I

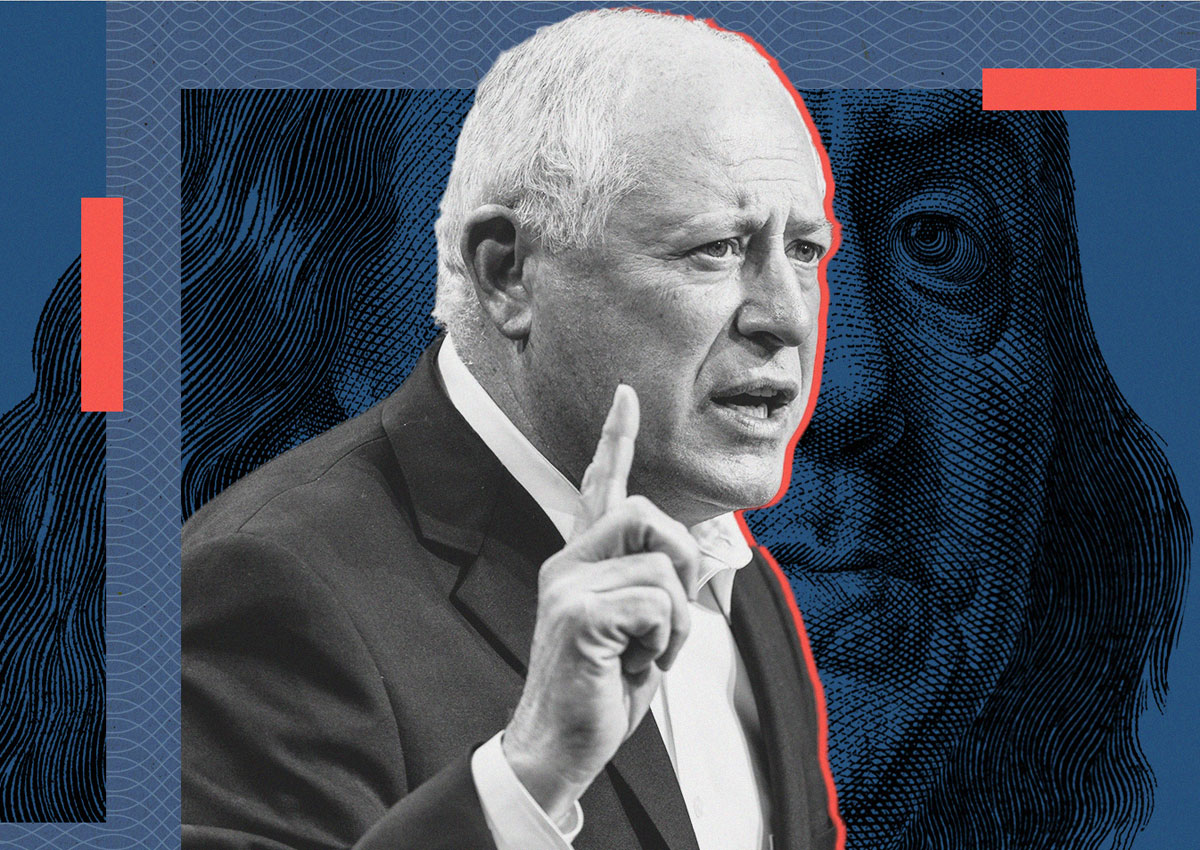

llinois voters overwhelmingly supported a "millionaire's tax" that would impose a 3% surcharge on incomes exceeding $1 million annually, with 60% of voters in favor. The nonbinding advisory measure could shape legislative efforts and provide property-tax relief for homeowners statewide. Former Governor Pat Quinn hailed the result as a potential game-changer, estimating it could generate up to $4.5 billion in tax revenue annually.

The initiative was one of several measures approved by voters, including expanding in vitro fertilization insurance coverage (72% approval) and increasing protections for election workers (89% approval). In other real estate-related news, Larry Rogers Jr. won 81% of the vote for Cook County Board of Review, backed by the real estate industry.

Rogers' campaign received significant donations from property tax attorneys and appraisers, as well as contributions from prominent Chicago-area developers like Andy Gloor and Keating Crown. The outcome could have implications for Cook County Assessor Fritz Kaegi, who has been critical of Rogers.