F

inancials in Focus: Instone Real Estate Group's Latest Numbers

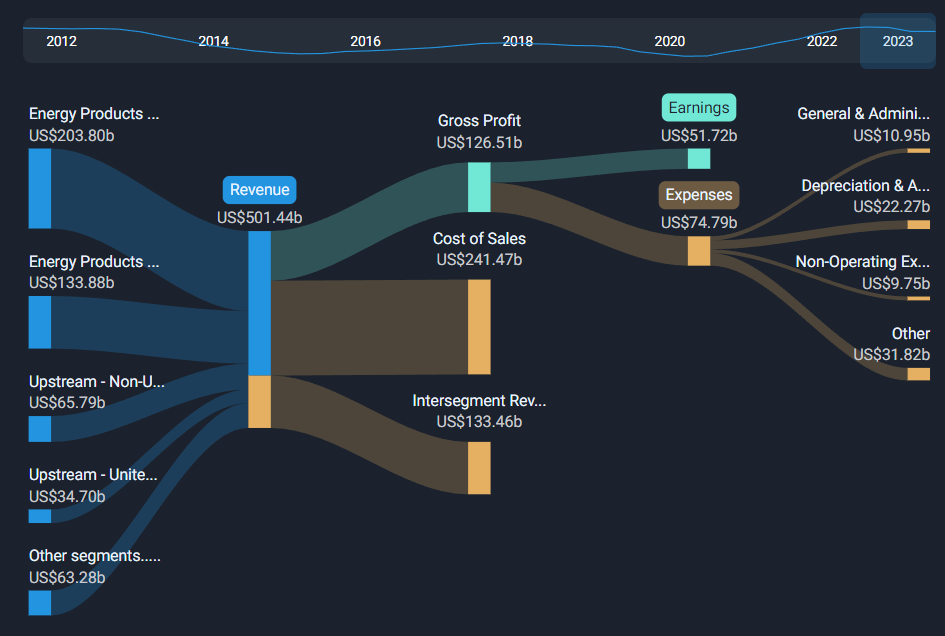

The German real estate player has just released its latest financials, and the numbers are telling a story of resilience. Revenue dipped 16% year-over-year to €434.6 million, but net income soared 55% to €31.2 million, driven by a significant reduction in expenses.

This shift in profitability is reflected in the company's profit margin, which expanded from 3.9% to 7.2%. Earnings per share (EPS) also saw a notable increase, rising from €0.46 to €0.72.

Looking ahead, analysts forecast revenue growth of 21% annually over the next two years, outpacing the decline expected in Germany's real estate sector. However, investors should remain cautious, as Instone Real Estate Group has one warning sign that warrants attention.

Despite a recent dip of 7.1%, the company's shares still hold promise for long-term investors. For those seeking dividend income, we've identified 21 US stocks forecast to yield over 6% next year – access the full list for free.

Note: All figures are based on trailing 12-month data and analyst forecasts. Our analysis is driven by fundamental data and unbiased methodology, but should not be considered financial advice. We aim to provide long-term focused insights that may not account for recent company announcements or qualitative factors.