P

aramount Group Inc., a New York-based real estate company, is taking a significant hit on its San Francisco investments made before the pandemic. The company has written down two major office properties to zero value and now considers half of its San Francisco portfolio essentially worthless. This move allows Paramount to restructure its finances and potentially attract new investors who can revive struggling properties.

Between 2016 and 2019, Paramount tripled its holdings in San Francisco by purchasing four downtown skyscrapers, valuing them at over $1.8 billion at their peak. However, the pandemic's impact on the office market left landlords like Paramount with significant debt that no longer matched declining property values. The KPMG building is a prime example of this issue, with a vacancy rate above 50% due to the accounting firm's relocation.

Paramount has internally charged the remaining value of the KPMG building as an "impairment loss," signaling to investors that it's giving up on the property and making it available for purchase. This strategy appears to be working, as the company has found a buyer for another struggling property, Market Center, with Flynn Properties reportedly leading the acquisition.

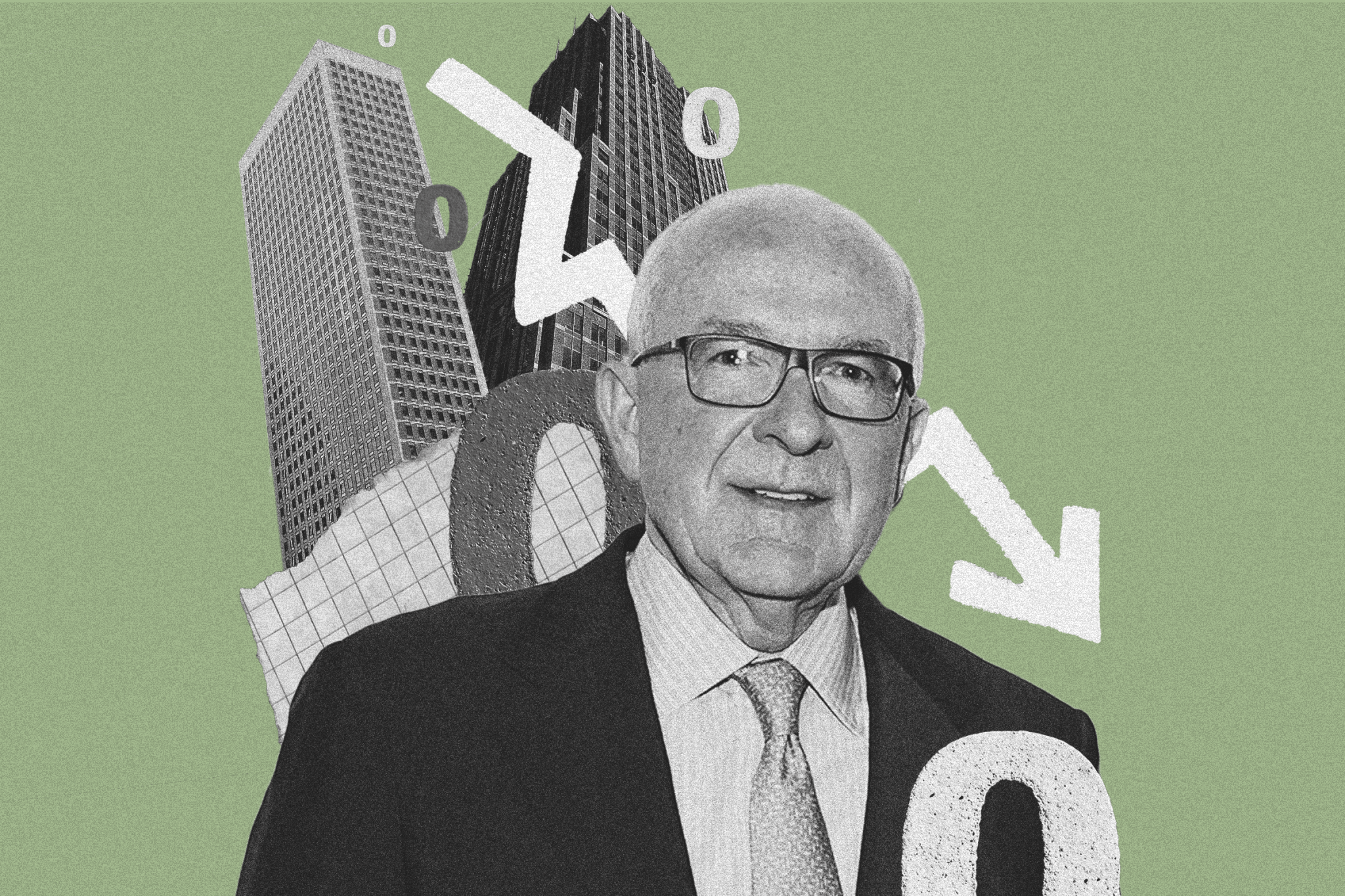

Purchasing a building at a lower debt or basis allows new owners more flexibility in rents and leasing. Paramount's CFO, Wilbur Paes, noted that the sale of Market Center will remove the asset from their books and generate a tax loss that can be utilized. The company has also written off another property, 111 Sutter St., which is now only half occupied.

Paramount's other trophy buildings are facing similar challenges, with key tenants like Google and JPMorgan terminating leases or downsizing their presence. However, the company remains focused on retrenching at its existing properties and attracting new tenants, such as Rakuten, which recently leased 29,000 square feet at 300 Mission St.

San Francisco's office market is considered challenging due to its lack of diversification compared to New York City. Nevertheless, REITs like Paramount are better positioned to navigate this down cycle due to their joint venture structures and cross-collateralized loan portfolios, which spread risk more evenly.