H

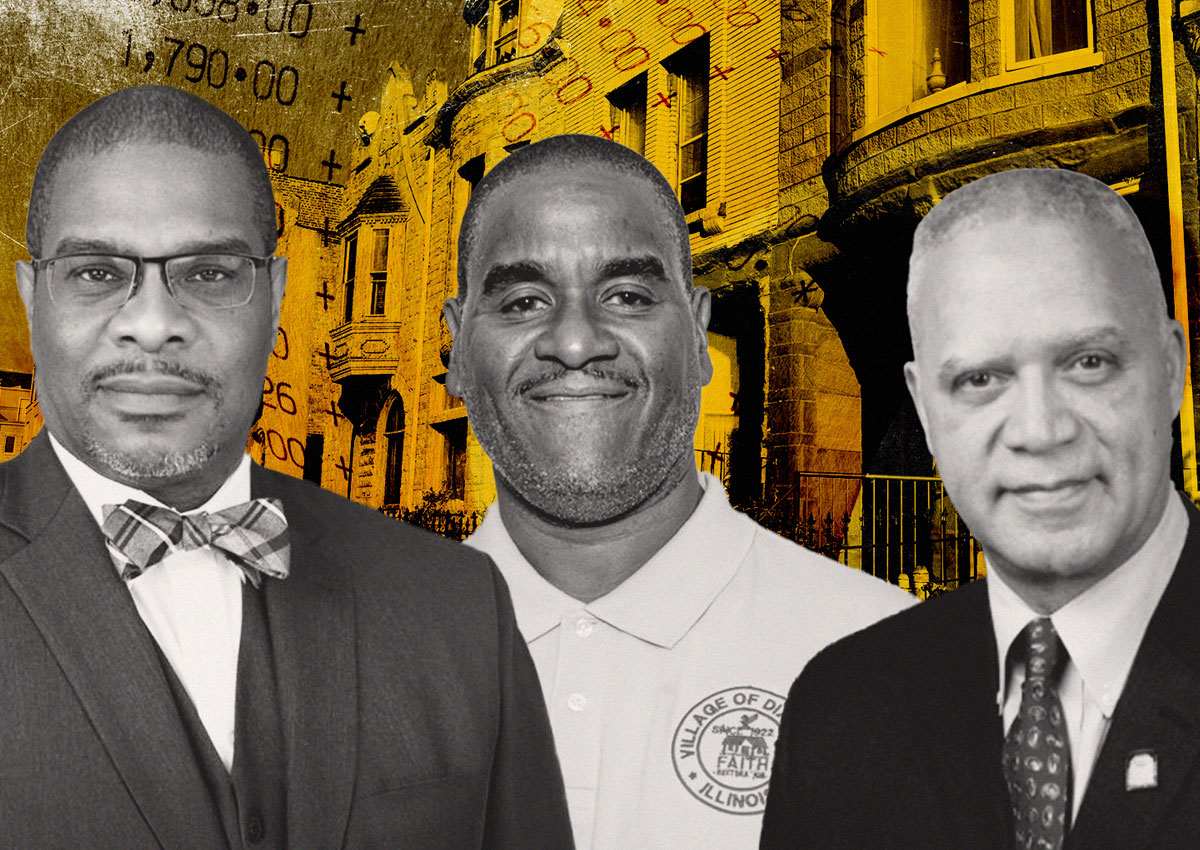

omeowners in Chicago's southern suburbs are grappling with an unexpected increase in their property tax bills. The median increase stands at almost 20 percent, marking the largest hike in three decades, according to Crain's report. Residents in majority-Black municipalities like Harvey, Markham, and Dixmoor were hit particularly hard, with increases exceeding 30 percent. This is due to the stagnant or declining values of their homes, which disproportionately affect Black homeowners.

The situation in Harvey, once an industrial hub, is particularly dire. The city's landscape is marred by abandoned homes and boarded-up businesses, a result of decades of economic decline. The town's history of job loss and population decline has led to soaring gas prices and rising inflation in the 1970s, forcing major employers out of business and causing the town's population to plummet.

The recent tax hikes have only worsened Harvey's financial woes. As property values fall and residents struggle to pay their taxes, local governments are left with fewer resources to provide essential services. Municipal debt rises, services are cut, and residents who can afford to leave do so, further reducing the tax base. This vicious cycle leaves residents bearing the brunt of the burden. In Dixmoor, where the median household income is $57,823, the typical tax bill surged from $877 to $1,950 this year, marking a 122 percent increase.

Private investors have taken advantage of the situation in Illinois' tax system, using loopholes to extract millions from already struggling municipalities. These so-called "tax buyers" purchase the taxes owed on delinquent properties, only to later back out of the deal and receive refunds, which come from the tax receipts intended for local services like schools and parks. This practice has drained nearly $280 million from communities that can least afford it, according to a 2022 study by the Cook County Treasurer's Office.

Despite these challenges, there are efforts underway to revitalize the region. The South Suburban Mayors & Managers Association has hailed the Southland Reactivation Act as a tool to attract developers by offering tax incentives for purchasing commercial properties in struggling townships like Thornton, Bloom, and Calumet. Federal support has also come in the form of a $20 million U.S. Department of Transportation grant, earmarked for the revitalization of Harvey's public transportation hub. The plan includes renovating the downtown Metra station and expanding the nearby Pace terminal, aimed at making it easier for residents to access transportation and attracting new businesses to the area.

Smaller projects like the $19 million Harvey Lofts development aim to breathe life into the city's downtown, offering 51 residential units with the hope of luring renters and businesses back to the area. Despite the struggle, residents like Bonnie Rateree remain committed to the community. "Harvey is like a pretty girl gone bad. Everybody wants a piece of her, but nobody wants to take care of her," said Rateree, who has lived in Harvey for decades. "I will never give up," she added.