H

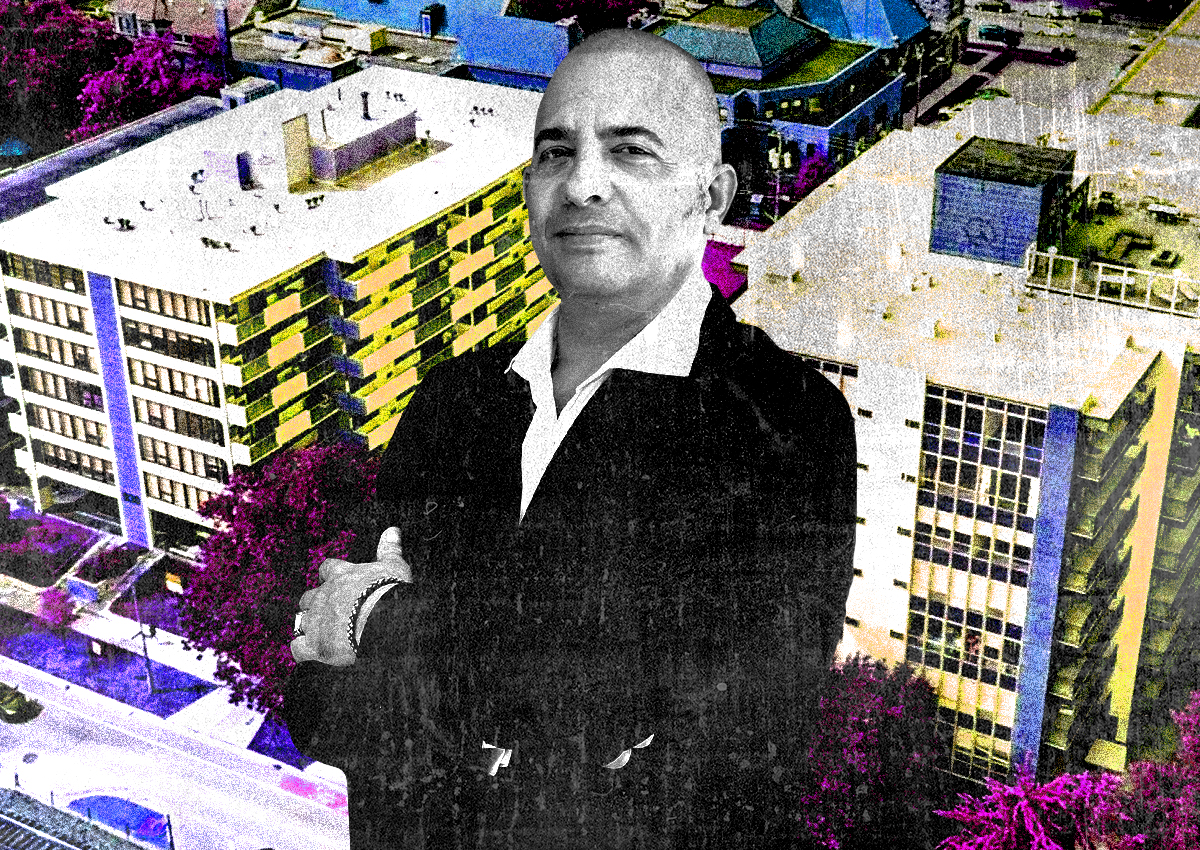

adar Goldman's massive apartment portfolio in Chicagoland is at risk due to a significant loan default in Oak Park. The Israeli businessman has failed to pay a $25.5 million floating interest rate loan for the Rhythm & Blues Towers complex, which comprises two buildings with 104 units. This amounts to $245,000 per unit, and Goldman is more than three months behind on payments.

The loan servicer, hired by Ready Capital, claims that Goldman defaulted in July and has yet to rectify the situation. However, a pre-negotiation agreement between the lender and borrower allows them to discuss resolving the distressed loan. The debt was not due until March 2025, but Goldman's failure to pay monthly debt service costs triggered the default.

Goldman denies that the default will persist, citing plans to refinance the property with a new lender. However, there has been no sign of a new loan, and the property is now being shopped for sale. It was listed about a month ago by Essex Realty Group for around $30 million, which market experts consider a high price.

Goldman purchased the Oak Park buildings in 2019 for $8.3 million and took out the loan to refinance his previous acquisition loan and renovate the property to increase rents. He has invested nearly $8 million in renovations, which have been completed, but the asset was not cash-flowing due to rising debt costs and vacant units during renovations. Goldman had to cover over $1 million of the property's expenses and debt service this year, and $2 million last year.

The outcome of the default remains unclear, with Goldman facing a complicated sale process similar to his previous attempt to sell a 1,700-unit workforce housing portfolio in Chicago.