B

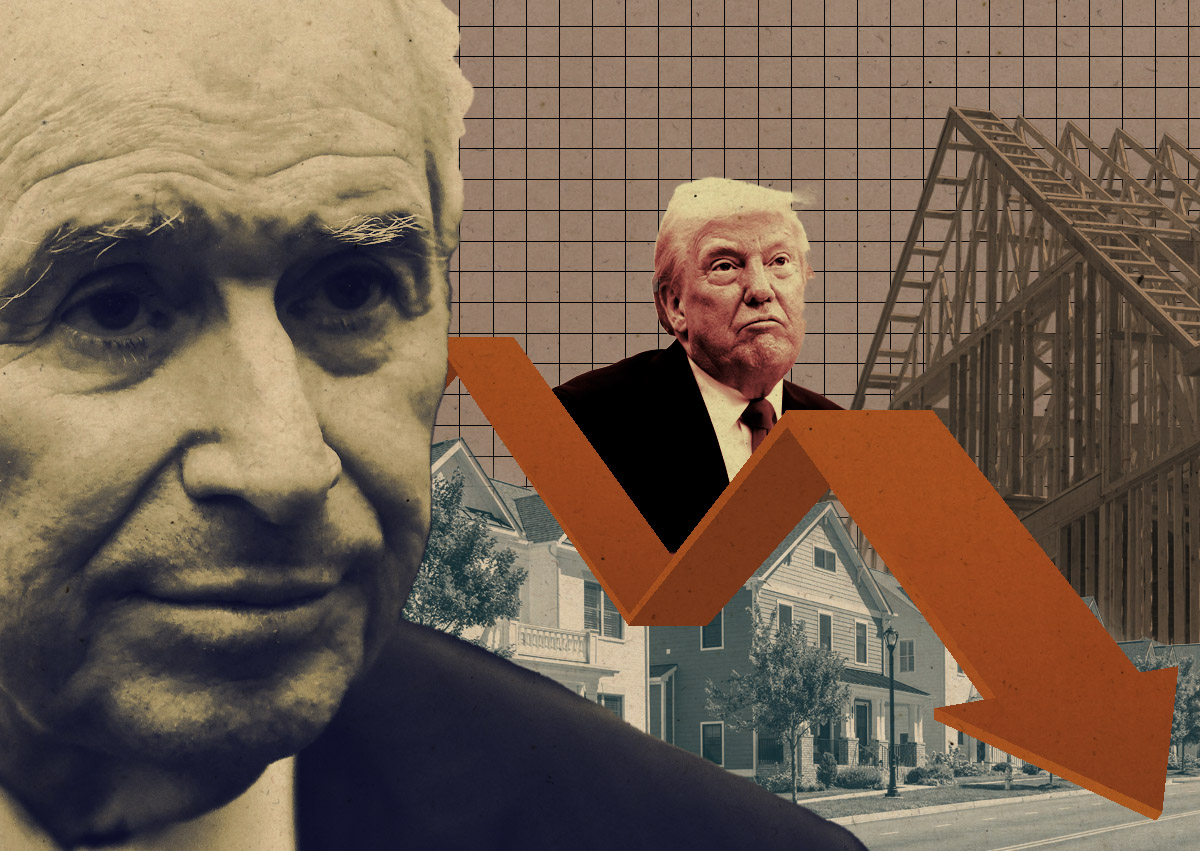

lackstone executives weighed in on the impact of President Trump's tariffs on real estate during their first quarter earnings call. Chief Operating Officer Jon Gray expressed a cautious outlook, suggesting that the current period may slow down investment in real estate. This is a concerning prospect for an industry that had been expected to bounce back after a few years of sluggish growth.

Gray attributed this potential slowdown to investors' tendency to shy away from sectors like real estate when markets become uncertain. The data supports his claim: Blackstone's distributable earnings from its real estate segment plummeted 20% year-over-year, while net realizations dropped 65%. The firm's real estate assets under management also declined by 5.6%.

However, the company as a whole posted strong results for the quarter, with distributable earnings of $1.09 per share and revenue of $2.76 billion. CEO Stephen Schwarzman noted that tariffs may drive up construction costs and reduce new supply, benefiting real estate values in sectors like logistics and apartments. Nevertheless, he cautioned that this thesis relies on avoiding recessionary conditions.

Schwarzman emphasized the need for a swift resolution to the current uncertainty to mitigate risks and maintain economic growth. Blackstone's diversified portfolio and strong overall performance suggest that it is well-positioned to navigate the challenges ahead.