T

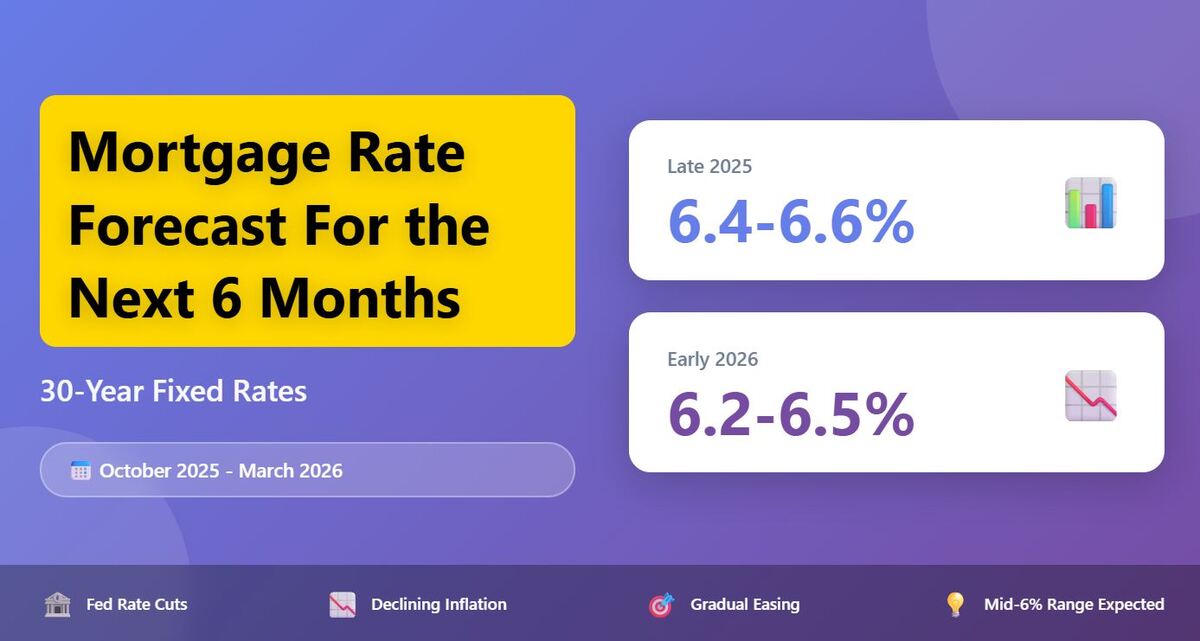

hinking of buying or refinancing? The next six months look to keep 30‑year fixed rates in the mid‑6% range, likely easing slightly if inflation cools and the Fed cuts rates further. Current data (late September 2025) shows an average of about 6.3%, down from a peak of 7.04% earlier in the year, after the Fed’s September 0.25‑point cut and hints of more cuts.

**What drives the rates?**

- **Inflation**: The Fed raises rates to curb price growth. Forecasts suggest inflation may peak near 3.1% in mid‑2026; a faster decline would lower mortgage rates.

- **Unemployment**: Rising joblessness can prompt rate cuts. Unemployment is expected to rise to 4.5‑4.8% by early 2026.

- **GDP Growth**: Annual growth is projected at 1.7‑2.3%. Slower growth could encourage lower rates.

- **10‑Year Treasury Yield**: A key benchmark that moves with economic news and Fed policy.

**Snapshot for October 2025 – March 2026**

- Fannie Mae: ~6.4% → ~6.2%

- MBA: ~6.4% → ~6.4%

- Freddie Mac: ~6.4% → ~6.2%

- NAR: ~6.5% → ~6.0%

- Wells Fargo: ~6.3% (no mid‑term estimate)

The consensus is a gentle decline from ~6.45% to ~6.20%. Divergence mainly hinges on how quickly inflation falls and how aggressively the Fed cuts rates.

**Implications for stakeholders**

- **Buyers**: A $400,000 loan at 6.4% equals ~$2,500/month for principal and interest. Affordability remains tight but better than the 7% peak. First‑time buyers may benefit from FHA programs that can offer slightly lower rates.

- **Homeowners**: Refinancing activity is up 42% YoY. Lower rates could reduce monthly payments and save thousands over the loan’s life.

- **Sellers**: If rates dip below 6.5%, more owners may list, increasing inventory and potentially raising prices modestly (1‑2%).

- **Investors**: In a high‑rate environment, focus on cash‑flowing rental properties in strong markets. Norada can help locate turnkey deals that deliver predictable returns.

**Scenarios**

- **Base**: Rates average 6.4% in Q4 2025, easing to 6.3% in Q1 2026. Inflation ~2.5%, unemployment ~4.6%, two Fed cuts.

- **Best**: Inflation falls faster (2.2%), rates could dip below 6.0% by March 2026, spurring a surge in mortgage applications.

- **Worst**: Inflation remains high (~3.5%) or a global shock occurs, pushing rates to ~6.8% and slowing the market.

**Common questions**

- *Will rates drop below 6% soon?* Unlikely in the next six months; possible later in 2026 if trends continue.

- *Buy now or wait?* Depends on budget, risk tolerance, and whether you can lock a rate today.

- *ARMs?* Offer lower introductory rates (5.5‑6.0%) but carry reset risk.

**Practical tips**

1. Monitor Freddie Mac’s weekly survey.

2. Lock a rate when you find a favorable one.

3. Consider paying points to lower the rate if you plan to stay long term.

4. Shop multiple lenders and discuss your financial profile.

**Investment note**

With rates high, prioritize cash‑flowing properties in robust rental markets. Norada identifies turnkey deals that deliver steady returns even when borrowing costs rise.

For more detailed forecasts, see:

- Morgan Stanley’s 2025 rate outlook

- MBA’s 2025–2029 predictions

- NAR’s early‑2026 rate expectations

- Wells Fargo’s long‑term view

Stay informed and prepared to make the best decision for your financial future.