L

uxury prices hit record highs in September 2025, with the median U.S. luxury home at $1.26 million—up 4.8% YoY and the highest for the month—while non‑luxury homes rose only 1.8% to a median of $371,583. Redfin defines luxury as the top 5% of a metro’s price range; non‑luxury falls between the 35th and 65th percentiles.

Since September 2023, luxury prices have climbed about 11%, outpacing the 6% growth of non‑luxury properties. “Luxury buyers operate under different rules,” says Redfin senior economist Sheharyar Bokhari. “They have cash, stock gains, and long‑term confidence, so they act when they find a desirable home.” High‑income buyers remain active despite high borrowing rates, viewing real estate as a safe haven amid market uncertainty, which keeps luxury demand resilient even as overall transaction volumes stay muted.

Sales volumes are near record lows: luxury sales up 0.3% YoY, non‑luxury down 0.3%. Pending sales rose 1.6% for luxury and 1% for non‑luxury, suggesting the market has found a floor after a slow year.

Inventory rebounded but remains tight. Luxury listings rose 7.7% YoY to the highest September level since 2020; non‑luxury inventory climbed 11.4% to the largest September supply since 2019. Yet compared to 2015, luxury listings are down ~50% and non‑luxury supply ~25%. “Demand is strong because buyers are less worried about rates, but inventory is limited, keeping prices high,” notes Redfin agent Rebecca Love.

New luxury listings were flat YoY; non‑luxury listings dipped 1.3%. Homes take longer to sell: luxury properties averaged 52 days on market in September (up from 46), the slowest September pace since 2020; 27% closed within two weeks, down from 28%. Non‑luxury homes averaged 43 days (up from 36), with 33% closing within two weeks, down from 36%.

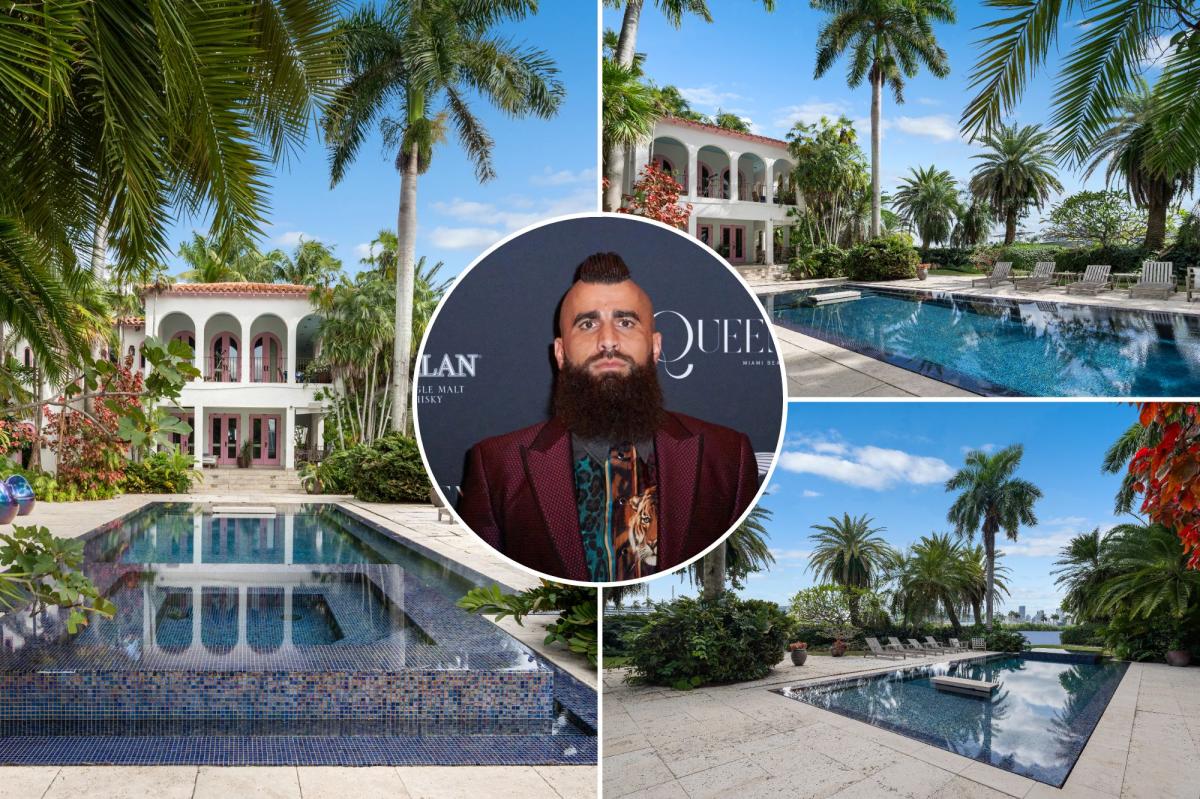

Regional highlights among the 50 largest metros: West Palm Beach saw the strongest luxury price growth (+14.8% to $4.13 M), followed by Newark (+12.3% to $2.05 M) and Virginia Beach (+11.2% to $1.07 M). Tampa and Oakland were the only markets with declines. Luxury sales activity surged in San Francisco (+30.5%), Providence (+19.1%), and Fort Worth (+13.5%), but fell in West Palm Beach (-22.4%), San Jose (-20.8%), and Philadelphia (-16.8%). Inventory expanded sharply in Tampa (+31.1%), Fort Worth (+18.7%), and Nashville (+18.6%), while shrinking in Philadelphia (-21.6%), San Jose (-20%), and Chicago (-14.8%). Fastest luxury sales were in San Jose (14 days), St. Louis (16 days), and Detroit (16 days); slowest were Miami (130 days), West Palm Beach (115 days), and Fort Lauderdale (114 days).

The widening gap between luxury and non‑luxury markets reflects how higher rates have unevenly affected the U.S. real estate landscape. Affluent buyers, insulated from financing costs and buoyed by asset gains, continue to drive luxury prices, defying broader headwinds that have slowed the rest of the market.