P

aid press release. For questions, contact the distributor directly.

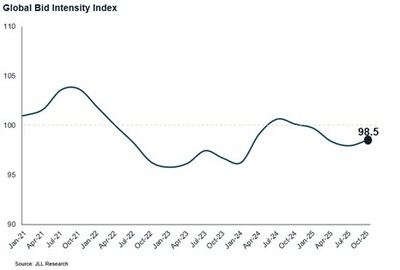

JLL’s Global Bid Intensity Index climbed in October, indicating a surge in capital inflows and heightened competition ahead. The index, a real‑time gauge of liquidity and bidder activity across global private real‑estate markets, shows that after a July turning point, momentum has accelerated. October delivered the second‑largest monthly rise in bidder dynamics this year, helped by the Federal Reserve’s rate cuts in September and October.

Richard Bloxam, CEO of JLL Capital Markets, noted that “institutional investors are showing renewed confidence as capital deployment speeds up in Q3, even amid lingering uncertainty.” He added that business sentiment is expected to keep improving, paving the way for continued capital growth into 2026.

The Living/Multi‑Housing segment remains the most active, driven by near‑record dry powder and persistent housing shortages in major markets. Industrial and Logistics sectors have rebounded as trade‑policy uncertainty eases, while Retail liquidity deepens across new sub‑types. Although increased transaction launches have slightly softened bidding competitiveness, consumer and retail spending still outpaces expectations.

Office markets are rebounding sharply from late‑2023 lows, with a broader bidder pool and greater lender participation. Bloxam emphasized that property fundamentals and valuations have largely held steady in 2025. While uncertainty will still influence decisions, the outlook for 2026 looks brighter. Investors are increasingly willing to take on risk, and robust debt markets are expected to further enhance liquidity.