T

wo former headlines are now headlines of decline. The former Snapchat headquarters, a mixed‑use beachfront complex in Venice, sold for $30.7 million to Stefan Ashkenazy, owner of the Petit Ermitage hotel. DLJ Real Estate Capital Partners had bought the property for $40.5 million in 2014. When Snapchat consolidated its Silicon Beach offices in Santa Monica, the Venice building sat empty, and the sale came at a loss to the seller.

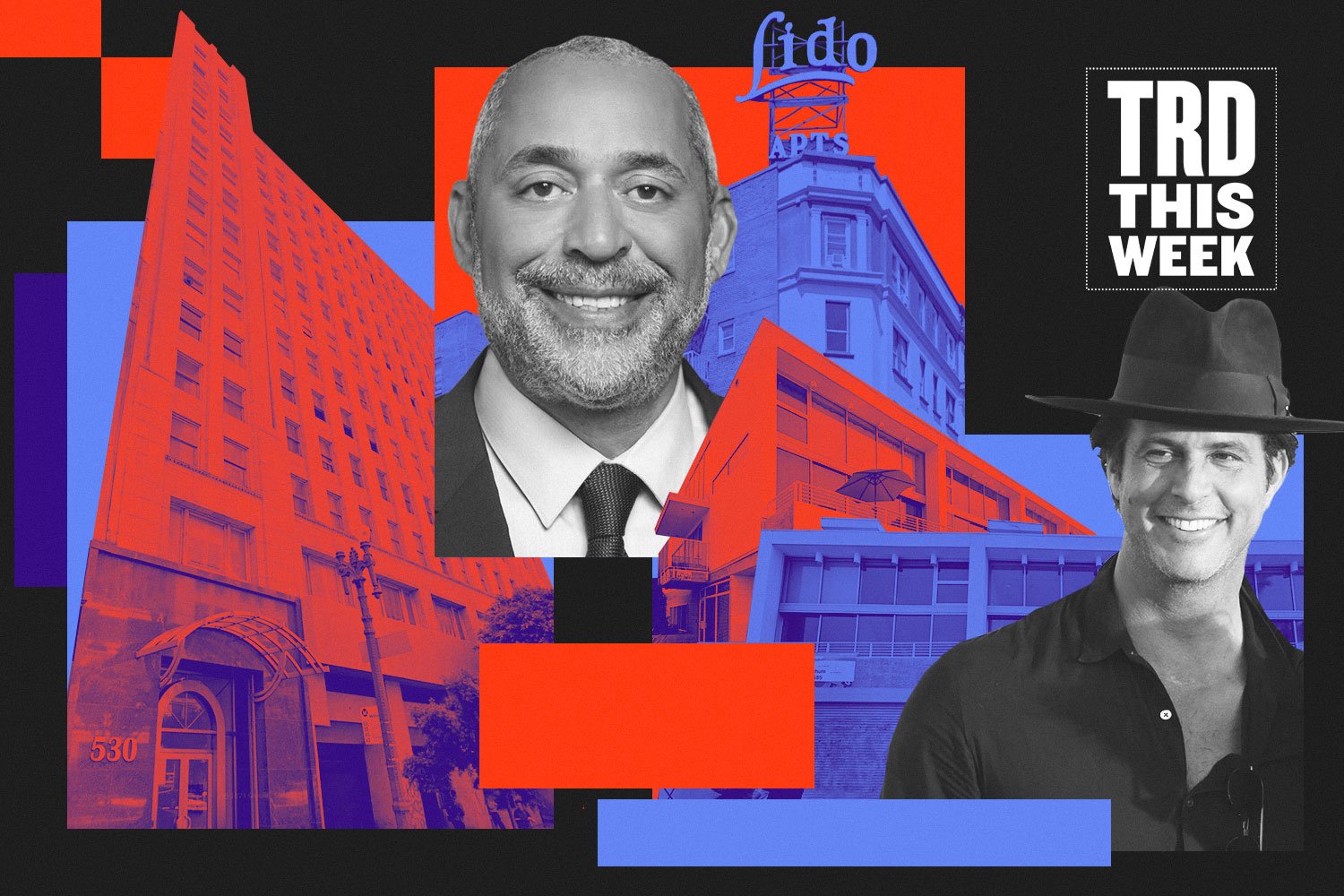

The other icon, an apartment block that graced the back cover of the Eagles’ *Hotel California* album, is headed for a foreclosure auction on October 28. Neveo Mosser and Mosser Capital owe $29.4 million on the loan. A notice of default preceded the auction. Mosser Companies had already defaulted on an $88 million loan tied to 12 San Francisco apartment buildings earlier this year, a fact that may explain the impending sale.

Laeroc Partners, the owner of 530 West 6th Street, faces a lawsuit from Cathay Bank. The bank alleges a $31 million loan default and seeks foreclosure and a receiver for the office and data‑center property. Laeroc denies the claims and requests dismissal with prejudice, asking the bank to cover all legal fees. Kim Benjamin, Laeroc’s president, signed the complaint. Attorneys for both sides have not yet responded.

In downtown Los Angeles, Banc of California inked an 11‑year lease for 40,000 sq ft at 865 South Figueroa Street. The deal includes naming rights, so the building will bear the Banc of California name, replacing the former TCW Tower logo. The bank had previously signed a $100 million naming agreement for the Los Angeles Football Club stadium but withdrew after four years.

EY Plaza, a 41‑story tower at 725 South Figueroa, has seen its valuation drop 10 percent to $135 million. The building, once valued at $446 million pre‑pandemic, is now being marketed by Colliers for a $275 million note on the distressed office tower. Offers are expected on October 28. The tower was owned by Brookfield before a receiver was appointed following a default on commercial mortgage‑backed securities. A prior sale attempt failed.

These stories illustrate how once‑glamorous properties and companies can slip into financial distress, with auctions, lawsuits, and rebranding marking the new chapters.