A

labama’s housing scene is shifting. After a surge in home values fueled by record‑low rates and a pandemic‑era boom, prices have begun to level off. From January to September, most of the state saw declines, mirroring a broader Southern and Western trend noted by Zillow.

Jeff Newman, a Birmingham broker at Arc Realty, attributes the slowdown to higher rates, market uncertainty, and waning consumer confidence. The average 30‑year fixed mortgage rate rose to 6.35% in September from 2.65% in early 2021, while the University of Michigan’s Consumer Sentiment Index fell to just over half its pre‑pandemic level.

Zillow reports that the typical Alabama single‑family home dropped about $1,000—roughly 0.4%—between January and September. The last comparable eight‑month drop occurred in March 2023; before that, it hadn’t happened since 2012. Despite the recent dip, prices remain well above pre‑COVID levels: the average home is now valued near $230,000 versus $164,000 in December 2019.

The market has swung wildly over the past two decades—from early‑2000s highs to the 2008 crash and the recent pandemic surge—leaving many buyers, sellers, and agents unfamiliar with a “normal” market. Newman notes that buyers and sellers now expect a typical 50‑60 day listing period, and that the lack of repair requests during the boom years has left some agents unprepared for current negotiations.

A correction is underway. About 20% of Alabama homes now carry a price cut, matching national figures. Homes are selling more slowly, reducing bidding wars and giving sellers a clearer sense of market value. Zillow’s data shows that time on market, price‑cut frequency, and cut amounts have risen across most metro areas.

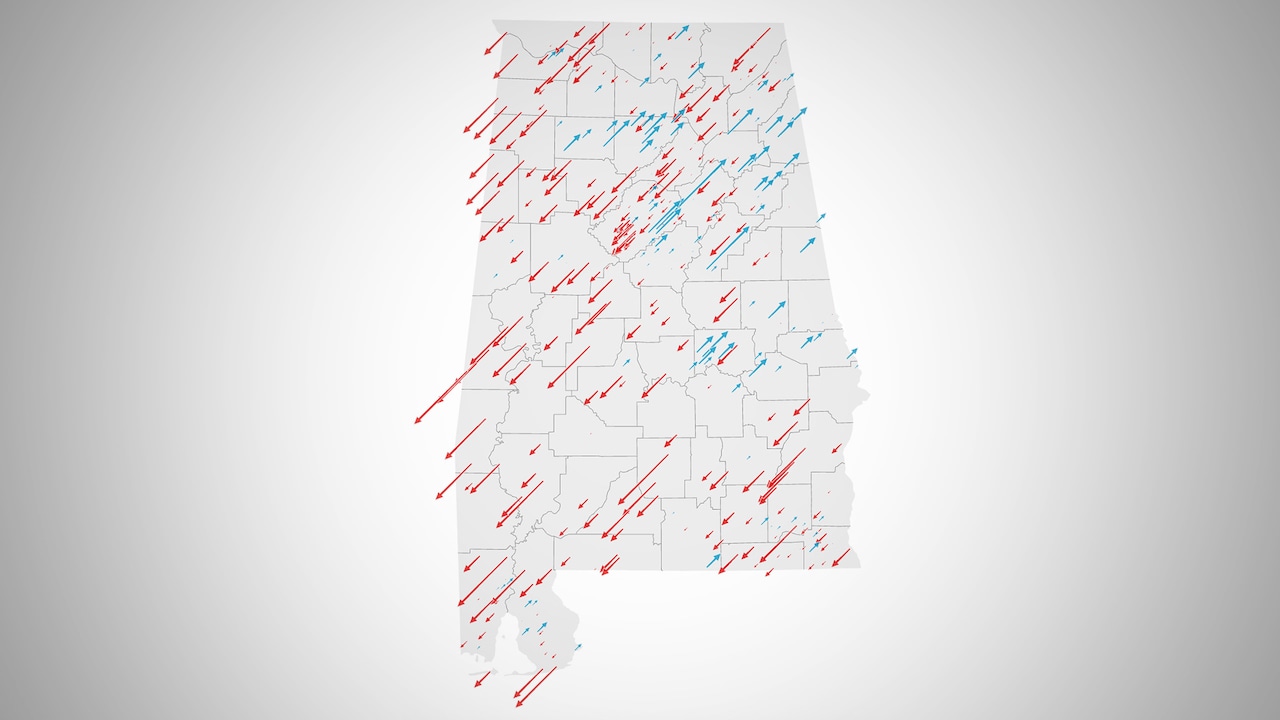

County‑level analysis reveals that 49 of Alabama’s 67 counties (73%) experienced price declines. The Black Belt region—Perry and Sumter—saw the steepest drops, each losing roughly $18,000 in eight months. Jefferson (Birmingham), Madison (Huntsville), and Mobile counties also fell. Conversely, Cullman County gained about $6,000, and Cherokee, Elmore, and Lee counties each rose by at least $5,000.

On the city level, 69% of the 436 places Zillow tracks lost value. Mountain Brook, the state’s priciest suburb, saw a $24,000 jump, and eight of the ten highest‑value cities increased through September. This trend underscores that higher‑priced homes are less sensitive to rate hikes; buyers of $800,000 properties have more flexibility than those eyeing $250,000 homes.

Zillow’s market heat index, which gauges buyer versus seller dominance, shows many Alabama markets cooling. In September, Birmingham and Huntsville hovered in the mid‑50s—a neutral stance after years of seller advantage. The index has trended downward, but the regions remain balanced.

Newman cautions that while prices are dipping, the long‑term trajectory remains upward. With limited inventory, supply and demand dynamics will keep values rising. Even if rates eventually fall, the market’s fundamental tendency to appreciate over time persists.

Zillow’s Home Value Index, which underpins these estimates, confirms that Alabama’s typical home value will likely climb in the coming years, despite short‑term fluctuations.