B

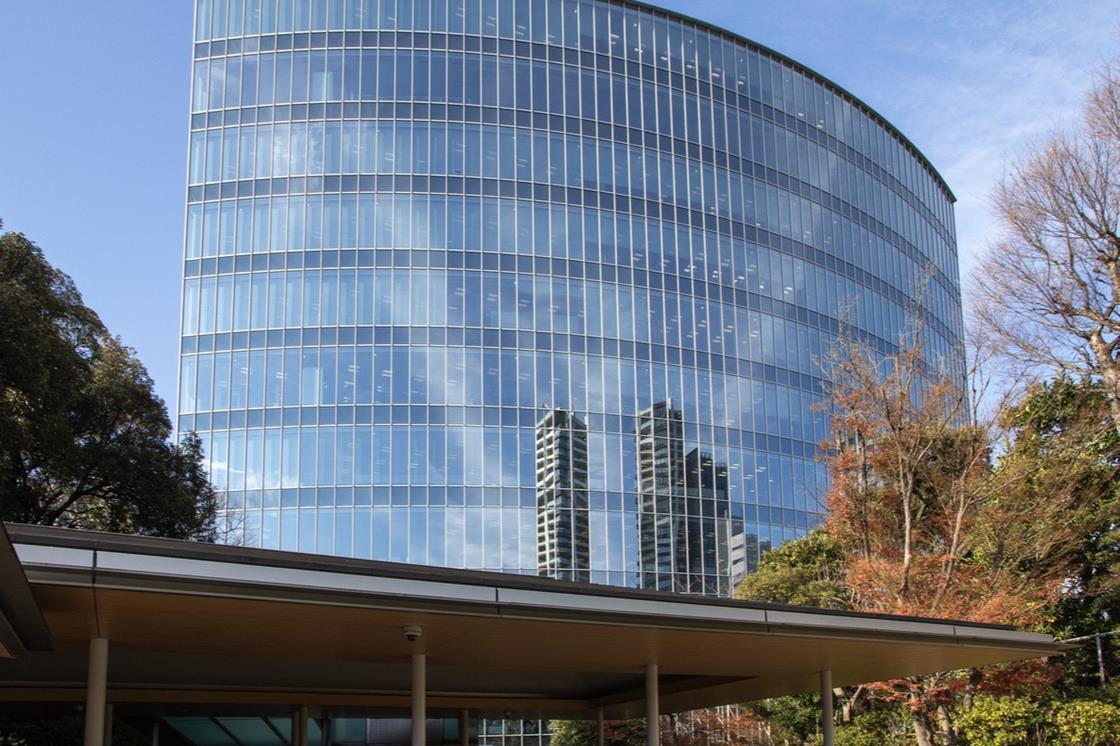

rookfield has invested $1.6 billion in Japanese real estate, acquiring a stake in the Gajoen complex in Central Tokyo and a logistics development project in Greater Nagoya. The company will manage the dual office tower, retail, and luxury hotel complex in Meguro, with plans for renovation and active asset management.

In Anpachi, Brookfield has acquired 1 million sqft of land to develop a 2.4 million sqft premium-grade warehouse. Construction is expected to begin in the first half of 2025 and complete by early 2027. The company sees strong potential for growth at Gajoen and expects tight vacancy rates in Greater Nagoya to drive demand for logistics facilities.

Brookfield's head of Asia Pacific and Middle East real estate, Ankur Gupta, said these transactions represent opportunities the company will seek in Japan in 2025, particularly in logistics and high-quality office. Ikushin Tsuchida, Brookfield real estate SVP, added that the company's operational expertise in placemaking and managing large mixed-use assets will give it an advantage when leasing the Anpachi Logistics Development.