C

ommercial real estate has long relied on vast amounts of data, but the industry's fragmented and outdated information has made decision-making more complex than necessary. Traditionally, teams have had to manually collect and verify data from multiple sources before interpreting it.

AI is changing this process by automating data collection and structuring unstructured information. This provides real estate teams with a more efficient way to analyze markets, manage properties, and make better investment decisions. Keyway, a real estate technology company, has developed AI-powered tools like KeyComps for real-time rental comp analysis and KeyDocs for automated document management.

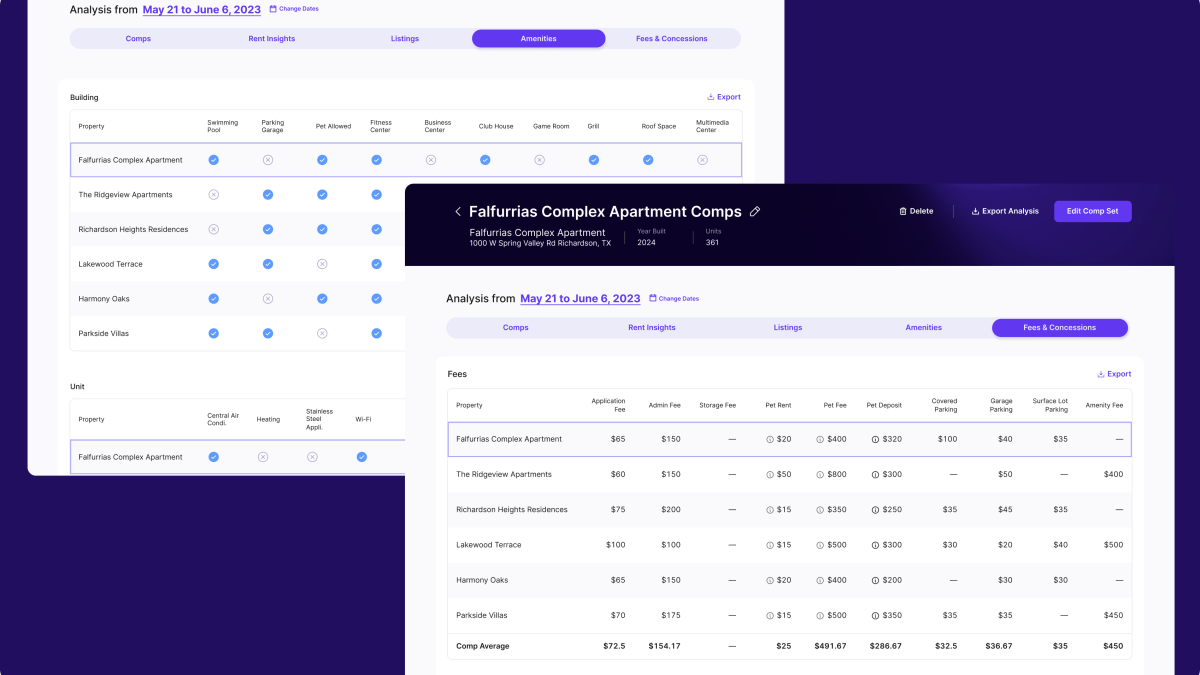

AI is playing an increasingly important role in real estate operations by automating complex analyses and identifying patterns. For example, KeyComps automates the rental comp analysis process by pulling in public data to provide clean, verified, and transparent rental comps. This simplifies the process of comparing rents from multiple sources, adjusting for differences across units, and verifying concessions.

Similarly, KeyDocs automates lease abstraction and document management, reducing the time spent reviewing legal agreements. AI extracts and highlights critical terms such as escalation clauses, renewal options, and compliance requirements, which helps real estate teams to minimize risk and make more informed decisions.

Data fragmentation is a major challenge in commercial real estate, with information scattered across various property management systems, spreadsheets, leasing documents, and market research reports. AI solves this problem by aggregating data from multiple sources and structuring it in a way that is useful for decision-making.

KeyComps centralizes rental market data from public sources, allowing real estate teams to compare rents, fees, and concessions in real time at the unit level. KeyDocs organizes and analyzes critical real estate documents, such as leases, offering memoranda, and zoning reports. AI can extract key terms from multiple documents, reducing the risk of missing important details and improving efficiency for asset managers and legal teams.

By consolidating fragmented data into a centralized and easily accessible format, AI allows real estate teams to make faster, more informed decisions while reducing errors and inefficiencies. The greatest value of AI lies in improving the accuracy of decision-making, mitigating risks by analyzing data at a scale and precision that humans cannot match.

In the coming years, three major areas will see significant change: AI-driven underwriting and market analysis will become the norm, lease and document automation will become standard practice, and AI will drive operational efficiency at the property level. Real estate teams that integrate AI solutions into their decision-making processes will be better positioned for success in a future where real-time data analysis and predictive insights are the norm.