B

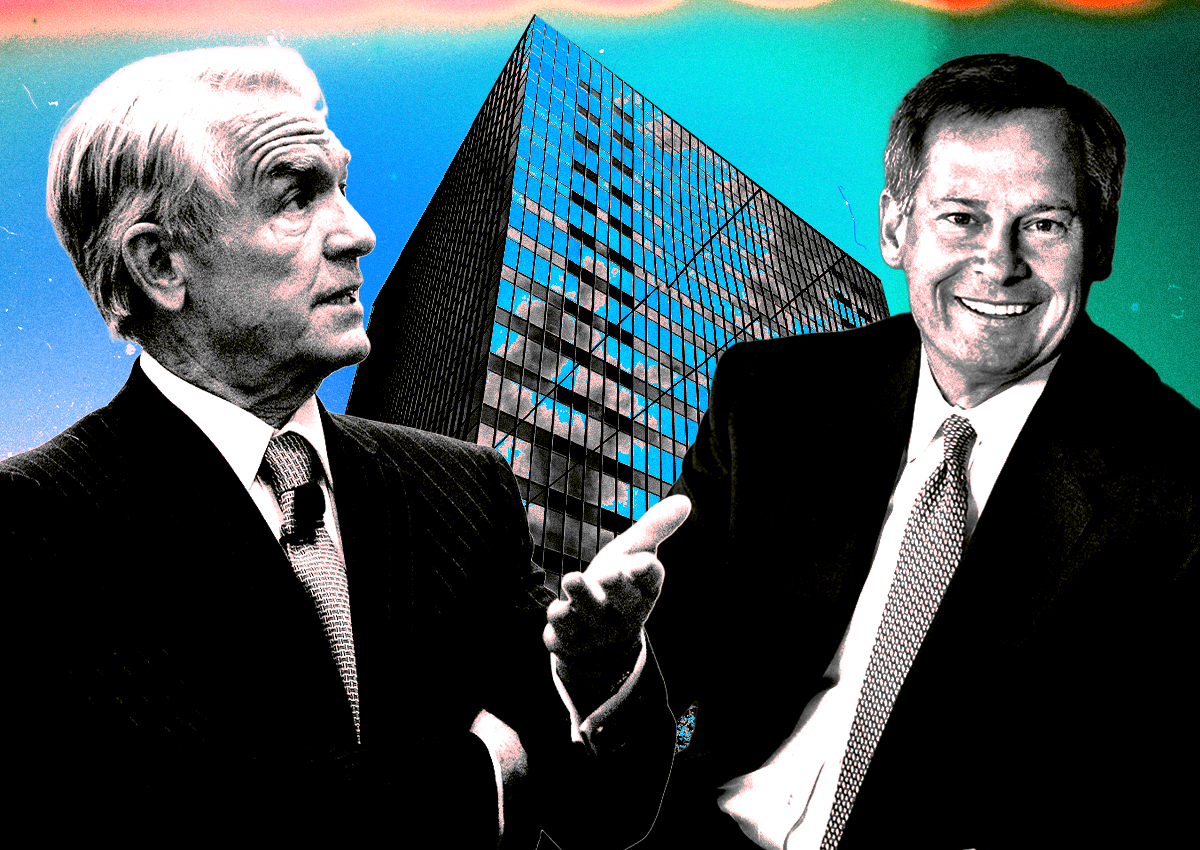

lackstone is counting on its anchor tenant to help navigate the shifting landscape of San Francisco's office market. A fresh loan extension is also expected to support this strategy. According to Bisnow, the New York-based investor has reached new terms for a $195 million loan against the Schwab building at 211 Main Street in San Francisco's Financial District. This deal moves the loan back to Overland Park, Kansas-based Midland Loan Services after it was previously placed into special servicing. The loan portfolio also includes three subordinate notes worth $25 million in total, as reported by Morningstar.

The new financing package now has a maturity date of April 2028, which was allowed to default earlier this year. Charles Schwab leases the entire 417,000-square-foot, 17-story building, although they have reduced their usage to about 170,000 square feet - roughly one-third of the available space. Despite this, Schwab plans to maintain a significant workforce in the Bay Area while moving its headquarters to Dallas.

The tenant remains responsible for the entire building until 2028, and they have made some space available for sublease. This concurrent timeline is why Blackstone has remained confident throughout the default and special servicing of the property. A spokesperson for Blackstone explained in April that this procedural step is necessary to change the loan term, which requires approval from the special servicer. The spokesperson emphasized that the building is fully leased to a high-quality, creditworthy tenant until 2028.