M

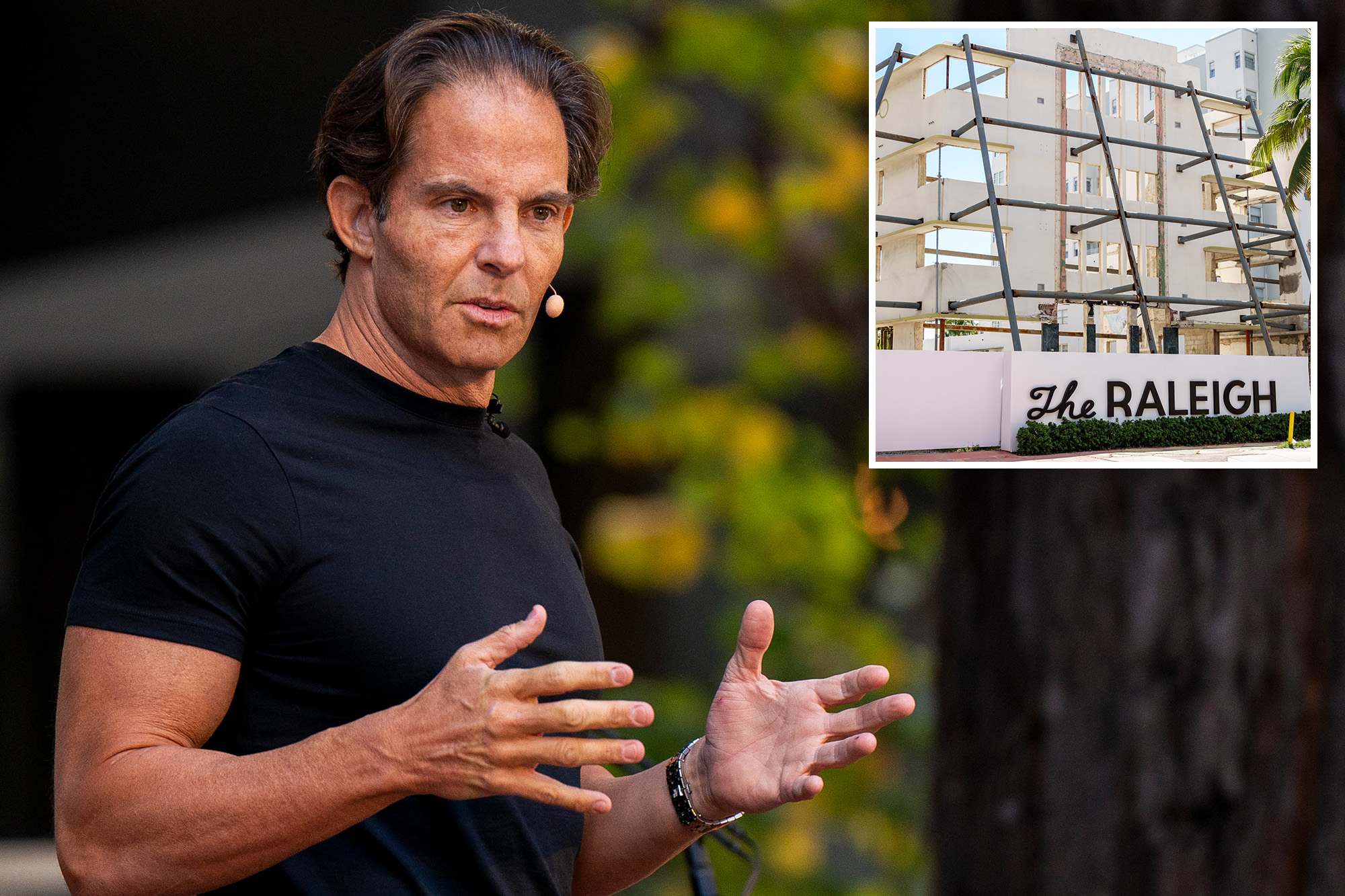

ichael Shvo, the former New York real‑estate star, sold Miami’s historic Raleigh Hotel to Nahla Capital for $270 million, according to Bloomberg. The deal followed years of sluggish condo sales, halted construction and a looming $190 million mortgage. Shvo and partners had bought the Collins Avenue site in 2019 for $219 million and earmarked $1 billion—including the purchase price—to restore the landmark and convert rooms into luxury condos, but the property had long been a derelict eyesore amid the area’s Art Deco hotels.

Nahla Capital, based in Manhattan, owns projects such as Rosewood Residents in Beverly Hills, 152 Elizabeth St. in NoLiTa, and a new condo tower at 1122 Madison Ave. Shvo’s spokesperson declined to comment.

Shvo’s career has been marked by controversy. Born in Israel, he rose quickly at Douglas Elliman in the early 2000s before a bitter feud with rival broker Dolly Lenz earned him the nickname “the most loathed broker in New York.” His charismatic style sometimes overpowered others; at a 2007 Real Deal forum, he interrupted prominent figures like Stephen M. Ross and Amanda Burden. In 2018, he pleaded guilty to second‑ and third‑degree tax fraud related to art purchases, paid a $3.5 million fine, and avoided prison.

Recent setbacks include the sale of an office‑development site on South Beach’s Alton Road to stave off foreclosure. Shvo and a partner, German pension fund BVK, are embroiled in litigation over multiple disputes, while BVK faces scrutiny in its home country over its dealings with Shvo. He is also attempting to sell units at the Mandarin Oriental Residences on Fifth Avenue, where only 19 of 65 apartments have sold; a buyer sued him over alleged construction defects in a $6 million unit and for allegedly treating the rooftop pool as a personal domain. In 2023, he lost the Beverly Hills Mandarin Oriental Residences to Centurion Investment Partners after defaulting on a $200 million loan.

A legal battle with Core Club founders Jennie and Dangene Enterprise ended with a Manhattan judge ruling that Shvo could not evict the club at 711 Fifth Avenue, despite claims of rent default. The club’s owners accused him of a “sinister and fraudulent scheme” and of sabotaging its launch.

Despite these challenges, Shvo has a notable success: the Transamerica Pyramid in San Francisco. His company purchased the building for $650 million in 2020, invested an additional $400 million in repairs and modernization, and attracted high‑profile tenants such as Morgan Lewis. Shvo predicts the tower will be fully occupied within the next year.