T

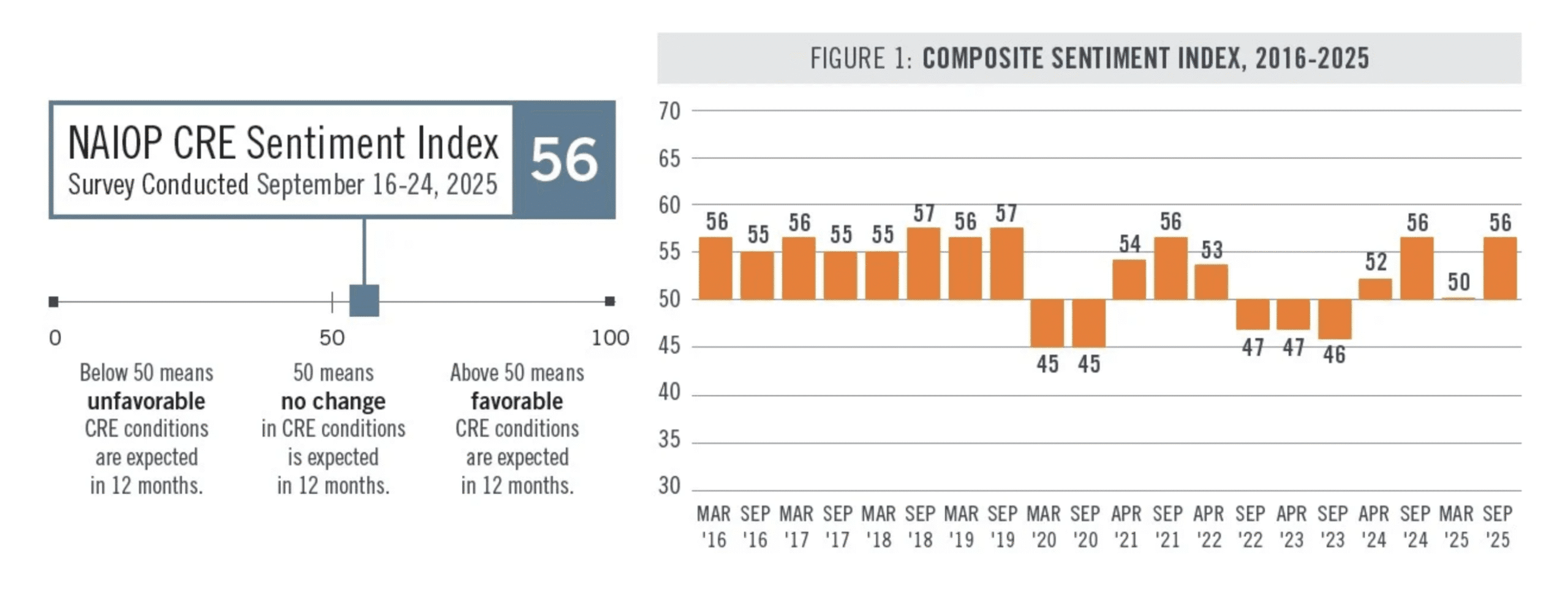

he latest NAIOP CRE Sentiment Index shows a clear rise in expectations for the commercial real estate market over the next year, now at 56—up from March 2025. The index, released by the NAIOP Research Foundation, gauges industry sentiment by asking professionals about jobs, space demand, construction costs, capital markets, and other fundamentals. Scores below 50 signal expected downturns, 50 indicates no change, and above 50 signals improvement.

Respondents now foresee a slower climb in construction material costs, suggesting tariff worries have eased, though trade policy remains a concern. Anticipated interest‑rate cuts and better capital‑market conditions also lifted optimism. Forward expectations for debt, equity, and cap rates are more favorable than in March.

Key takeaways: cap‑rate outlook is the best since the survey began in 2015; developers and owners plan to boost deal volume; occupancy and rent expectations are slightly higher; the industrial and multifamily sectors will drive activity, followed by data‑center, retail, and office, with data‑center and retail interest up from March.

Marc Selvitelli, NAIOP president and CEO, said the index signals a meaningful confidence shift, citing improved capital markets, stabilizing vacancy rates, and a brighter economic outlook that positions the industry for growth.

The survey drew 276 responses from 232 NAIOP member firms—developers, owners, managers, brokers, analysts, consultants, lenders, and investors—collected between September 16 and 24, 2025. Download the full Sentiment Index here.