P

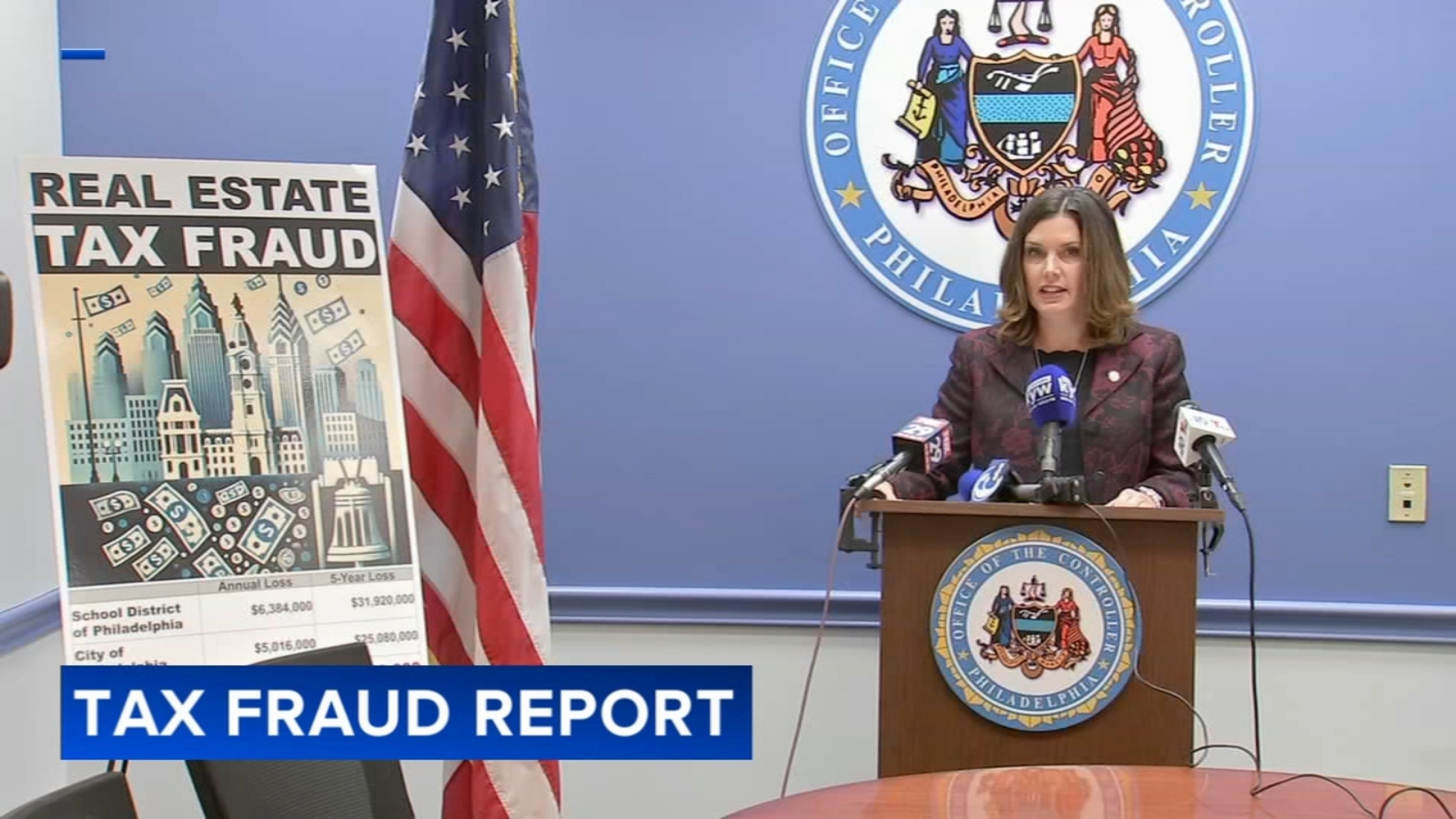

hiladelphia's Real Estate Tax Fraud Costs City Nearly $11.5 Million Annually

The city controller has revealed that real estate tax fraud is causing significant financial losses for Philadelphia and its school district, amounting to nearly $11.5 million each year. Controller Christy Brady released the findings of a special investigation into the Homestead Exemption program on Wednesday.

This program aims to help Philadelphians reduce their real estate taxes, but an examination found 23,000 properties that appear to be misusing it. The report has been forwarded to relevant authorities, including the Office of Property Assessment and the Department of Revenue, along with recommendations to address the issue.