O

’Reilly Auto Parts has already opened more than 160 new locations in 2025 and is on track to reach 200 by year‑end. During the Q3 2025 earnings call, executives announced plans to add up to 235 additional stores in 2026. Most new sites will follow the company’s 7,000‑square‑foot prototype, which accounts for over 90% of its 6,400‑plus store network. The chain is also expanding its “hub” format—about 14,000 square feet, roughly twice the size of a standard outlet—and a handful of “super hubs” that can reach 50,000 square feet.

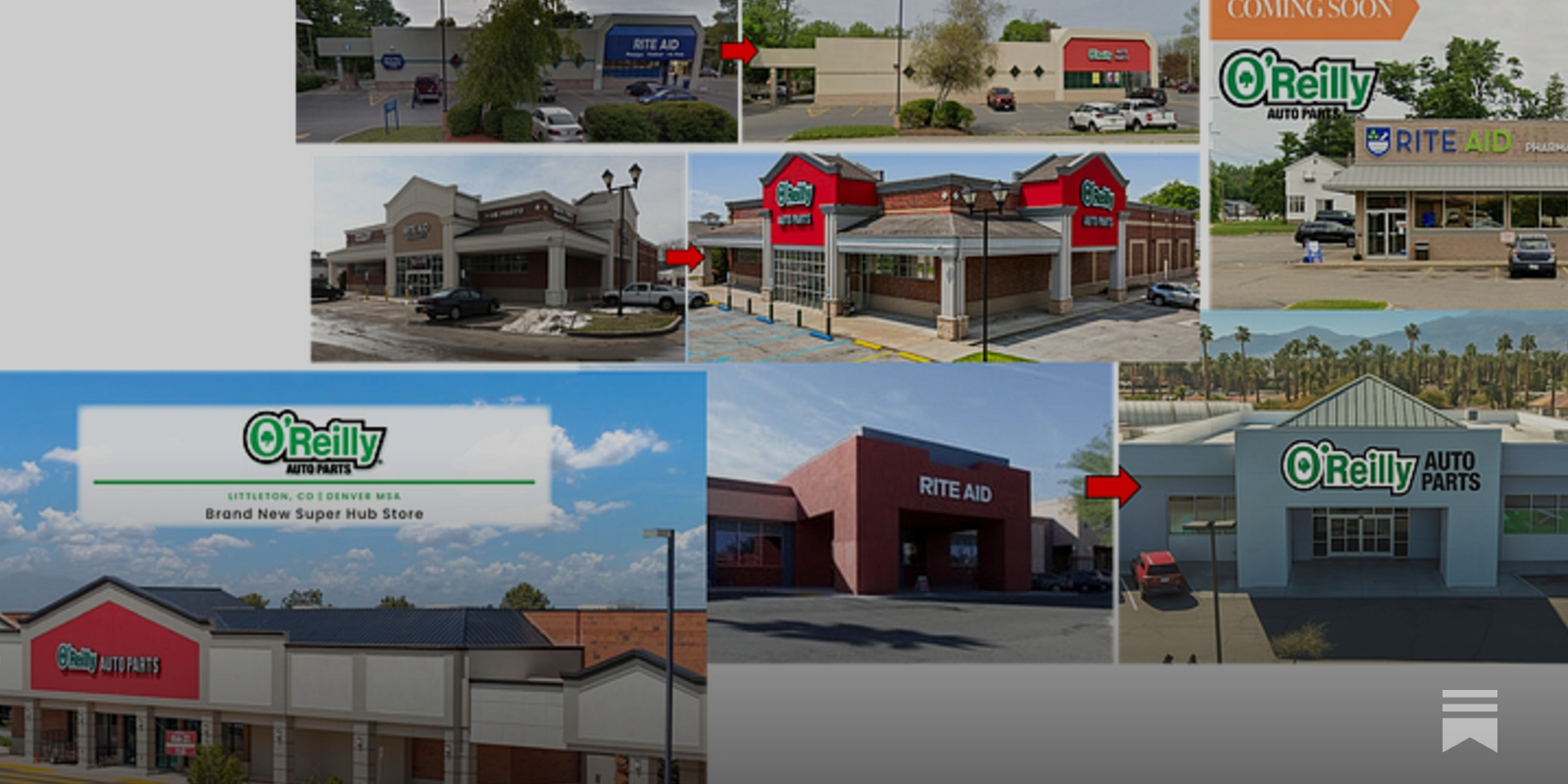

A key driver of this growth is the repurposing of existing retail properties. O’Reilly has been converting former drugstores, especially the 2,000+ vacant Rite Aid locations that emerged after the chain’s 2023 and 2025 bankruptcies. The company has already transformed dozens of these sites across the country, including properties in Michigan, Ohio, and New York—from Poughkeepsie to Rochester’s suburb of Greece and the small town of West Carthage. These former Rite Aids are attractive because they sit in the Northeast and Mid‑Atlantic, regions where O’Reilly has historically been under‑served, and their square‑footage aligns well with the 7,000‑square‑foot prototype.

Using existing buildings also cuts costs. CEO Brad Beckham noted that a new, ground‑up store typically costs about $3 million to build, but converting a pre‑existing Rite Aid can be done with minimal renovations, offering greater budget certainty and faster openings. This advantage is especially valuable as land, construction, and development costs rise.

The same repurposing strategy is fueling the rollout of hub stores. Many of the 14,000‑square‑foot hubs are housed in former drugstore sites that match the size and layout needed for the larger format. Examples include a 17,000‑square‑foot former Rite Aid in Palm Desert, CA, and a 15,000‑square‑foot former Rite Aid in Lockport, NY, both recently opened as O’Reilly hubs. Other auto‑parts retailers—Advance Auto Parts, AutoZone, and Napa Auto Parts—have also opened stores in former Rite Aid, Walgreens, and CVS locations.

O’Reilly is also testing “super hubs,” which can reach up to 50,000 square feet and are typically located in high‑density metropolitan areas. These larger sites are being sourced from vacant big‑box real estate. For instance, a 48,000‑square‑foot former furniture store in Littleton, CO, and a 42,000‑square‑foot former big‑box retailer in Merrillville, IN, have been converted into super hubs. In Appleton, WI, the city issued a permit for O’Reilly to transform half of a 100,000‑square‑foot former Shopko building into a super hub.

Across all formats, the common thread is the reuse of vacant retail space. With the recent wave of Rite Aid closures and the availability of big‑box properties from bankruptcies of Conn’s, Big Lots, and Joann Stores, O’Reilly is poised to open many more repurposed locations in 2025 and beyond.