A

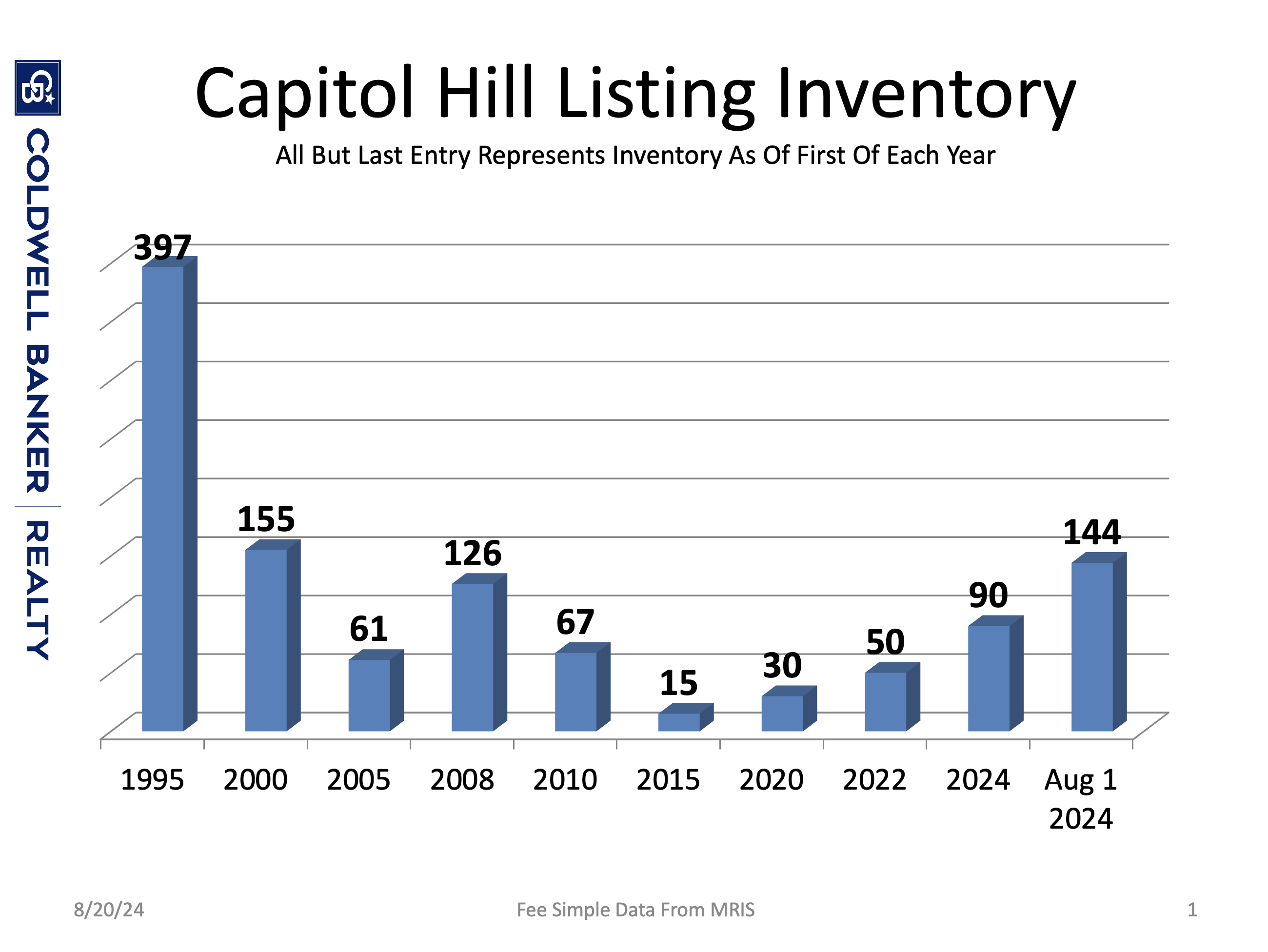

s summer draws to a close, the Capitol Hill real estate market is experiencing its usual slowdown. It's easy to get caught up in the uncertainty and think that prices are plummeting, but the truth is that this time of year is historically the slowest for sales. The first six months of the year account for 60% of our sales, while the last six months make up just 40%. This doesn't mean the market is tanking - it's simply a buyer's market.

The right house at the right price will still move quickly, even in this slower period. However, it's essential to be cautious with pricing and not get too aggressive. We can only look back at trends and try to predict what's next. The recent talk of lower interest rates may have an impact, but how long buyers will wait before returning to the market is anyone's guess.

Looking at the numbers for single-family homes in Washington DC, we're expecting a small bump in median sales prices (3-5%) by the end of the year, with around 3,400 sales. Days on market may increase slightly to 35, and upper-bracket sales will make up about 83% of the market. On Capitol Hill, median prices are down slightly, but properties over $500,000 still account for roughly 98% of our market.

The key takeaway is that it's essential to focus on your individual situation rather than trying to time the market. When the numbers and other factors work in your favor as a buyer or seller, seize the opportunity.