L

ynchburg residents are bracing for a potential tax bombshell as the city council weighs its options on real estate taxes. The decision hinges on the 2025 reassessment, which has seen property values skyrocket. According to the city assessor's office, median single-family home values have jumped from $185,000 in 2023 to $219,000 in 2025.

If the current tax rate of $0.89 per $100 of assessed value remains unchanged, homeowners with median-value properties could see their taxes soar by nearly $300 annually, from over $1,600 to almost $2,000. Councilman Marty Misjuns is adamant that he'll fight against a tax increase, citing his constituents' opposition.

However, Councilman Sterling Wilder advocates for maintaining the current rate, emphasizing budgetary constraints. "If you want a lower rate, what are you willing to give up?" he asked. Wilder acknowledges that citizens may not want higher taxes but stresses the importance of city services.

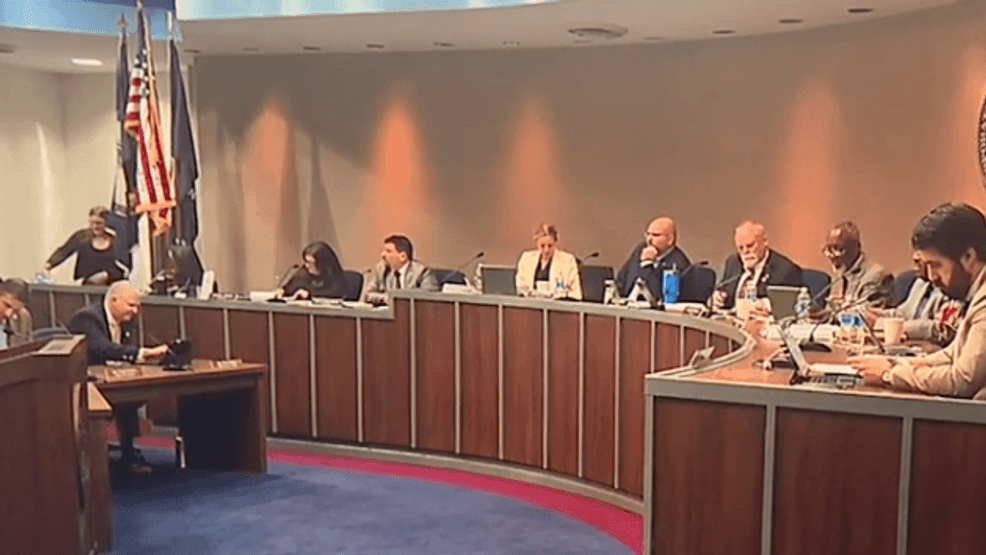

A public hearing is scheduled for April 22, where officials will present their projections: a more than seven percent increase in the city budget if the council retains the current tax rate. The decision ultimately rests with the six-member council, and only time will tell how they'll balance the books.