S

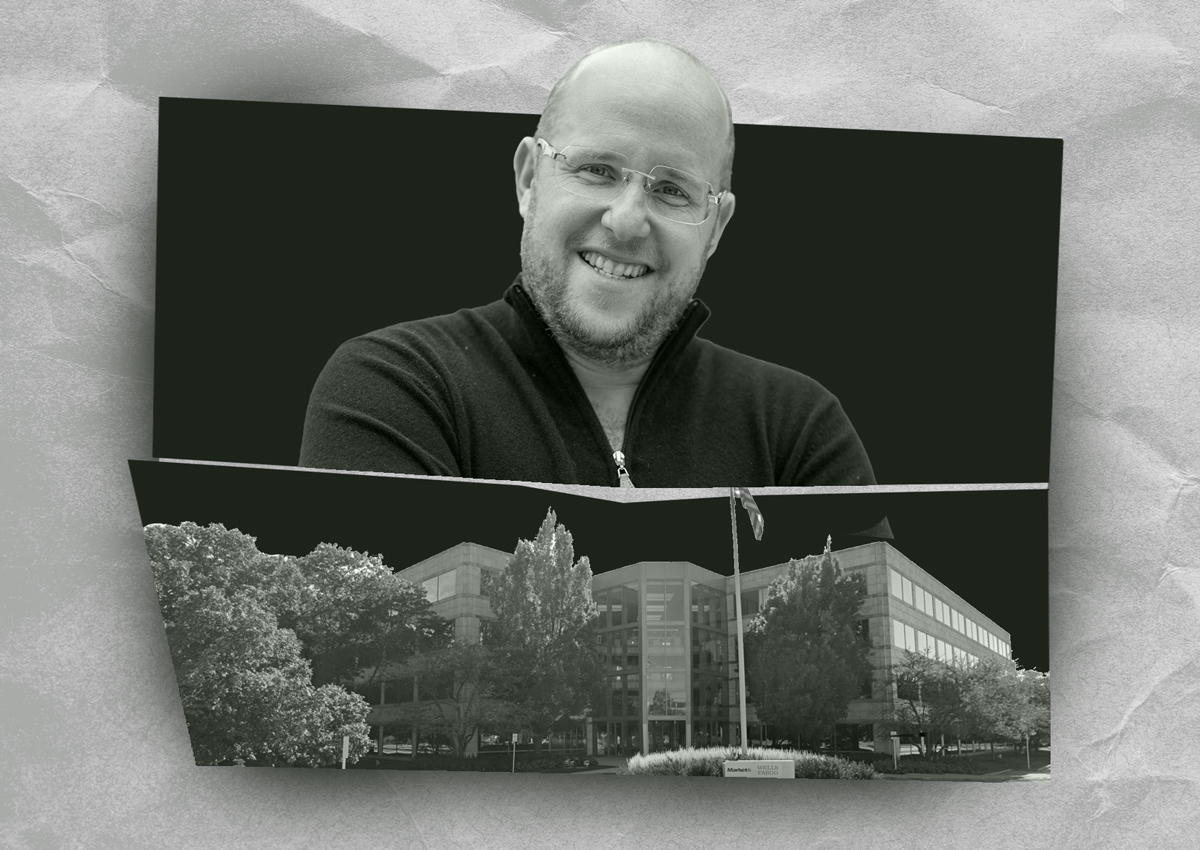

haya Prager, head of Opal Holdings, is facing accusations that his firm improperly withheld over $2 million in cash needed to manage a 697,000-square-foot office property in suburban Chicago. The allegations come from Keelee Leyden, a receiver appointed by a Lake County judge to oversee the Corporate 500 Campus at 500-540 Lake Cook Road in Deerfield.

Leyden claims that shortly after her appointment in July, $1 million was wired out of the property's bank accounts, hindering her efforts to keep the asset healthy amid Unify Financial Credit Union's foreclosure lawsuit. She is also seeking the return of over $1 million in other payments and security deposits moved out of the property's accounts without authorization.

This dispute follows a string of foreclosure lawsuits against Opal Holdings' other properties, including a massive Minneapolis-area office campus and Fort Worth's tallest tower, after it allegedly defaulted on more than $100 million in loans. Prager's firm is also accused of duping lenders into allowing Opal to double-dip on debt.

The court has yet to rule on Leyden's motion to compel Prager to turn over the Corporate 500 property's funds. Representatives for Opal Holdings and Leyden did not respond to requests for comment. The fight over the missing money is being hashed out in Unify Financial Credit Union's foreclosure suit against the Opal affiliate that owns the property, which was sparked by Opal allegedly failing to pay property taxes.