S

tock Analysis – Oct 18 2025, 23:18 ET

Author: Paul LaBossiere, Contributor

Editor: Thomas H. Kee Jr.

Pacer Industrial Real Estate ETF (NASDAQ: INDS)

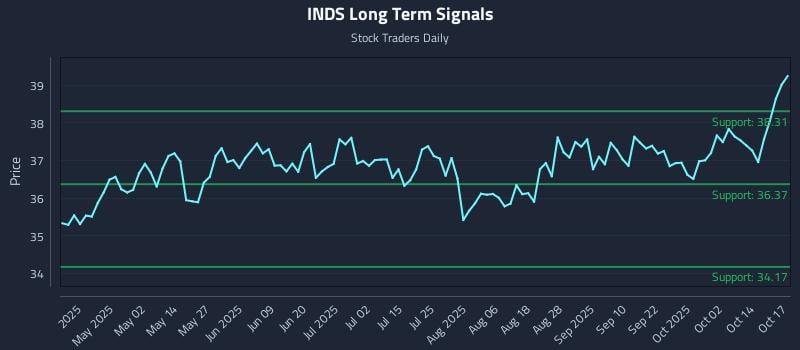

Key takeaways: Current price sits at $39.23. Support levels: $34.17, $36.37, $38.31. No definitive positioning signal; downside risk remains high due to lack of long‑term support. Positive sentiment persists, but caution advised.

AI‑driven institutional strategies: Three distinct plans crafted for varying risk appetites and holding periods, each embedding advanced risk‑management rules to fine‑tune position sizing and curb drawdowns.

Multi‑timeframe signals:

• Near‑term (1‑5 days): Strong – Support $39.04, Resistance $39.47

• Mid‑term (5‑20 days): Strong – Support $37.76, Resistance $38.79

• Long‑term (20+ days): Neutral – Support $36.37, Resistance $38.31

Color legend: Blue = current price, Red = resistance, Green = support.