Q

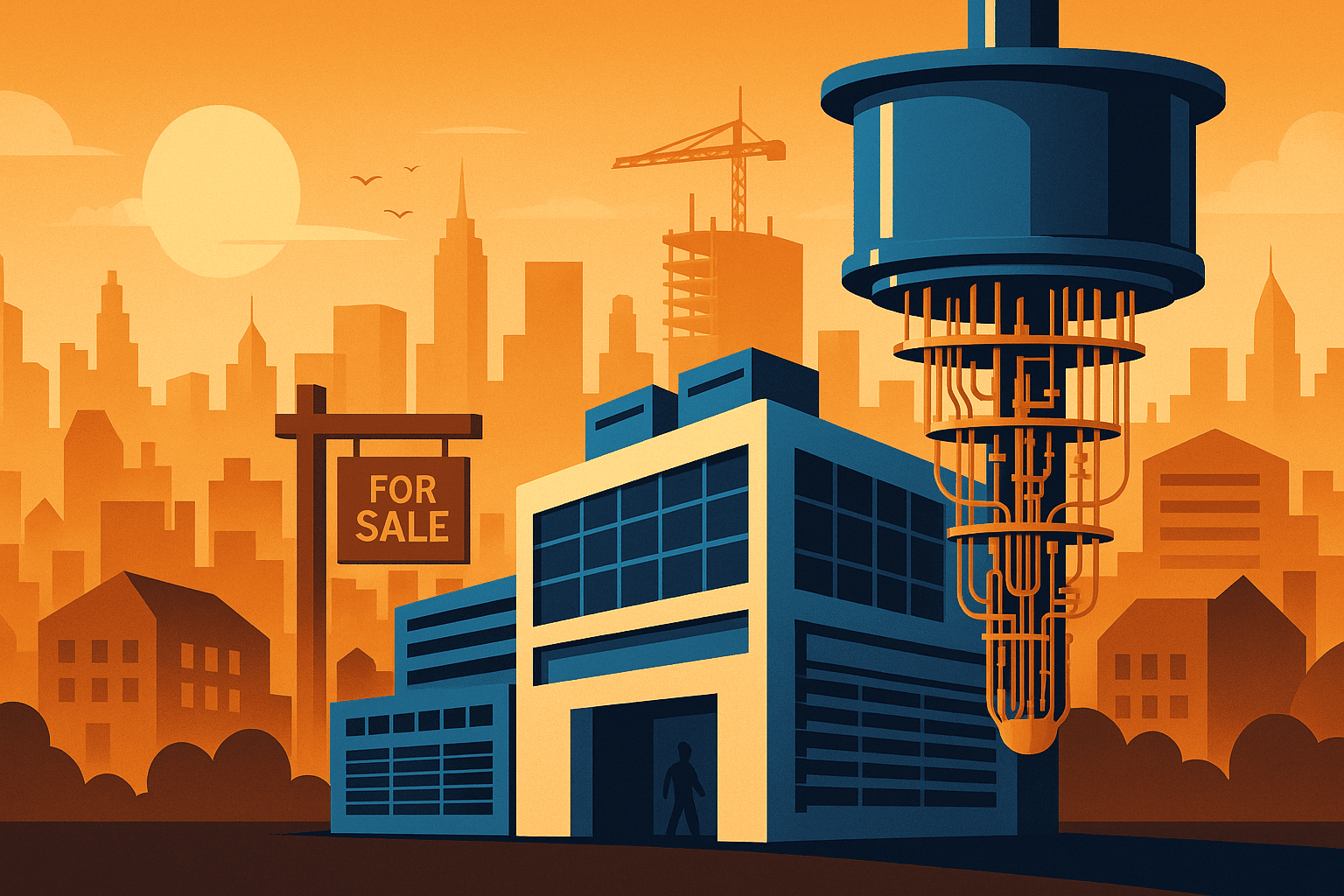

uantum Real Estate: A New Frontier

JLL’s latest research warns that the next wave of real‑estate demand will be driven by quantum computing, mirroring the AI‑led boom in data‑center construction. The firm calls it a “quantum land grab,” forecasting a surge in specialized facilities that will house quantum processors by the early 2030s.

**When Quantum Becomes Commercial**

According to JLL, commercial quantum machines are expected to enter the market around 2030. At that point, the industry will shift toward hybrid data centers that combine quantum and classical systems side by side. The report projects global quantum investment to climb from roughly $2 billion in 2024 to as much as $50 billion after a breakthrough that delivers “quantum advantage.”

**Why Quantum Needs a New Kind of Property**

Quantum computers rely on qubits that can exist in multiple states simultaneously and become entangled across distances. This physics demands extreme conditions: temperatures near absolute zero, isolation from electromagnetic noise, and vibration‑free environments. These requirements create a new class of high‑tech real‑estate: hybrid facilities that house both conventional servers and cryogenic quantum labs.

**The Roadmap to Deployment**

JLL outlines a decade‑long trajectory:

- 2020s – research labs and pilot projects in leading research hubs (Boston, Munich, Tokyo, Toronto).

- Early 2030s – first commercial deployments in hybrid data centers.

- Mid‑2030s – widespread adoption and the emergence of dedicated “quantum campuses.”

**Investment Momentum**

In 2024, the quantum sector generated under $1 billion in revenue but attracted about $2 billion in private capital, a sharp rise from the $300 million annual inflow seen between 2016 and 2019. JLL projects investment could reach $10 billion by 2027 and $20 billion by 2030. A major technological milestone—quantum advantage—could trigger an additional $50 billion, echoing the AI surge after ChatGPT.

**Geography of Quantum**

Like AI, quantum activity will cluster around a handful of ecosystems that combine research infrastructure, government support, and private investment. The report highlights Boston, Munich, Tokyo, and Toronto as early leaders, with potential expansion into other innovation districts as cloud providers (AWS, Google, Microsoft) develop in‑house quantum services.

**Quantum‑as‑a‑Service (QaaS) and Hybrid Facilities**

Early adopters will likely use QaaS, accessing quantum processors via the cloud to avoid the high cost of on‑premise hardware. Over time, as costs fall and engineering challenges resolve, more firms will install on‑site quantum systems, especially within large data centers. Hybrid facilities will keep classical and quantum components in separate, specialized rooms or sections, often within the same building. The Leibniz Supercomputing Centre in Germany exemplifies this model, combining traditional supercomputing with dedicated quantum labs, cryogenic cooling, and vibration isolation.

**Real‑Estate Implications**

Quantum’s physical footprint is distinct: it requires precise environmental control, electromagnetic shielding, and power supplies far beyond ordinary commercial standards. The demand for such infrastructure will create new opportunities for developers, investors, and operators. JLL calls the current period a “window of opportunity” for those willing to partner with quantum companies, governments, and data‑center operators.

**How to Position for Quantum Real Estate**

1. **Location** – Target properties near major research universities, national laboratories, and innovation districts that offer talent and reliable energy. Boston, Munich, Tokyo, and Toronto are prime examples.

2. **Partnerships** – Engage early with quantum hardware vendors, science agencies, and data‑center operators to design facilities that meet cryogenic, shielding, and isolation requirements while remaining efficient for conventional workloads.

3. **Readiness** – Prepare for a gradual but accelerating adoption curve. The first wave will focus on government‑ and university‑backed clusters; the next will expand as QaaS offerings grow. Familiarity with zoning, energy supply, and financing models for high‑specification labs will position investors for the commercial scale that follows.

**The Bottom Line**

Quantum computing could become a $100 billion industry by 2035, and the infrastructure to support it will be a critical component of that economy. The real‑estate sector that can anticipate the unique demands of quantum hardware—cryogenic cooling, electromagnetic isolation, and precise environmental control—will reap the rewards of a new, high‑growth market. The quantum land grab is already underway; developers who learn the physics, locate near research hubs, and build the right partnerships will secure a first‑mover advantage in this emerging landscape.