F

PA Multifamily is offering a 758-unit residential complex west of Chicago for sale, marking their latest investment in the area this year. The California-based firm has listed the ReNew Wheaton Center, a complex consisting of six apartment buildings, including two 20-story high-rises. The complex, located at 1 Wheaton Center in Wheaton, is being marketed by JLL's Kevin Girard, Mark Stern, and Zachary Kaufman.

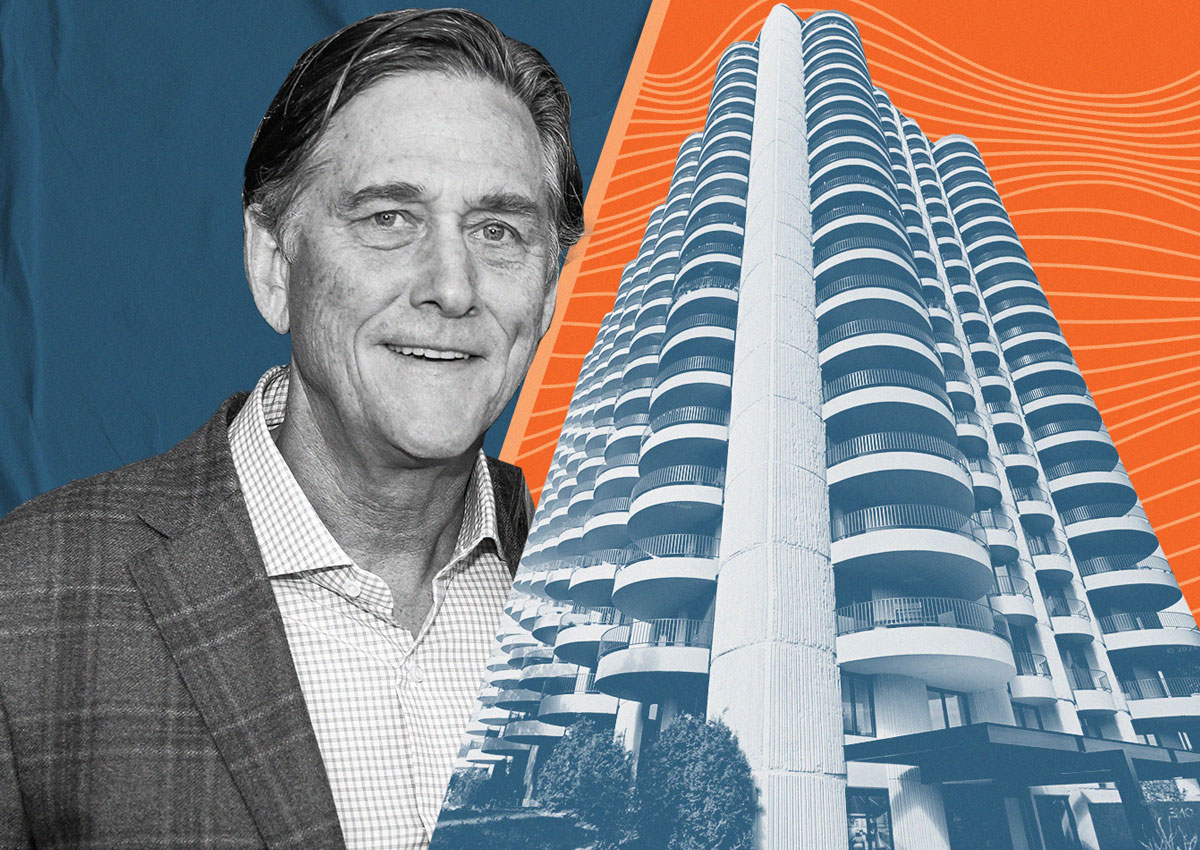

Despite the challenges posed by rising interest rates and slowing sales in the multifamily investment market, FPA, led by founder Greg Fowler, is optimistic about overcoming these obstacles by offering potential buyers "accretive assumable financing." This financing structure has become increasingly popular in the Chicago real estate market, as demonstrated by recent transactions such as the $31 million sale of the 78-unit MODE Logan Square Apartments and the $94 million sale of the Haven on Long Grove in Aurora, both of which utilized assumable interest rates to secure buyers in a difficult market.

FPA has also employed this financing approach in their own transactions. They acquired the 642-unit Reserve at Hoffman Estates in July for approximately $102 million, aided by an $80 million assumable loan at a 4.52 percent interest rate. The terms for the loan at ReNew Wheaton Center have not been disclosed.

FPA purchased the ReNew Wheaton Center, previously known as Wheaton Center, for $131 million, or $173,000 per unit, in 2018. Since then, the property, built in 1972, has maintained a high occupancy rate of 96 percent, with rents increasing by 9 percent on new leases and 5 percent on renewals, according to JLL.

This sale marks the latest in a series of high-profile transactions by FPA Multifamily in the Chicago area. Earlier this year, the firm paid $144 million for a 500-unit tower at 1326 South Michigan Avenue in the South Loop, which stands as the city's largest residential deal this year. Other notable acquisitions include the 267-unit Seneca tower in Streeterville and the 558-unit Westmont Village in the western suburbs.