T

he Lynchburg City Council will tackle contentious issues at its twice-scheduled meeting on Tuesday. A work session is set for 4 p.m. in the second-floor conference room of city hall, where Vice Mayor Curt Diemer plans to discuss a video posted on city media channels that he claims defamed a local citizen.

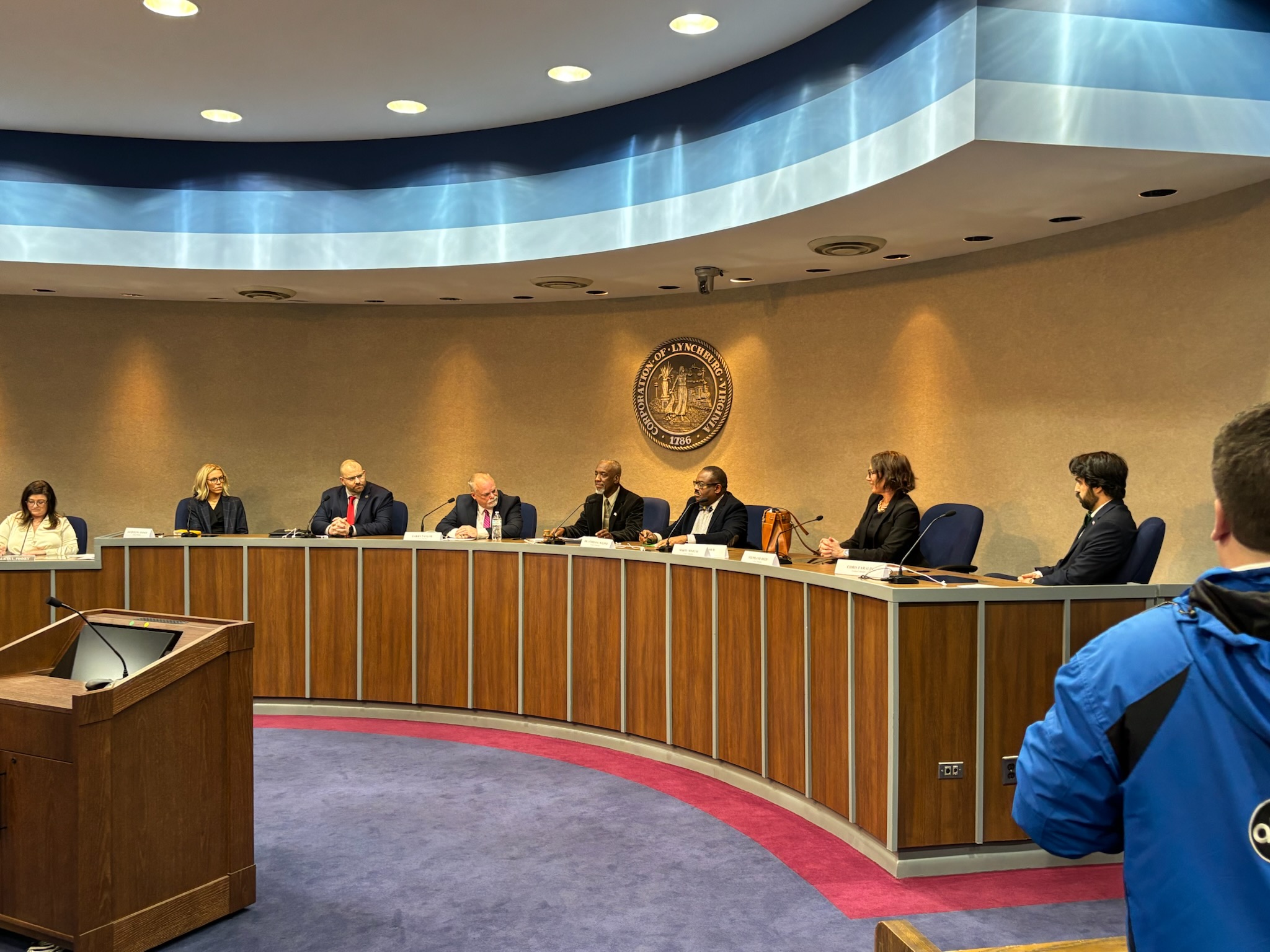

Conflict among council members has been ongoing, with the May 27 meeting featuring heated exchanges between Chris Faraldi and Martin Misjuns. The regular meeting at 7 p.m. in council chambers will focus on several key items, including setting the real estate tax rate for the upcoming fiscal year.

The draft ordinance does not specify a tax rate, but a proposal to maintain the current rate of 89 cents per $100 of assessed value was met with resistance due to a recent property reassessment that increased values by an average of 20%. To keep tax bills steady, council members would need to lower the rate to 76.7 cents per $100.

A public hearing will be held on increasing the transient lodging tax from 6.5% to 8.5% and raising the daily room fee from $1 to $3. A previous proposal to raise the tax to 12.5% was rejected after residents and business owners expressed concerns.

Additionally, a public hearing will discuss rates for ambulance services provided by the fire department. The proposed changes would increase nonemergency transport fees from $350 to $422.07 per trip and emergency transport fees from $500 to $675.30. These rate hikes are expected to generate an estimated $200,000 more in revenue annually.