H

omebuyers were lured with a sweet deal: pay 5-10% upfront and borrow the rest from a lender, deferring EMI payments until possession. Developers agreed to bear interest costs until buyers received keys. What could go wrong? A lot, as it turns out.

After widespread defaults by cash-strapped developers, banks demanded repayment from homebuyers despite homes remaining undelivered. The Supreme Court directed a CBI inquiry into a housing scam involving builders and banks. This may be just the tip of the iceberg.

Real estate developers employed various tactics to attract buyers, including subvention schemes and deferred payment plans linked to construction progress. These schemes aim to reduce initial financial burdens for homebuyers by offering lower upfront costs and delayed EMIs. However, there's often a devil in the fine print.

In a subvention scheme, a tri-party agreement is executed among the homebuyer, builder, and lender. The builder agrees to pay pre-EMIs until possession, but the actual borrower remains the homebuyer. If the builder defaults on interest payments, it's the homebuyer who's exposed. Delays in under-construction houses are common in India, with thousands of buyers falling victims.

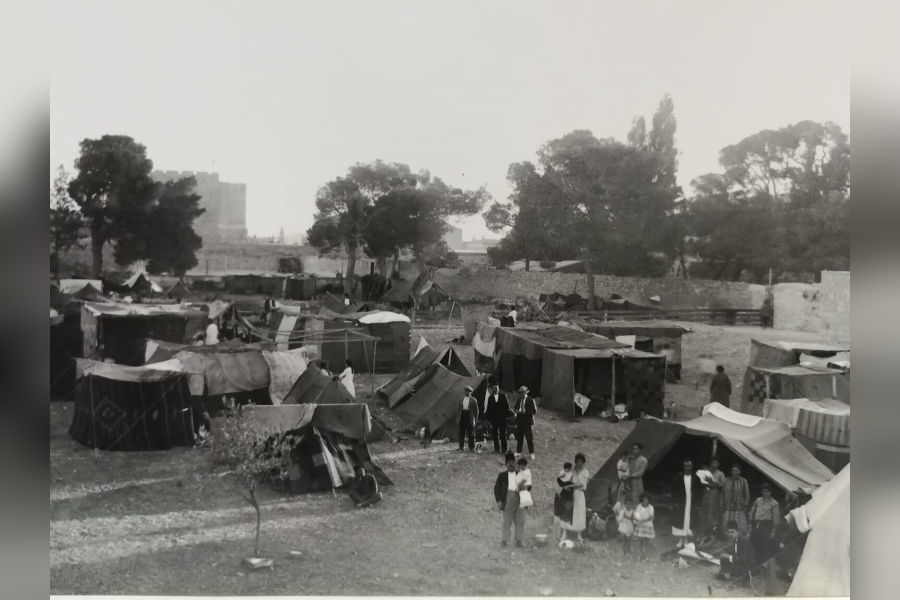

Data analytics firm PropEquity found that one in five under-construction houses remained undelivered as 1,981 projects across 44 cities were stalled over eight years. Even remaining projects were delivered after a substantial delay of 3-4 years. Construction delays are a standard feature of Indian realty for several reasons.

The RBI banned banks from entering into subvention arrangements and barred lenders from making upfront disbursements to builders in under-construction projects. However, several NBFCs and fintech platforms continue to tie up with builders to offer variants of such plans. The construction-linked plan (CLP) has proven to be a mirage.

Under CLP, the buyer pays in tranches linked to construction milestones, but this arrangement is often not aligned with the builder's cash flow. Builders receive payment only when work is completed, supposedly reducing risk for buyers. However, experts point to a critical flaw: builders slow down construction deliberately once they've received a majority of the project cost.

Builders and lenders have led homebuyers into a storm by exploiting subvention schemes to attract buyers without ensuring timely delivery. Banks have played a role by approving loans without adequate scrutiny of the project's viability. Builders used these schemes to collect funds early while construction lagged, and banks overlooked due diligence to grow their home loan portfolios.

Regulatory guardrails are in place through RERA, but these lack sufficient enforcement mechanisms. This encourages builders to play the devil with impunity. Homebuyers must approach real estate deals with caution and verify the builder's track record and financial stability before committing.

Verify the builder's track record and financial stability.Ensure the project is registered with RERA and check its status online.Avoid schemes that lack escrow accounts.Demand clear documentation of payment schedules and possession timelines.Seek independent legal and financial advice before committing.Prefer projects backed by reputed banks that conduct thorough due diligence.Watch out for front-loaded payment schedules. Paying 70-80% of the flat cost within 18 months while the project is scheduled for completion years later is a red flag.

Don't fall for incentives offered by the builder while overlooking crucial aspects of the project. Focus on fundamentals like location, builder credibility, legal clearances, and construction quality rather than flashy incentives.