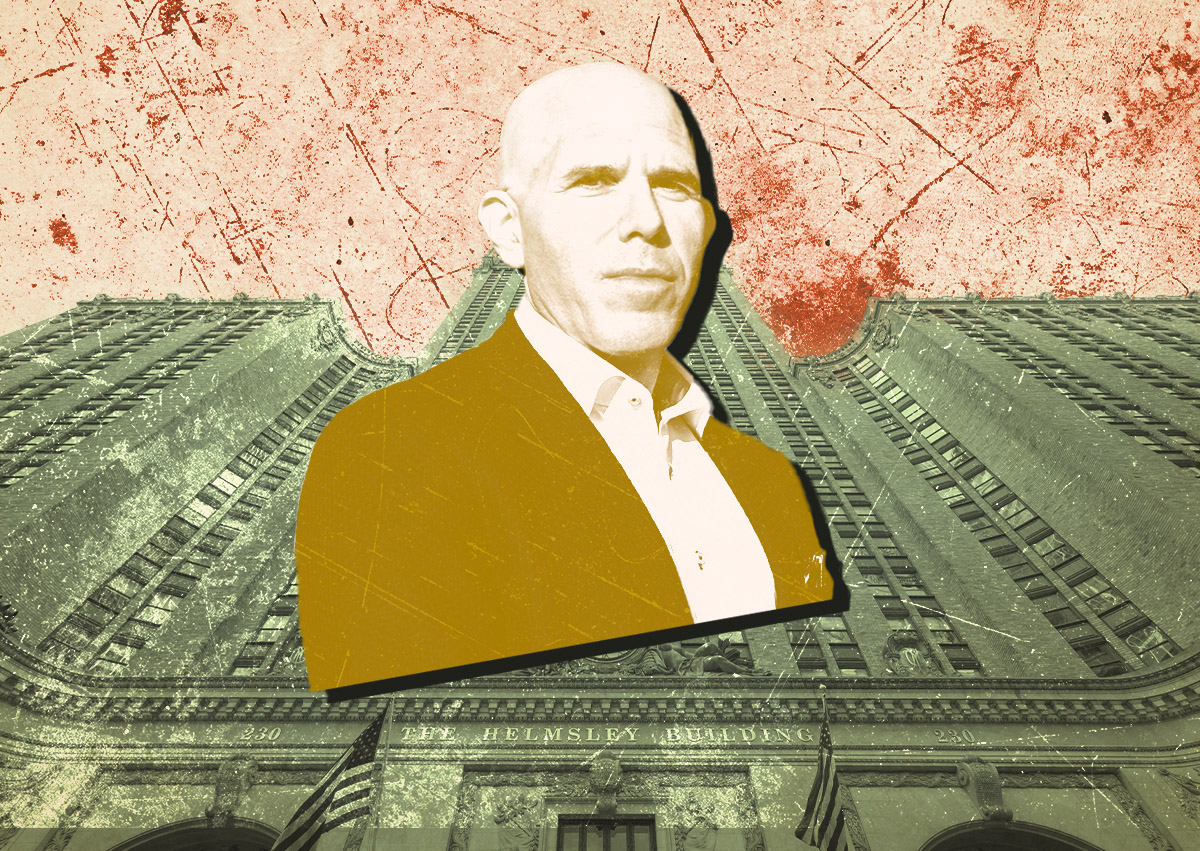

A

year after RXR defaulted on a massive loan backing the iconic Helmsley Building in Midtown Manhattan, lenders have taken action. Morgan Stanley and other lenders filed a foreclosure action in New York State Supreme Court, citing a $670 million mortgage default. The loan was transferred to special servicing ahead of maturity, with RXR initially working to restructure it.

Despite claims of "constructive conversations" between the parties, lenders are now pushing forward. With an additional $125 million in mezzanine debt held by Morgan Stanley and Brookfield, they could assume control of the building upon foreclosure completion. The Helmsley Building was purchased by RXR for $1.2 billion in 2015, with a $785 million acquisition loan from American International Group.

However, the pandemic has significantly impacted the property's value, with an appraisal last month valuing it at $770 million – roughly 64% of its original purchase price. Vacancy rates have soared and average rents have dropped, threatening 30 percent of the building's rent roll as leases expire next year. RXR is reportedly considering converting part of the property into residences to mitigate these issues.