D

ang Thanh Tam’s fortunes surged during Trump’s first‑term trade wars, and although new tariffs threaten his gains, he has a $1.5 billion Trump International Hung Yen resort to offset the risk. In May, Eric Trump, EVP of the Trump Organization, flew to Vietnam to launch the project—a 2,500‑acre complex featuring a five‑star hotel, luxury villas, and two golf courses designed by Bryson DeChambeau. The ceremony, held in a modest white tent 37 miles south of Hanoi, was far less glamorous than the Qatar deal Eric had closed three weeks earlier, yet it marked a major milestone for Vietnam and for Dang, who, at 61, beamed as confetti fell. Eric declared the venture a “commitment to excellence, a celebration of culture and a lasting investment in Vietnam’s future,” to which Dang echoed his enthusiasm.

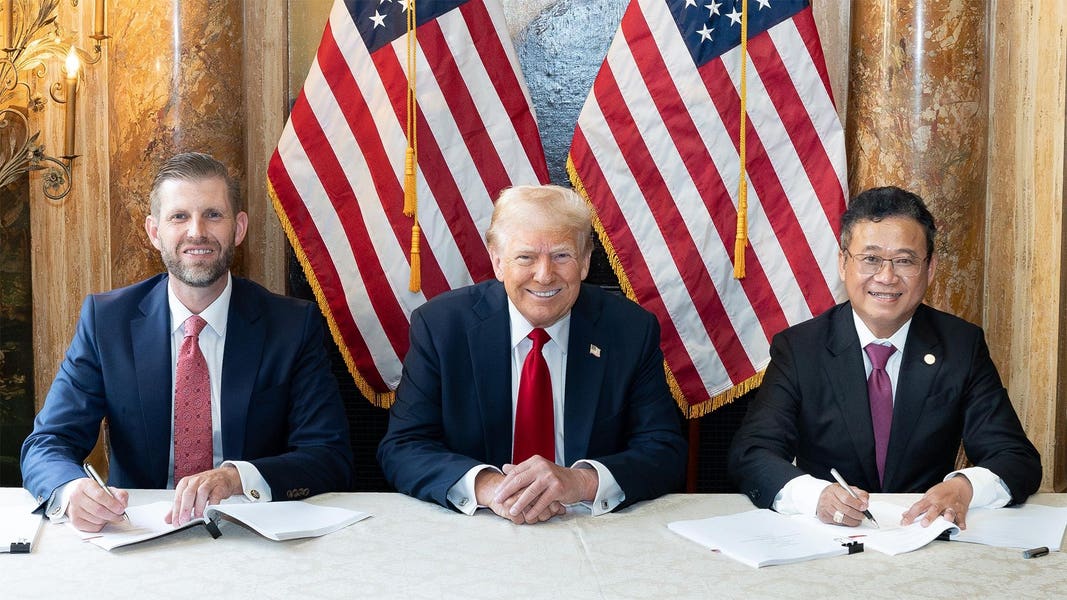

The agreement, signed in New York last September before Trump’s election, already proved lucrative: Dang’s company paid the Trump Organization $5 million in licensing fees, as disclosed in Trump’s June financial filing. Dang’s success mirrors Trump’s own trajectory—a property developer who built an empire on high leverage, nearly collapsed, and was rescued by geopolitical shifts. Today, Dang ranks among Vietnam’s wealthiest, with a $400 million net worth derived from a 34 % stake in Kinh Bac City and a 29 % stake in telecom infrastructure firm Saigontel.

Kinh Bac City, founded in 2002, grew from industrial parks that attracted manufacturers like Foxconn to a publicly listed company in 2007. Heavy borrowing nearly wiped out the firm in 2011 when interest rates spiked, but Dang restructured debt and refocused on industrial real estate. The 2017 U.S.–China trade war triggered a surge of relocations to Vietnam; Vietnamese exports to the U.S. rose 119 % between 2017 and 2021, and Kinh Bac’s revenues and net income increased 161 % and 54 %, respectively. The company now owns nearly 20,000 acres of industrial and residential land, hosting tenants such as Canon, LG, and Foxconn. Over 90 % of its customers are firms from China, Hong Kong, Japan, South Korea, and Taiwan, all of whom export to the U.S. The U.S. remains Vietnam’s largest export market, accounting for roughly 30 % of total turnover.

When Trump returned to office in 2021, the second‑term tariffs threatened Dang’s business. Slower industrial land deliveries in 2024 and a 46 % duty on Vietnamese imports announced in April caused Kinh Bac’s shares to tumble 27 %. Against this backdrop, the May 2025 groundbreaking of Trump International Hanoi proved timely, showcasing Dang’s close ties to the Trump family and marking the culmination of a relationship that began early last year. “We first engaged with Eric Trump through our international network,” Dang told Forbes. “The Trump Organization’s rigorous background checks impressed us, and we chose the brand for its global luxury reputation and belief in Vietnam’s long‑term potential.”

By June, Kinh Bac’s stock had recovered, posting a $47 million net profit on $140 million revenue in the first half of 2025, buoyed by approvals for new industrial parks. In July, Trump announced a new trade deal reducing tariffs to 20 % for goods transshipped through Vietnam, though a 40 % rate would still apply to certain products. Dang remains optimistic: “The tariffs created short‑term uncertainty but accelerated global supply‑chain shifts. For Vietnam, this was a structural opportunity.” He highlighted Vietnam’s advantages—young, trainable workforce and abundant rare‑earth reserves—and positioned Kinh Bac as an ecosystem builder for advanced manufacturing.

Born in 1964 in Haiphong, Dang grew up amid the Vietnam War, later moving to Ho Chi Minh City in 1976. He studied marine engineering, law, and business, then left Vietnam in 1988 to work in shipping across Asia, gaining a global perspective. In 1996, he and his sister founded Tan Tao, a joint venture with a state‑owned firm and a bank, financing a 450‑acre industrial park. By 2002, Dang launched Kinh Bac City, securing Canon’s investment in 2003 and Foxconn’s tenancy in 2007 after meeting Terry Gou at an APEC summit. The company went public in 2007, amassing a $1 billion valuation and a fortune that made Dang one of Vietnam’s richest men. He invested heavily in banks and mining, but a 2011 interest‑rate surge forced him to divest and refocus on industrial real estate.

Dang’s debt crisis peaked in 2013 when Kinh Bac’s debt reached 188 % of equity. He sold his bank holdings and concentrated on industrial parks, eventually regaining stability. The U.S.–China trade war and China’s COVID lockdowns accelerated the “China plus one” strategy, making Vietnam a preferred alternative for manufacturers. Kinh Bac’s northern location—close to China’s manufacturing heartland—offers a logistical advantage, allowing companies to assemble final products in Vietnam while sourcing components from nearby suppliers. Foxconn’s investment in Bac Giang for iPads and MacBooks exemplifies this trend, and Apple’s reliance on Vietnam for many of its U.S.‑market products underscores the country’s growing role in high‑tech manufacturing. Kinh Bac also hosts Chinese component makers Goertek and Luxshare, both key suppliers for Apple.

Dang’s new hospitality venture, the $1.5 billion Trump‑branded golf resort, presents a larger financing challenge. Success will hinge on structuring the project through partnerships and non‑recourse debt, as noted by analyst Tieu Phan Thanh Quang. Nevertheless, Dang remains confident that the Trump brand will elevate his firm’s luxury portfolio. He sees the Hung Yen project as just the beginning, expressing openness to future Trump‑branded developments.

In sum, Dang Thanh Tam’s journey—from a war‑torn childhood to a global industrial real‑estate empire—mirrors the broader narrative of Vietnam’s rapid economic ascent. His partnership with the Trump Organization, forged amid shifting trade dynamics, positions him to capitalize on both domestic growth and international supply‑chain realignments, ensuring that his fortunes continue to rise even as geopolitical tides shift.