all of 2024.

According to Roberts Valpiters, Managing Partner at EU Law Firm, the current pace "already puts the program close to full-year 2024 levels." He projects that Latvia could reach 88 main applicants by year-end and notes that 2025 is likely to be its strongest year since 2021-2022.

Latvia's growth partly reflects processing delays in competing programs. Greece, for instance, has a backlog of over 52,000 pending cases as of spring 2025, while Portugal's modernization under AIMA has improved some processing timelines but still leaves room for improvement.

Turkish nationals now lead the applicant demographics, claiming 20% of approved applications in H1 2025. Valpiters attributes this shift to Latvia's appeal as "the lowest EU RBI option" with a €50,000 company-investment route and a €10,000 state contribution. Vietnamese investors also climbed significantly, from 2% to 11%, driven by Latvia's affordable options for work permits and Schengen access.

Chinese applicants dropped sharply, from 26% in 2024 to just 7% in H1 2025. UK nationals broke into the top five applicant nationalities for the first time, matching Indian applicants at 9%. Real estate investments surged from 29% of approvals in 2024 to 45% in H1 2025, with business investments maintaining their dominant position at 50%.

Latvia processed 20 real estate-based approved applications in H1 2025, exceeding last year's full-year total. Business investments totaled 22 investors, indicating potential for 10% growth over 2024 levels if current momentum continues.