M

arcus & Millichap has issued a research brief on the federal shutdown that began on October 1, 2025. The analysis indicates that commercial real estate (CRE) will feel little direct pressure in the short term, though a prolonged halt could expose the sector to new risks.

**Economic implications**

- **GDP slowdown:** Each week the shutdown persists, U.S. GDP growth could slip by 15–20 basis points, a hit that usually rebounds once the government reopens.

- **Data gaps:** Key economic releases—employment figures, consumer price indices from the Bureau of Labor Statistics and other agencies—are delayed, forcing investors and policymakers to rely on alternative indicators.

- **CRE outlook:** Past shutdowns show limited long‑term damage to CRE. The main short‑term threat is a dip in consumer and business confidence, which could dampen spending and property sales.

- **Fed stance:** Despite missing data, the Federal Reserve is expected to continue policy decisions, with the possibility of future rate cuts.

**Key points from the brief**

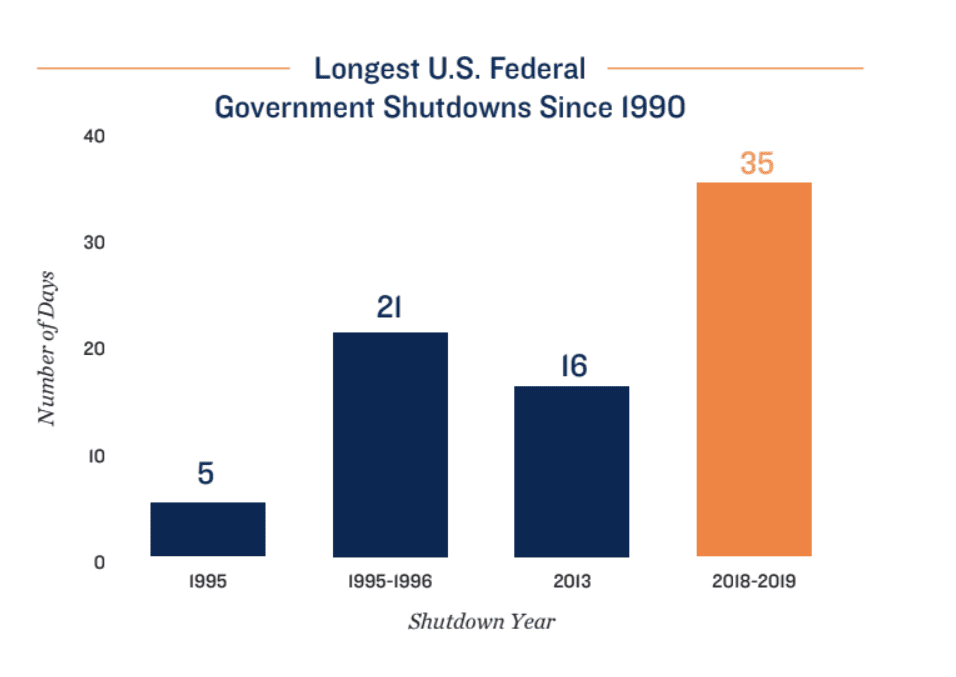

- **Historical context:** The 2025 shutdown resembles the 2013 full closure more than the 2018‑19 partial shutdown. The 2013 event furloughed 850,000 workers and cut GDP, but most of that loss was later recovered.

- **Direct vs. indirect effects:** Marcus & Millichap stresses that indirect, market‑driven impacts are the primary concern for CRE; direct effects are expected to be contained.

- **Furlough scale:** Roughly 550,000 to 750,000 federal employees will be furloughed.

**Implications for CRE**

Immediate effects are projected to be modest. However, a longer shutdown could erode employment prospects and negatively influence household formation, consumer spending, and home sales, thereby tightening the CRE market.