A

fter purchasing two downtown Miami office buildings two years ago for $56.7 million, Triple Double Real Estate and Stonerock Capital Partners could potentially lose these properties due to foreclosure. An affiliate of Atlanta-based Ardent Companies has filed a foreclosure complaint in Miami-Dade Circuit Court against the joint venture that owns a 12-story building with a data center and ground-floor retail at 200 Southeast First Street, as well as a 26-story office tower anchored by First Horizon Bank at 44 West Flagler Street. The complaint alleges that the joint venture defaulted on a $49.4 million mortgage debt that matured on June 1st, according to the lawsuit.

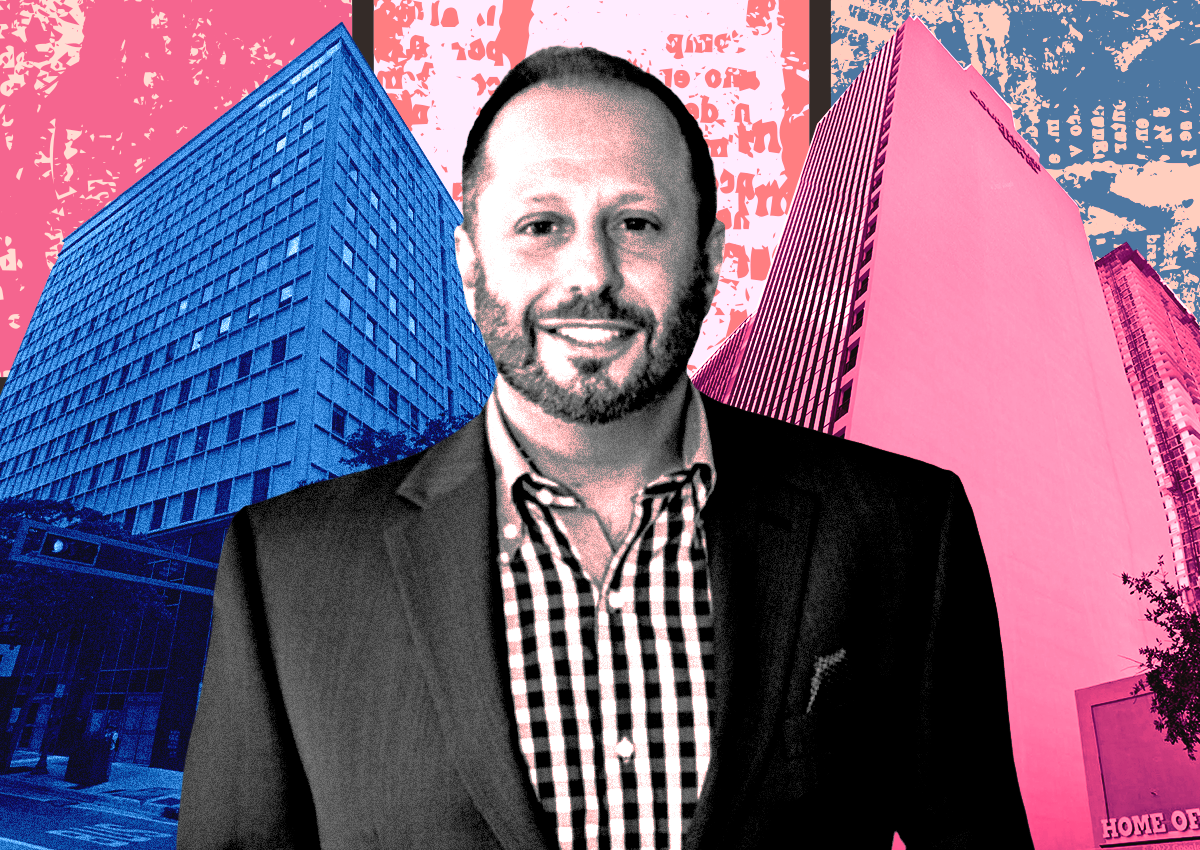

Delray Beach-based Triple Double, led by CEO Andrew Greenbaum and President Jeremy Becker, and Boca Raton-based Stonerock Capital, led by Yaakov Handelsman, purchased both properties in 2022. The purchase was financed by a $58.3 million mortgage provided by Ardent, as per records.

Representatives for Triple Double and Stonerock Capital and Ardent’s attorney did not respond to requests for comment on this matter. The office tower at 44 West Flagler was completed in 1974, while the office mid-rise at 200 Southeast First Street was completed in 1958, as per records. The smaller building is subject to a ground lease that expires in 2055. Tenants in the larger building include the Consulate General of Jamaica and the Law Offices of Robert Hanreck. Tenants in the smaller building include The Spot Barbershop, Idea Financial, and Jonathan Schwartz P.A.

The joint venture allegedly made its last mortgage payment in December and failed to pay $1.2 million in property taxes for both properties in 2023, as per the lawsuit. While South Florida commercial real estate has largely escaped the distress seen in other markets, the tri-county region is experiencing some fallout. Foreclosure filings for office, retail, multifamily, and industrial properties have increased in recent months.

Last month, Atlanta-based Trimont filed a foreclosure complaint in Broward County Circuit Court against an affiliate of Alliance HP, a Bryn Mawr, Pennsylvania-based real estate firm, that owns One Financial Plaza in Fort Lauderdale. Trimont alleges that Aliance HP defaulted on a $59.2 million mortgage that matured in October of last year.

In July, New York-based R&B Realty avoided losing Gateway at Wynwood, a mixed-use project in Miami’s Wynwood, at a foreclosure auction. The R&B affiliates that own the 14-story office and retail building filed for Chapter 11 in U.S. Bankruptcy Court in New York, court records show. Wilmington Trust NA, as trustee for Boise-based lender A10 Capital, won a final judgment for a $112 million mortgage debt allegedly owed by R&B.