T

he Montage Big Sky hotel, owned by CrossHarbor Capital Partners' Montana arm, Lone Mountain Land Company, boasts a 15x15 foot scale model of the Yellowstone Club. This model showcases the club's private ski mountain, golf course, and hundreds of numbered properties within its 15,000 acres, aiding in membership sales.

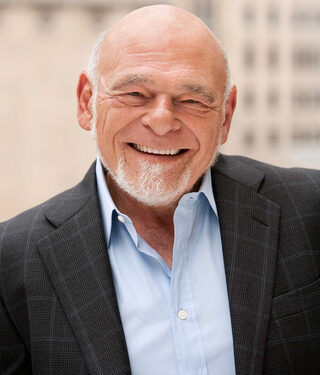

Sam Byrne, managing partner at CrossHarbor Capital, highlights the amenities added to the Yellowstone Club since purchasing it out of bankruptcy in 2009, including a performance arts barn, high-end restaurants, a nightclub, spa, and more. "There's nobody doing what we're doing," he boasts.

CrossHarbor has invested heavily in Big Sky, spending at least $4 billion over 15 years through debt and equity. This includes acquiring 43,000 acres, building homes, restaurants, hotels, and workforce housing. The company now owns more than half of Big Sky's town center, with Lone Mountain Land Company leading the charge.

Eric Ladd, a former Yellowstone Club sales and membership team member, notes that CrossHarbor's timing was perfect, riding a 15-year wave of growth in Big Sky. "We've had about 30 years of growth in less than a decade," he says.

Byrne, who cofounded CrossHarbor Capital in 1993, has a long history in real estate and has invested in various projects nationwide. The firm's investors include around 300 families or family offices, some of whom are Yellowstone Club members.

CrossHarbor is somewhat secretive about its returns, but early backers have made approximately 4.5 times their invested capital. Kidd notes that the other Montana investments should "work out" and reward investors for their patience and commitment.

The Yellowstone Club was founded by Tim Blixseth in 1999, who borrowed $375 million from Credit Suisse to develop the club. However, he used over $200 million for personal expenses, leading to the club's bankruptcy in 2008. CrossHarbor partnered with club members to buy it out of bankruptcy for $115 million.

Byrne observed that growth in Jackson Hole, Wyoming accelerated after adding high-end hotels, prompting Lone Mountain Land Company to develop The Wilson, a Marriott Residence Inn-managed property, and the luxury Montage Big Sky hotel.

Big Sky is experiencing a slowdown after riding an intense wave of growth during Covid. Offers for homes and condos are still coming in, but Lone Mountain Land is offering enticements like furniture credits with a property purchase. Despite this, prices have not been cut.

In contrast to the exclusive Yellowstone Club, buying into Moonlight Basin or Spanish Peaks is relatively affordable, with residences starting at $1.5 million and membership fees ranging from $150,000 to $200,000.

CrossHarbor's success in Big Sky can be attributed to avoiding excessive debt and leveraging land equity. Lone Mountain Land has spent over $200 million on workforce housing, but 75% of the Big Sky workforce still commutes from surrounding areas.

Byrne and Kidd plan to continue growing, with a new hotel project, One&Only Moonlight Basin, set to open in December, followed by the hotel next year. They also aim to expand further into Montana, creating a separate club at Crazy Mountain Ranch and building more homes and hotels in Big Sky.