A

s the year draws to a close, savvy real estate investors are seeking ways to minimize their tax liability. One effective strategy is leveraging Qualified Opportunity Funds (QOFs), which offer significant tax benefits while promoting long-term growth in economically distressed communities across the US.

The QOF program incentivizes private investment in these areas by allowing investors to defer and reduce capital gains taxes. By directing funds into designated opportunity zones, investors can reap substantial tax advantages while contributing to community development.

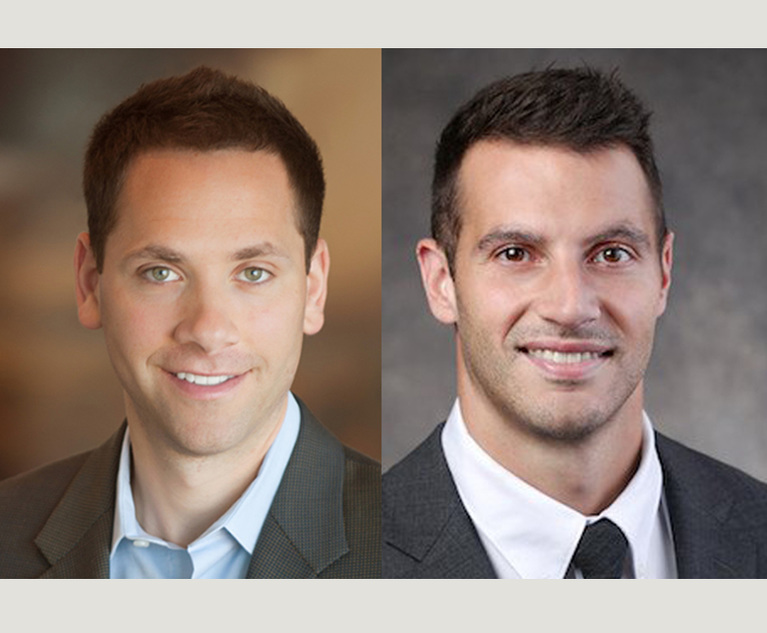

David S. Cohen and Liam T. Krahe, co-founders of SF QOZ Fund I, are at the forefront of this trend. Their expertise in navigating the complexities of QOFs has helped numerous investors capitalize on these opportunities.

As real estate investors explore year-end tax planning strategies, incorporating QOFs into their portfolios can be a game-changer. By doing so, they can not only minimize their tax liability but also contribute to the revitalization of economically distressed communities nationwide.