C

olorado's housing affordability crisis has reached a boiling point, with the state ranking 50th in terms of affordability among all states and the District of Columbia. Mesa County is particularly hard hit, experiencing the largest decline in housing affordability among the seven Denver metro area counties analyzed. In fact, since March 2015, housing unaffordability in Mesa County has risen by a staggering 82.4%, while average wages have only increased by 39% over the same period.

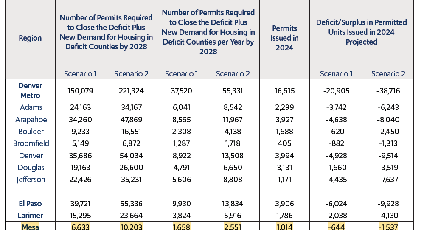

Home prices have more than doubled, rising 111% from January 2015 to March 2025, and the number of hours worked to pay a mortgage has skyrocketed from 47 per month to 100. The housing supply has failed to keep pace with demand, exacerbating the crisis. According to the Common Sense Institute study, Mesa County needs between 1,650 and 2,550 new residential units per year to close the existing gap and meet projected growth by 2028.

However, in 2024, only 1,014 permits were issued, leaving a deficit of between 644 and 1,537 units for the year. The study highlights several factors contributing to the crisis, including interest rates, increasing costs of building materials, and local regulations such as the new state energy code requirements and Grand Junction's impact fee schedule.

To address this issue, local leaders must prioritize increasing housing stock at all price points. A cost-benefit analysis of regulatory changes and input from the housing industry should be a hallmark of future rulemaking impacting housing. The 64% of local households that cannot afford a home today are counting on us to figure out how to narrow the deficit in housing for our community.