C

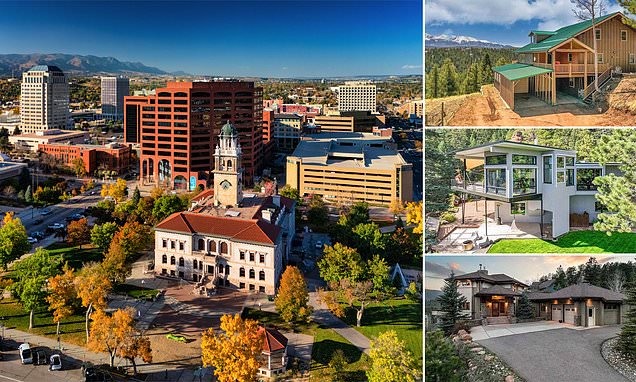

olorado Springs, once a highly sought-after housing market, is undergoing a significant shift. Thousands of residents are listing their homes, many worth over $1 million, as both residential and commercial real estate sectors face a reset. The city's general manager for Norwood Development Group, Patrick Kerscher, notes that interest rates have doubled in the past three years, creating uncertainty.

As of March 2025, Colorado Springs had over 7,100 active home listings, according to Realtor.com. Homes are now sitting on the market for an average of 75 days, a significant increase from the frenzied pace seen during the pandemic boom. The median listing price rose slightly from $458,000 in December 2024 to $474,000 in March 2025, but price cuts are becoming more common as inventory swells.

Colorado Springs is one of 58 metro areas nationwide where housing inventory has surged, giving homebuyers more leverage than they've had in years. The city's urban planning manager, Ryan Tefertiller, notes that the market is shifting out of its rapid expansion mode and into a period of recalibration. Locals are taking a step back due to rising mortgage rates and affordability concerns.

Despite the slowdown, Realtor.com recently named Colorado Springs one of its Top 10 Housing Markets for 2025, projecting a 27.1 percent increase in existing-home sales for the year. The city's strong military population is a key factor, with many buyers relying on VA and FHA loans that offer more favorable terms than conventional mortgages.

The commercial sector is also experiencing caution, with uncertainty slowing major decision-making. However, the city is exploring mixed-use developments to reimagine older commercial spaces and meet the changing needs of the post-pandemic workforce. As home listings climb and commercial tenants pause on commitments, Colorado Springs is entering a new phase – still attractive but no longer immune to broader market forces.