U

.S. Economic Snapshot – October 2025

The federal shutdown that began on October 1 has left many government‑released employment, wage, and inflation figures missing. Private estimates are being used in the interim, and official data will be added when available.

**Employment & Labor Market**

ADP’s private payroll data reported 44,000 new private‑sector jobs in October, surpassing forecasts. The modest growth reflects shifting demographics and tighter immigration rules, indicating a macro‑slowdown rather than a recession. With unemployment and other official metrics unavailable, the broader labor market remains hard to gauge, but business‑survey signals suggest a cautiously improving hiring outlook. Public‑sector hiring is constrained by the shutdown, posing a short‑term growth risk.

**Inflation**

The Consumer Price Index for September rose 3 % YoY, up from 2.9 % in August. Although lower than expected, it remains well above the Fed’s 2 % target. Housing inflation—still high after a two‑year decline—and tariff impacts are driving the figure, but the effect is expected to be temporary.

**Federal Reserve Actions**

In October the Fed cut the federal‑funds rate by 25 bps, easing short‑term debt markets. The move was largely anticipated, yet Fed officials signal caution about further cuts as inflation risk climbs while the labor market stabilizes. The 10‑year Treasury yield hovered near 4.12 % for the month, a slight dip mid‑month but largely unchanged, continuing its downward trend for 2025. This benchmark influences mortgage rates.

**Economic Growth Outlook**

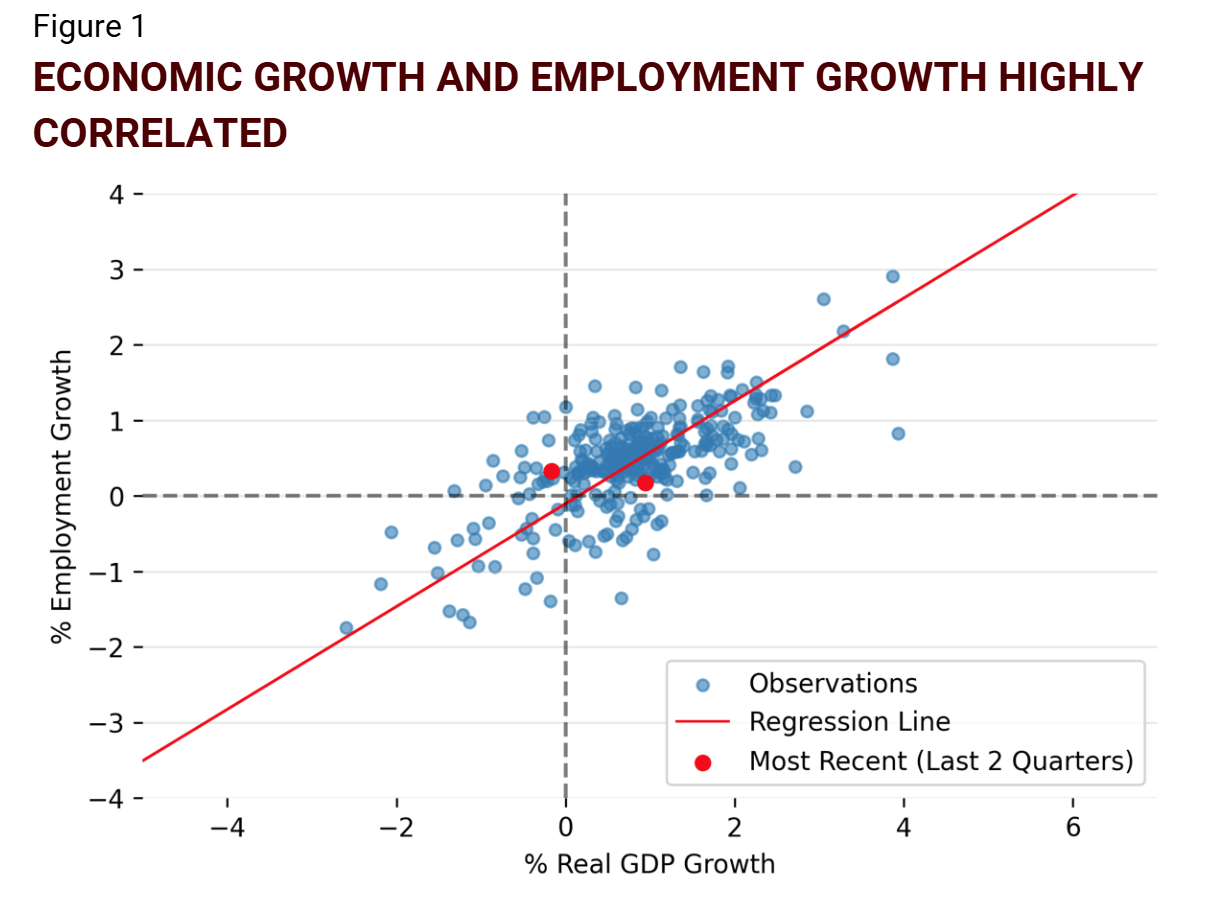

Growth sustainability hinges on employment expansion. Historical data show that GDP volatility tracks labor‑market changes. Current employment growth is near zero, driven by a broad slowdown and immigration policy. Trade‑adjusted GDP remains steady but unlikely to persist without a rebound in job creation. Artificial‑intelligence‑driven productivity gains could help, yet past surges have been short‑lived.

**Fed Dual Mandate**

The Fed balances price stability and full employment. Persistently high inflation keeps the central bank from fully easing policy. Its balance‑sheet operations—selling mortgage‑backed securities and buying Treasuries—have pushed mortgage rates higher. The recent 25‑bps rate cut was expected, but Fed Chair Powell’s reluctance to cut further has pushed long‑term rates up. An announced pause in net asset‑sale reductions in December may lower long‑term rates later.

**Trade Policy & Employment**

President Trump’s April tariffs and retaliatory measures have strained trade and capital markets, adding macro‑risk. Business‑survey data since 2017 show sharp drops in expected employment growth during periods of high policy uncertainty—first during COVID‑19, then the trade war. Resolving tariff disputes could lift the employment outlook.

**Texas Economic Indicators**

The shutdown hampers regional data, but the Federal Reserve Bank of Dallas survey shows a mixed business sentiment in Texas, with overall conditions moderating. Firms’ plans to hire in the next six months fell across manufacturing, services, and retail, especially in retail. Manufacturing firms reduced hiring plans, while services and retail saw slight increases. The survey hints at a potential labor‑market deceleration, though more data are needed to confirm a trend.

**Housing & Mortgage Rates**

Mortgage rates fell 13 bps in October, from 6.30 % to 6.17 %. Broad housing‑cost measures continue to decelerate as higher rates and a macro‑slowdown dampen activity. Persistent inflation keeps the Fed’s short‑term policy uncertain, but a shift toward Treasury purchases could ease financial conditions and lower mortgage rates. The mortgage spread—30‑year mortgage minus 10‑year Treasury yield—held steady at 217 bps, above the historical 150–175 bps range, suggesting potential declines of 50–75 bps as markets normalize.

**Key Takeaways**

- Private payroll data show modest job gains, but official employment metrics are missing due to the shutdown.

- Inflation remains above target, driven by housing and tariffs, but is expected to ease.

- The Fed has cut rates but signals caution on further easing; long‑term rates are rising.

- Economic growth depends on employment; current trends suggest a slowdown unless jobs rebound.

- Trade uncertainty continues to weigh on the labor market.

- Texas firms are tightening hiring plans, hinting at a possible deceleration.

- Mortgage rates are falling, yet the spread remains high, indicating room for further declines.

These insights provide a concise view of the U.S. economy amid the shutdown, pending official data, and evolving policy dynamics.