Vermont Real Estate Roller Coaster Slows Down

Post-pandemic boom and low inventory, buyers are easing, yet sellers still hold the advantage.

Cayuga County Real Estate: Homes Sold Sept. 20-26

Cayuga County home transfers (Sept. 20‑26): 32 sales; median 1,066‑sq‑ft Swift St., Auburn.

Assumable Mortgages: Reducing Costs in South Florida Real Estate

Could you please provide the subheading you’d like rewritten?

Four Real Estate Stocks Pull Back After Fed Rate Cut – QQQ & DIA

Four RE stocks lose momentum despite Fed rate cut, highlighting sector risks amid supportive policy.

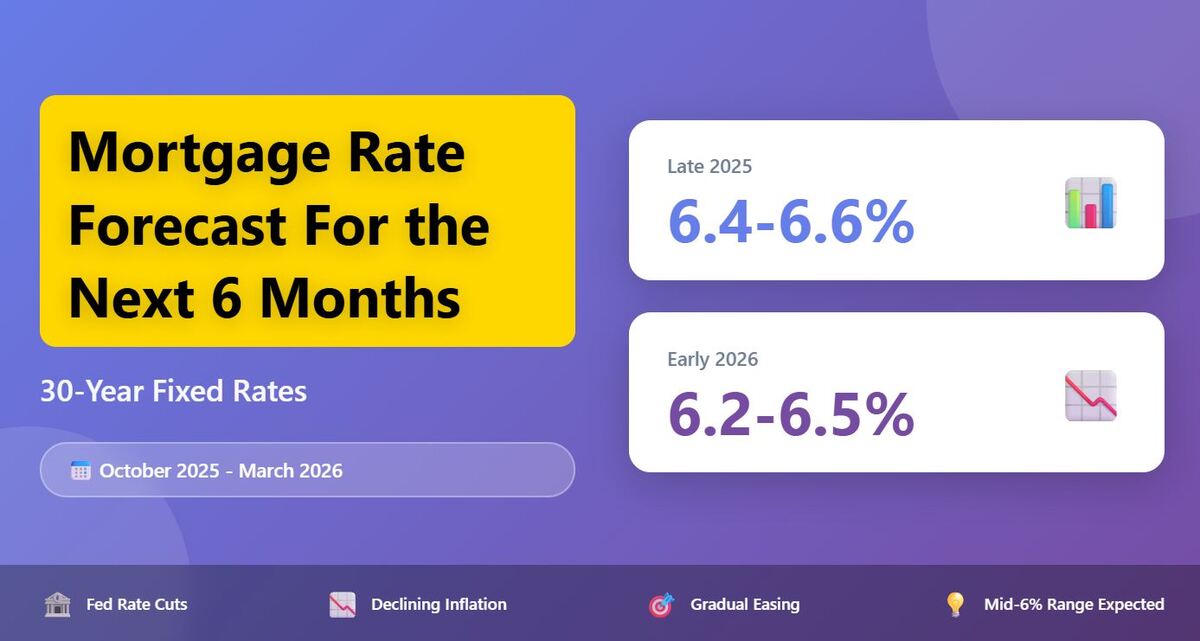

Mortgage Rate Outlook: Oct 2025 – Mar 2026

2025-26 mortgage rates Oct-Mar: Fed cuts, inflation, buyer affordability, and Fannie Mae & MBA forecasts.

Late-summer homebuying surge defies expectations

Pending home sales rose in August, but economists say rates must drop to ~6% for noticeable market improvement.

Florida Housing Market Shifts as Pending Sales Surge

Florida housing market booms in Aug 2025 as falling mortgage rates spur pending sales surge.

August Sees Surge in Buyers Signing Contracts

Lower mortgage rates fuel confident moves in the home‑buying market.

U.S. Homebuyer Affordability Rises for Fourth Consecutive Month

Homebuyer affordability up in August, fourth month in a row, due to lower mortgage rates and higher incomes, MBA reports.

Hidden Fees: Savvy Property Investing for Long-Term Gains

RE/MAX Ready’s Matt Mittman reveals hidden costs of long‑term real‑estate investing. Watch below.

Is 2026 the Year for a Real Estate Crash or Recovery?

2026 real estate: boom or crash? Experts predict modest growth, not extremes. Prices, rates, sales, regional trends.

Media Advisory: BC REA Partners Urge Permanent Housing Roundtable

Vancouver, Sept. 29, 2025 – BCREA hosts press conference; housing and municipal partners issue urgent call.

Los Angeles Business Journal: New Real Estate Investment Firm Launches

Eliav Dan, investment banking veteran, launches West LA real estate investment banking & advisory firm.

IYRI ETF at $50.24; NEOS Real Estate Yields 8.7% as Fed Cuts Fuel REIT

NEOS Real Estate High Income ETF (IYRI) – $124.46M AUM, $50.24, 8.7% yield, monthly payouts. Fed rate...

Guggenheim extends lease, expands footprint on Madison Ave.

Guggenheim renews 17‑year lease, expanding to 360k sq ft from 240k.

2026 California Housing Market Forecast: Next Year Predictions

2026 California housing forecast: Experts analyze price trends, rates, inventory, regional factors—stabilization ahead.

2025 Housing Market Forecasts from NAR's Chief Economist

2025 Housing Market Outlook by NAR’s Lawrence Yun: Sales, mortgage rates, inventory—expert predictions.

Mortgage Rates on 9/28/25: Notable Rise, Higher Borrowing Costs

Mortgage rates climb (Sept 28, 2025) – 30‑yr fixed 6.67%. Refinance rates mixed as Fed cut affects borrowing costs.

October 2025 Mortgage Rate Forecast: Are Rates Set to Drop?

Will mortgage rates fall in Oct 2025? See expert forecasts, economic drivers, and impacts for buyers and refinancers.

Column: Intelligent Upgrades for the Current Real Estate Market

Kitchen/bath upgrades, fresh paint, decluttering, curb appeal raise home value amid steady rates.