C

ondo Owners Oppose Sale Plan Despite Court Ruling

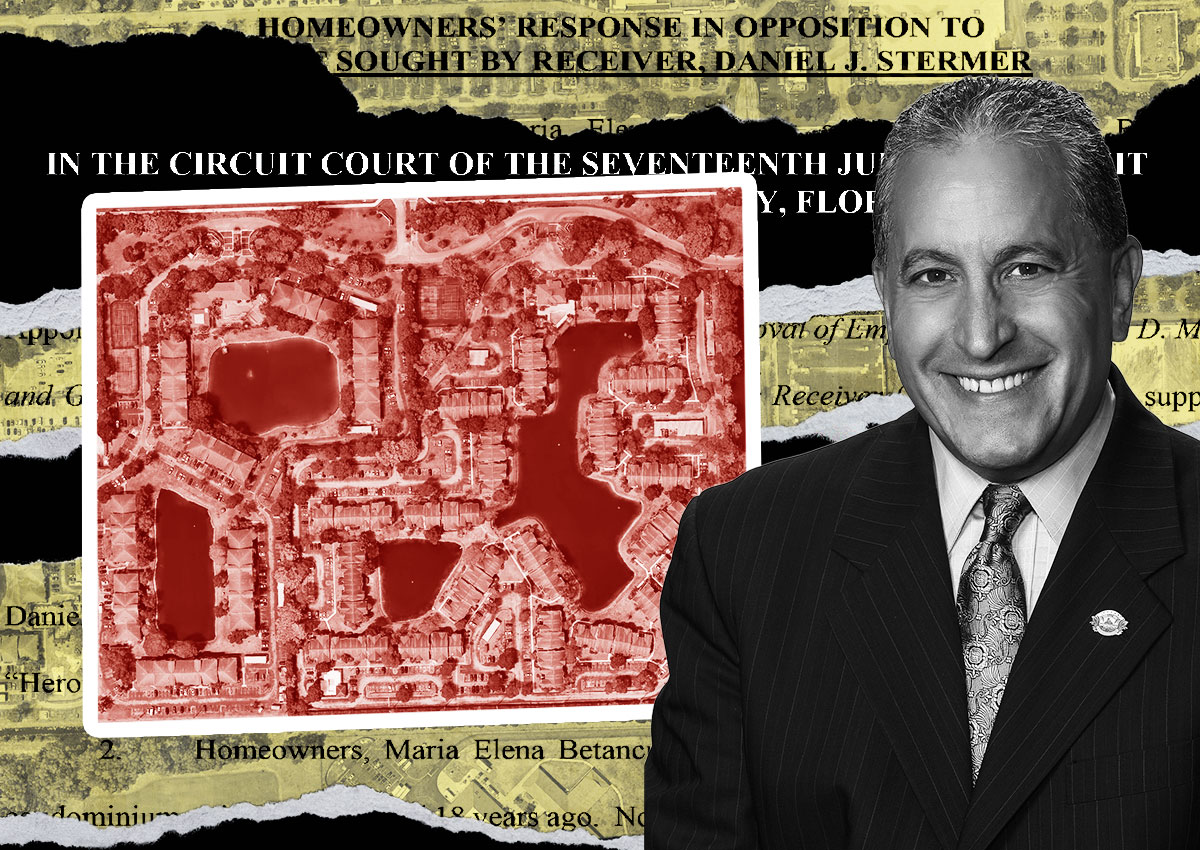

In a recent court hearing, a pair of condo owners at the embattled Heron Pond complex in Pembroke Pines opposed the receiver’s plan to list the property for sale. The 25-acre Heron Pond, located at 8400 Southwest First Street, is home to 304 units in 19 two-story buildings. Since last summer, the city has issued multiple unsafe structure notices for six buildings and 26 units in seven other buildings, rendering them uninhabitable.

The receiver, Daniel Stermer, was appointed in April, and further engineering reports showed hidden deficiencies in lateral load resistance, leading to the evacuation of all remaining residents late last month. Stermer now wants to set the stage for a marketing process to raise the sale price. Unit owners Maria Elena Betancur and Gloria Patricia Betancur opposed the receiver’s motion to hire Greenspoon Marder attorney Dennis Mele as special counsel during a court hearing on Wednesday. They also opposed hiring Condominium Advisory Group to help with the termination of the association.

The Betancurs take issue with the costs of the receivership, including the additional hiring of advisers to the sale, as well as with some of Stermer’s decisions so far. Homeowners now face higher costs to relocate and the potential loss of their equity in Heron Pond units, all while the association’s funds are bankrolling the receivership.

Judge Jack Tuter Jr. sided with Stermer, capping Greenspoon Marder’s rate at $600 per hour, less than Mele’s hourly rate of $775. Elizabeth Perez, the Betancurs’ attorney, said homeowners were under the impression that when the receiver was appointed, they could rehab these properties. Instead, they are left looking for a new place to live, facing higher prices, and paying expenses out of their pocket.

The Betancurs paid $201,900 for their 1,033-square-foot unit in 2007. Tuter said he was limited in what he could do. “What is your solution? Let’s just sit there and do nothing and just let the properties fall into further decline?” he told Perez during Wednesday’s hearing.

Brian Rich, an attorney for the receiver, said Condominium Advisory’s contract is set at $3,000 a month and can be canceled with a 30-day notice. Perez said after the hearing that her clients are contemplating all legal options available to them, one of which would potentially be a lawsuit against the association.

The plan to sell Heron Pond marks the latest chapter in the complex’s long-running saga, which includes accusations against former board members of purposeful mismanagement. In their motion, the Betancurs bring up claims similar to those made by other unit owners in past court filings. They point to Federated Foundation Trust as a secretive entity that amassed 111 units, allowing people tied to the trust to take board seats.

Stermer’s decision to sell Heron Pond could pave the path for Federated to buy units at a discount. The receiver’s goal has been to take the easy way out by selling Heron Pond, according to the Betancurs. They believe he should have been doing a historical accounting of allegedly misappropriated funds and investigating Patel/Viradia.

Keith Grumer, an attorney for Federated Foundation Trust, denied allegations against the trust. He called some of the claims in Betancurs’ motion “slanderous” and said the filing lays out no supporting evidence. The Betancurs’ filing only impedes the sale, leading to higher costs for homeowners.

In a non-binding poll by the receiver, 86 percent of those who voted agreed to a sale. Owners representing 80 percent of the units participated in the poll. Federated Foundation voted in favor of a sale, according to Stermer’s report.

A special assessment for needed repairs would break down to at least $40,000 per unit, Stermer wrote in his report. The Betancurs argued that Stermer is presenting a “false dichotomy” between selling or paying at least $40,000, arguing that another engineering report contradicts some of the findings in the receiver’s engineer’s report regarding the extent of disrepair.

The complete evacuation came after ACG Engineering Services’ July report that determined lateral load resistance deficiencies in some buildings undergoing repairs, due to inadequate design and construction. Because they are embedded in the “bones” of buildings and can’t be seen, ACG recommended the complete evacuation at least until hurricane season ends or repairs are completed.

Exactly how funds from a sale will be divided among unit owners hasn’t been decided, Stermer said. In his report to the court filed last month, Stermer pointed out a state law that says if the disbursement to a homeowner is less than the outstanding mortgage balance on a condo unit, the lender has to accept the homeowner’s proceeds as satisfying the mortgage. This means unit owners won’t be on the hook for more than they receive to pay off their mortgage, but they also won’t make a profit.