I

n November, Riverside financial advisors Laura and Jeremiah Lee hosted a private networking session at Victoria Country Club, inviting local business owners, commercial property investors, and long‑time residents to discuss a topic that keeps surfacing: building wealth through local commercial real estate. The event, co‑organized with Stance Commercial Real Estate, a Riverside‑based brokerage, gathered a crowd of seasoned entrepreneurs and property owners who have called the city home for years.

TriCord Advisors, the husband‑and‑wife firm, is a fee‑based, fiduciary‑driven advisory group with four Certified Financial Planner™ professionals. Their partnership with commercial real estate experts reflects a holistic view of wealth creation, especially for clients who already own or are considering owning commercial assets. Roughly 30 % of TriCord’s clientele hold commercial property, yet many are unaware of the tax advantages and estate‑planning benefits that come with such holdings. Jeremiah Lee notes that clients often lack insight into the time and effort required to manage these assets.

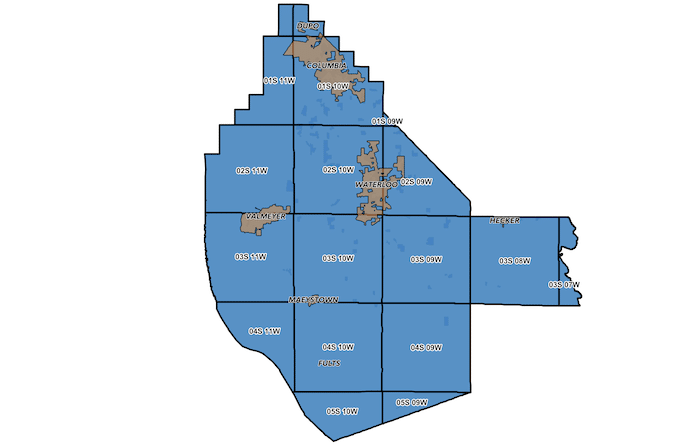

The workshop delivered hard data on Riverside’s market. Office space enjoys a 95 % occupancy rate—the lowest vacancy rate nationwide—while retail and industrial sectors sit at 94 % and 90 % respectively. Lease rates average $2.39 per square foot for office and $2.08 for retail, with sales prices around $243 and $295 per square foot. Stance’s presentation framed these figures as a baseline for evaluating investment opportunities.

Local market knowledge proves crucial. National retailers may overlook Riverside due to outdated demographics, but insiders see the city’s evolving profile: rising household incomes and shifting consumer patterns. The upcoming construction of Fleming’s Steakhouse at The Mark downtown signals that national brands are recognizing these changes. Jeremiah Lee recalls a client who, during the pandemic, leveraged a 1031 exchange to swap five residential rentals for a single commercial office building, sidestepping capital gains taxes while securing steadier cash flow and a more manageable asset for future generations.

The event highlighted that many commercial owners are also residents, not just external investors. One attendee remarked that the community is built on people who live, work, and own property locally, rather than outsiders testing the market. This local ownership creates a unique dynamic where investment decisions are intertwined with community well‑being.

Laura Lee emphasized that every client’s financial picture is distinct. TriCord begins by analyzing current data and then explores the client’s long‑term goals—personal finances, business, family legacy, and retirement. Commercial real estate often fits into diversified portfolios as a vehicle for tax efficiency and estate planning. The fee‑based model aligns TriCord’s incentives with client outcomes, avoiding product sales pressures.

Key questions addressed include whether to hold or sell a commercial property, how real estate fits into retirement income, and the optimal mix of liquid assets versus property holdings. TriCord’s approach is to tailor strategies to each client’s unique circumstances, leveraging local market insights.

Beyond the event, TriCord engages the community through a weekly series called “Building Wealthy Habits,” covering financial topics and fostering shared learning. Laura Lee highlighted that assembling the right mix of local residents, property owners, and business operators creates a fertile ground for meaningful financial dialogue. The firm’s deep community ties and professional expertise equip clients to navigate strategies that capitalize on Riverside’s specific opportunities.