U

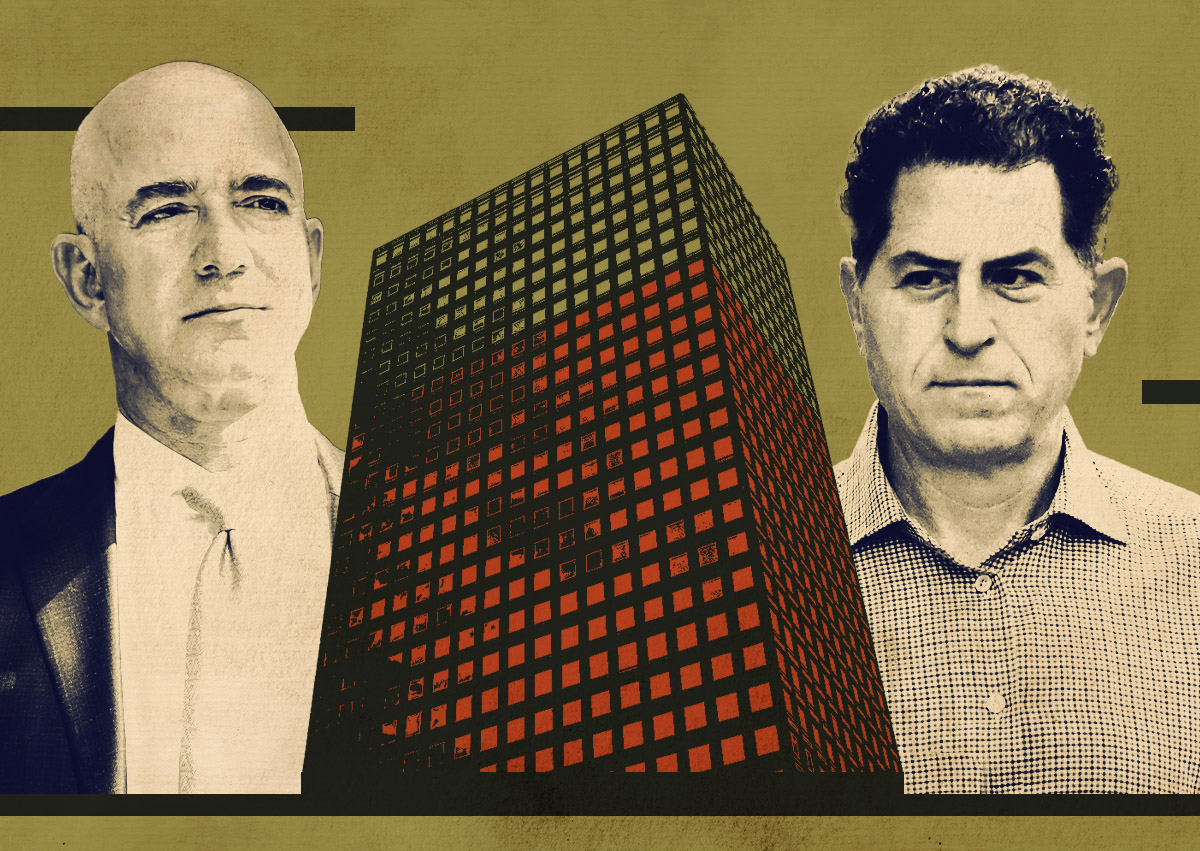

S companies are reversing their remote work policies, with one-third mandating a return to in-office work five days a week, up from 31% in the previous quarter. This shift is driven by declining growth in the white-collar workforce and increased unemployment rates, which have given management more leverage. Amazon has called its corporate workforce back to the office full-time, while Dell Technologies requires their global sales team to do so.

To entice employees to return, companies are offering perks like luxury gyms and fine-dining restaurants. HSBC Bank, for example, saw a significant increase in in-office attendance after adding an additional 35,000 square feet of space. Real estate developers are taking note of the shift, with Tishman Speyer completing a $3.5 billion refinancing on a revamped Rockefeller Center.

However, office market challenges persist, with vacancy rates stabilizing at near-record highs and nearly 209 million square feet of office space vacated since the pandemic began. Defaults and missed payments are still plaguing the market, with the delinquency rate on office loans increasing to 8.36% in September. Banks report that problems with office loans overshadow other commercial property struggles.

Despite this, investor interest in distressed properties is rising as prices drop, with Eastdil Secured completing 18 office sales worth $2.6 billion. However, many expect office tenants to offload space once their leases mature, which could lead to further market challenges.