C

ook County Assessor Fritz Kaegi's recent property valuations for Chicago Loop office buildings may not accurately reflect the pandemic's lasting impact on building owners, according to the Building Owners and Managers Association of Chicago. The assessments show a nearly 16% average decrease in values for two dozen large office buildings around the Loop, but some landlords argue this doesn't account for the full extent of the market downturn.

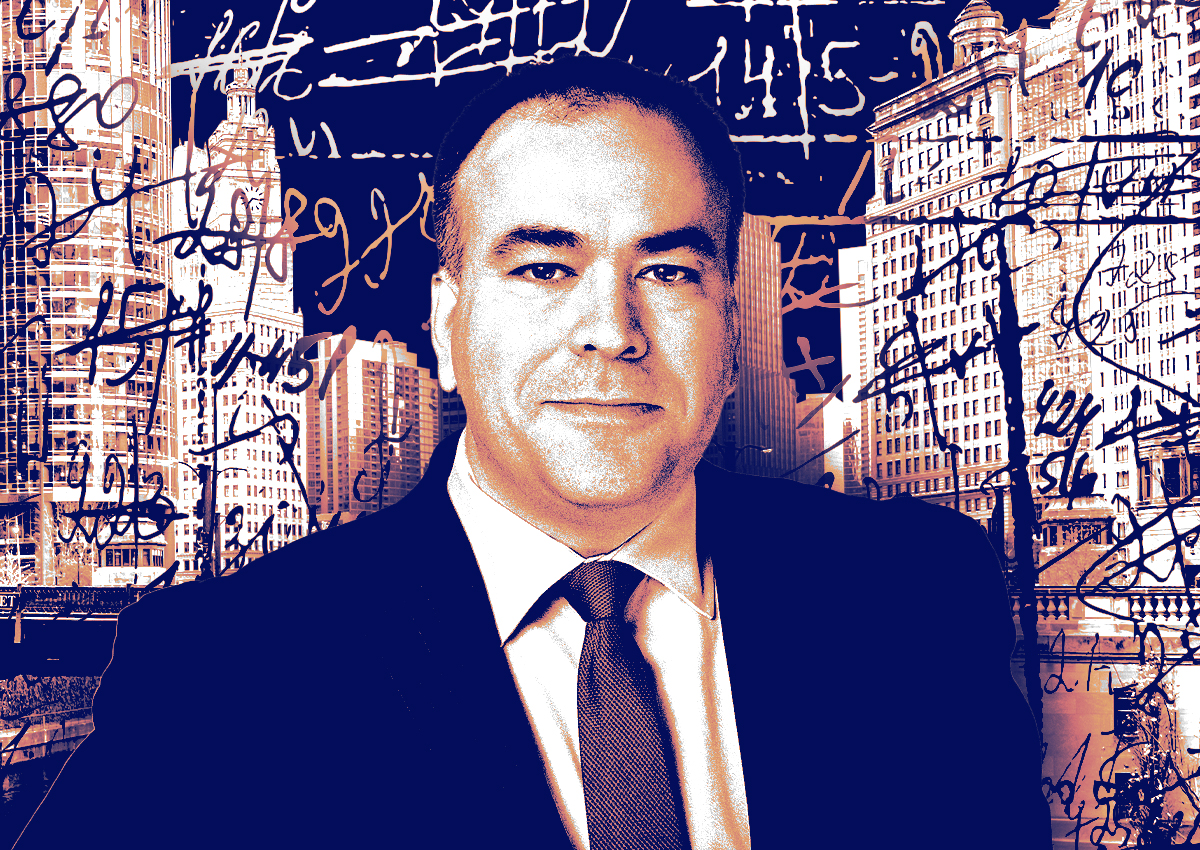

Kaegi has defended his estimates, citing high-profile properties like Blackstone's Willis Tower as still being worth pre-pandemic levels. However, executive director Farzin Parang disputes this stance, saying it ignores the pandemic's effects on office buildings. Lower-tier office buildings saw valuations drop around 30%, while hotel properties in the Loop experienced significant assessment increases.

The county faces pressure to balance its tax load as Mayor Brandon Johnson proposes a $300 million property tax hike in his 2025 budget. Many property owners are concerned about the impact on their tax bills, particularly since commercial property assessments have increased more than residential ones since 2021.