R

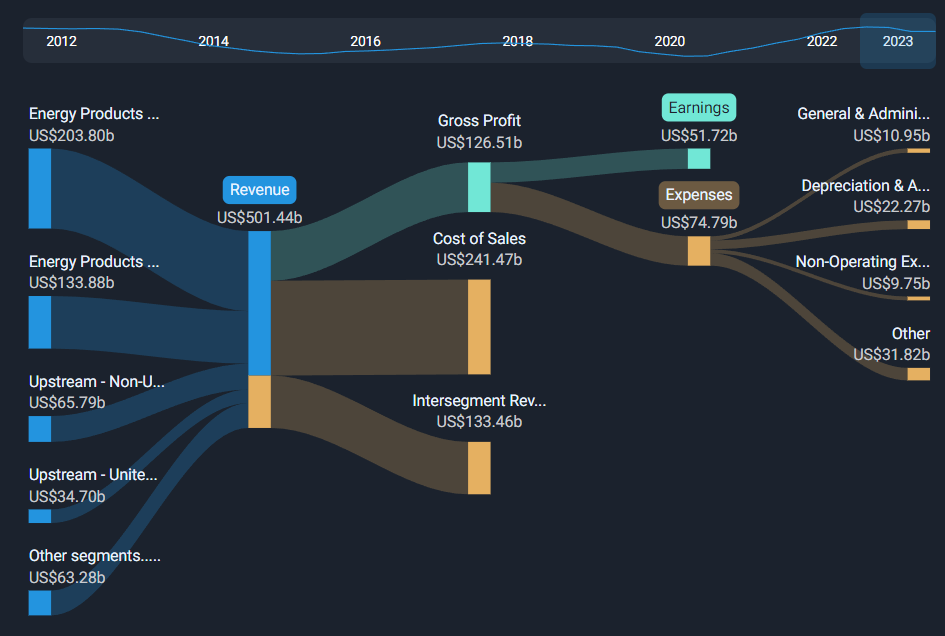

evenue rose 13% to RM22.1m in the latest quarter, with net income increasing by a significant 63% to RM3.03m. This growth is reflected in the company's profit margin, which expanded to 14%, up from 9.5% in the previous quarter. Earnings per share (EPS) also saw an improvement, reaching RM0.005 compared to RM0.003 in the same period last year.

Looking ahead, revenue is forecast to grow at a rate of 6.0% annually over the next three years, outpacing the REITs industry's growth forecast of 2.7%. The company's shares have gained 4.8% in value over the past week. However, it's essential to consider potential risks, as we've identified five warning signs for Al-Salam Real Estate Investment Trust that investors should be aware of.

Note: This article is general in nature and provides commentary based on historical data and analyst forecasts. It does not constitute financial advice and is intended to bring long-term focused analysis driven by fundamental data.