I

n July 2017, the president appeared in a cowboy hat at the White House, a moment that sparked speculation about a potential Trump venture in Nashville. Two weeks later, on September 22, Delaware incorporated DT Marks Nashville LLC and DT Marks Nashville Member Corp. The entities are barely known, yet their names echo a pattern used by the Trump Organization for at least twenty licensing entities registered through Corporation Service Company, the shell firm that creates new Trump‑branded companies.

Although the president has not publicly announced a Nashville project, he has long hinted at one. If these Delaware entities are indeed the vehicle, it would mark his first new U.S. real‑estate licensing deal since 2017 and illustrate how his political resurgence fuels fresh business opportunities. Trump Organization representatives declined to comment, and Forbes could not confirm ownership or purpose.

Like other Trump projects—recently announced in Vietnam, Romania, Qatar, and the UAE—these Nashville ventures follow the “DT Marks [Location]” naming scheme. For example, the Trump International Hotel in Oman is not owned by the president; he owns DT Marks Oman LLC and Member Corp., through which he collects licensing fees. The same applies to the Trump International Golf Club outside Dubai, where he receives income via DT Marks Dubai LLC and Member Corp. All of these entities were registered in Delaware by Corporation Service Company, alongside dozens of others.

Trump’s international licensing business has surged since his return to politics, growing from $100 million to $500 million. In contrast, his domestic licensing empire has stalled, with no significant new deals since he first took office eight years ago. At the start of his first term, sons Eric and Don Jr. launched two hotel brands, Scion and American Idea, aiming to distance the properties from the Trump name while targeting markets outside the large liberal cities where the president had built his career.

During that period, the Trump Organization claimed between nine and thirty‑nine agreements under the new brands, including locations in Dallas, Cincinnati, Austin, New York, and Nashville. However, most of these projects yielded little revenue. Trump earned only $37,000 in 2017‑2018 from the Mississippi Delta region, where the Chawla family of local hoteliers partnered with him while he was in office. No other projects generated income for the president.

The sons eventually shifted focus to maintaining existing assets rather than adding new ones, pausing their expansion until the end of his presidency. The January 6 riot in the final days of his first term inflicted lasting damage on the Trump brand. Kevin Brown of Morningstar noted that the event permanently harmed the Trump name for decades. Twitter and Facebook banned the president, and several banking partners withdrew support.

Out of office, Trump pursued retaliation by launching his own social‑media network. In 2022, an executive who had previously worked with Trump on a UAE deal introduced the family to a new opportunity in Oman. Subsequent foreign deals followed, especially as his 2024 campaign gained traction. Yet the brand remained polarizing in the U.S., prompting developers to remove the Trump name from properties rather than add it.

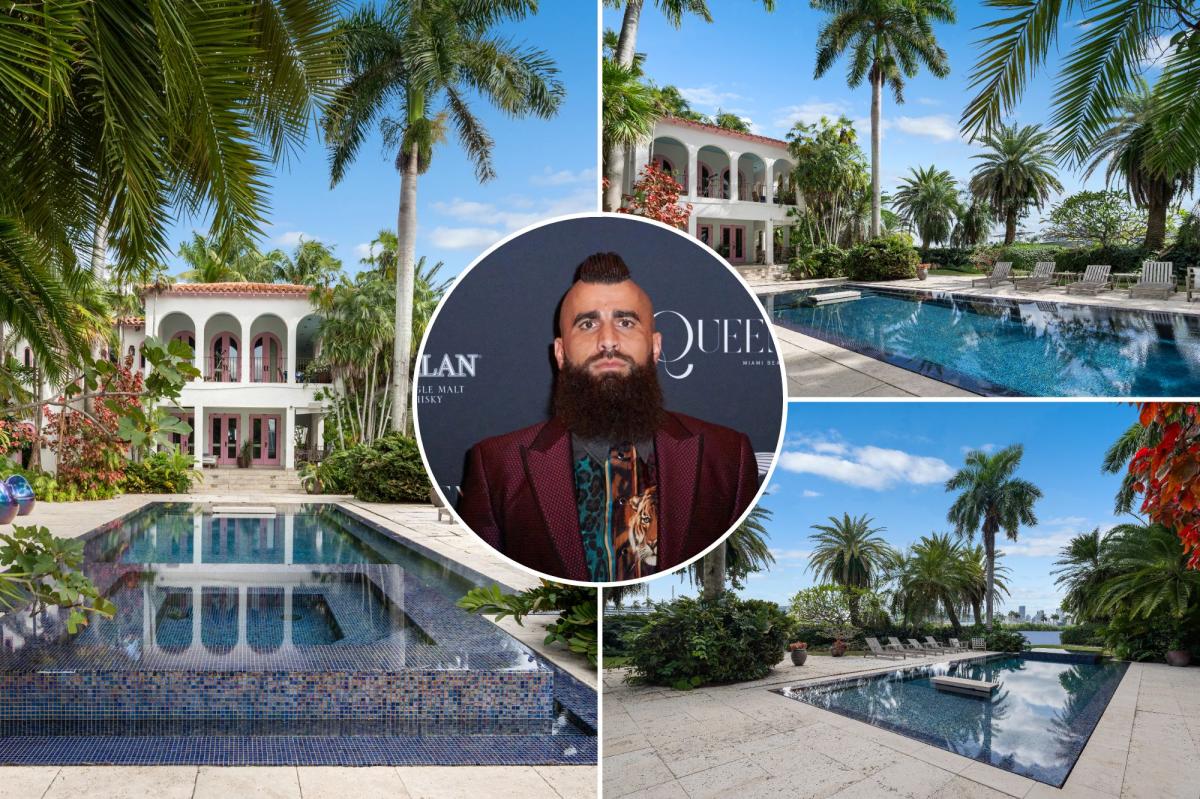

By the time Trump returned to the White House this year, he was earning revenue from only one U.S. real‑estate licensing deal—a hotel just outside Miami that pays roughly $400,000 annually. That property lost group business when the Trump name became politically charged. “Convention organizers would choose a Westin‑type hotel to avoid offending guests,” says Gil Dezer, a long‑time partner on several Trump projects. Dezer explains that while some backed away, he and his team pivoted: “Half of America may not like him, but half does. In today’s digital world, we can target those groups and fill the hotel.”

A Trump‑branded property in Nashville, a liberal‑leaning city in a conservative state, would undoubtedly stir controversy. Petitions emerged in 2017 when the Trump Organization floated the idea of a Nashville venture. The family enjoys support in Tennessee, but it is unclear who would be involved in the new project. John Rich, a country‑music star and long‑time Trump ally, said he was unaware of any plans. Kid Rock, a Trump supporter with a Nashville bar, did not respond to inquiries. Local developer Paul Boyle declined to comment.

For those looking to do business with Trump, Dezer suggests the timing is favorable. “He’s in the office,” he says. “He’s making the right moves, presenting himself well. Trump is hot right now—an excellent brand to sell.”