S

oHo, a vibrant neighborhood in Lower Manhattan, boasts an impressive array of top-notch restaurants, art galleries, and shopping options. This makes it a magnet for tourists and a prime target for investors.

Despite its popularity, SoHo's vacancy rate is surprisingly low, posing a significant challenge to developers looking to revamp or build new retail spaces. As a result, property owners are being highly selective about which brands they invite to fill the limited available space in this supply-constrained area.

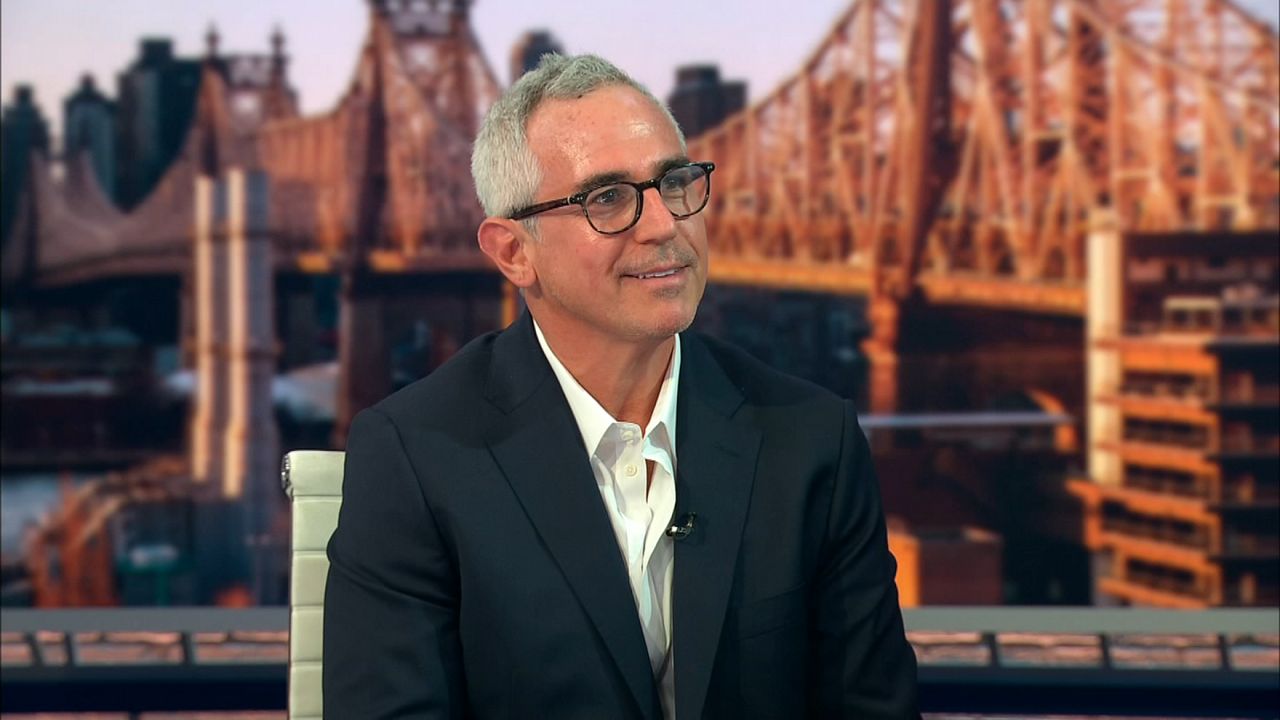

Greg Kraut, CEO and co-founder of KPG Funds, recently discussed the strategic approach to filling vacancies in SoHo on "The Rush Hour".