A

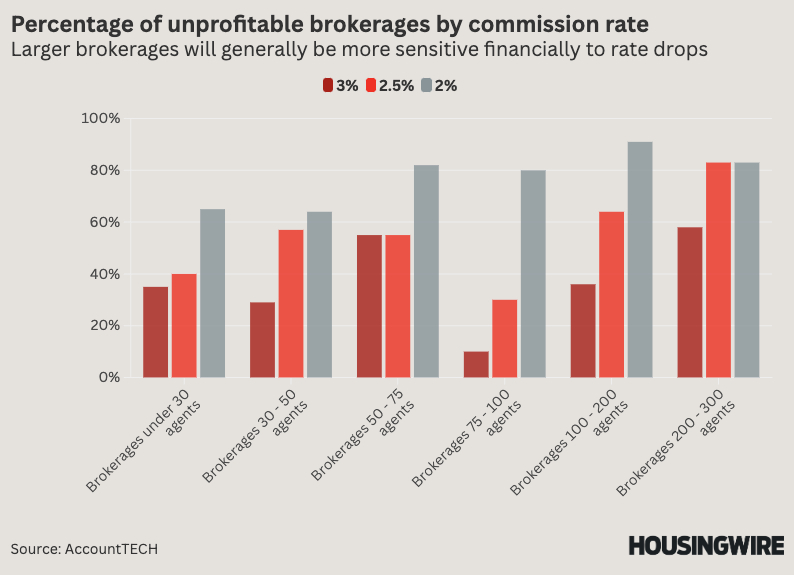

potential commission rate drop due to the National Association of Realtors antitrust lawsuit settlement could be an existential threat to many brokerages. Data from AccountTECH suggests larger brokerages are more sensitive to lower commission rates than smaller ones. This is because large brokerages often have fixed expenses like office space and middle management.

AccountTECH CEO Mark Blagden notes that opening an office comes with the need for staff, much like eating bread requires jam. His study analyzed 100 brokerages of varying sizes and found that smaller brokerages are generally more financially stable but less sensitive to lower commissions.

For brokerages with fewer than 30 agents, 65% are profitable at a 3% commission rate, while only 35% are profitable at 2%. In contrast, brokerages with 75-100 agents see a significant drop from 90% profitability at 3% to 20% at 2%. Larger brokerages struggle even more, with only 42% of those with 200-300 agents profitable at 3%, and just 17% at 2.5%.

Blagden believes that brokerages with 50-75 agents are best positioned to sustain commission drops. At an average commission rate of 2.5%, 70% of these brokerages remain profitable, significantly higher than other ranges. However, this number drops to 20% at a 2% commission rate.

To stay profitable, struggling brokerages should consider reducing office space or taking a higher split of commissions. While some brokerages like Compass have reported no change in commissions, others like Redfin have seen them drop.