H

omeownership in America has long been touted for its financial benefits, offering a path to wealth-building through fixed-rate mortgages that seemingly locked in monthly housing costs. However, this notion is being challenged as overall homeownership expenses skyrocket due to climate change, rising home prices, and other factors. As a result, property insurance premiums are increasing, followed by property taxes and utilities.

According to research from ICE, variable costs like taxes and insurance now account for nearly one-third of the average mortgage payment nationwide. In risk-prone areas or those with high property taxes, these costs can reach nearly half of monthly payments. Other expenses such as electricity, water, and transportation are also contributing to the growing burden.

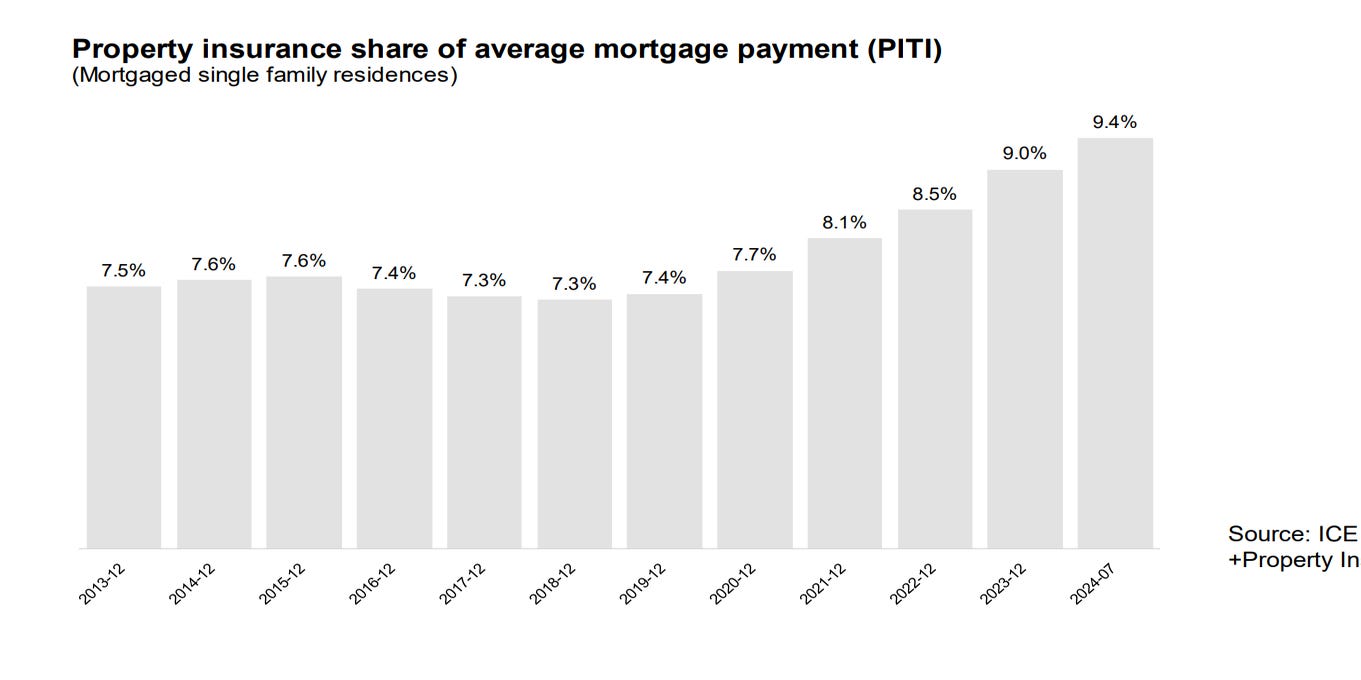

ICE's October 2024 Mortgage Monitor reveals stark numbers: property insurance payments have risen by an average of 52% since 2019, with some areas experiencing spikes of up to 90%. The national average property insurance payment reached a record $181 per month in July. Insurance premiums now make up 9.4% of homeowners' monthly payments.

For many Americans, these rising costs are becoming unsustainable. Homeowners who are struggling to make ends meet are turning to organizations like Neighbors Helping Neighbors, a Brooklyn-based housing nonprofit. Counselors at the organization report that even non-mortgaged homeowners, particularly the elderly, are finding it difficult to cope with increasing expenses.

As variable homeownership costs continue to rise, mortgage lenders and investors will need to reassess risk profiles. Historically, lenders focused on borrowers' financial and risk profiles at the time of loan origination. However, the evolving climate and hazard-related risks to properties mean that lenders must now consider how these risks change over time, even after a purchase is complete.