I

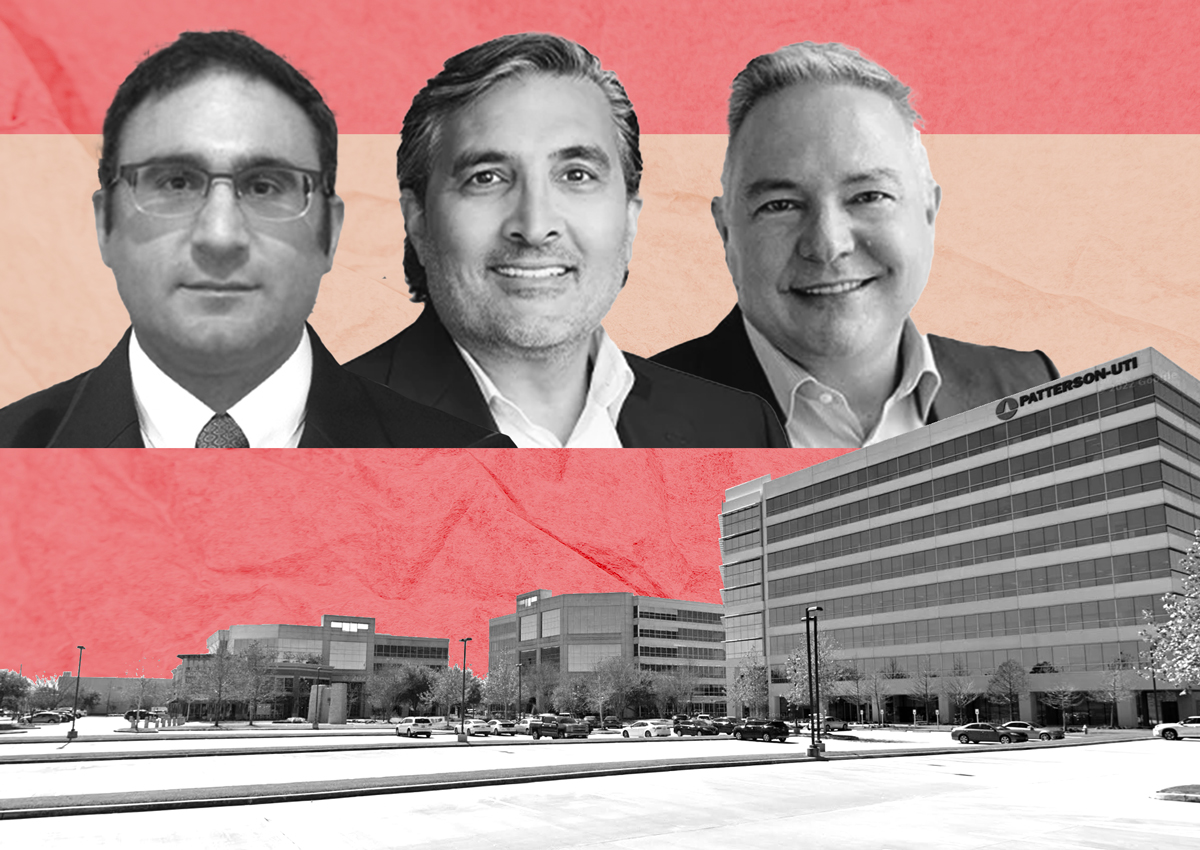

nterra Capital Group has acquired Remington Square, a 392,400-square-foot office complex in northwest Houston. The three-building property, located at 10603, 10613 and 10713 West Sam Houston Parkway, was purchased from New York-based BGO for an undisclosed price. Harris Central Appraisal District records valued the property this year at $73.5 million.

Developed by Stream Realty Partners and Sun Life, Remington Square features a First Watch restaurant, fitness center, tenant lounge, and conference rooms. The 16.8-acre campus has potential for an additional building. As of July, the complex was 77.2 percent leased to tenants including Patterson-UTI Energy and Republic Services.

Interra CEO Jack Polatsek views the acquisition as a strategic move in Houston's strengthening office market. "This property represents an opportunity to capitalize on market dynamics that favor well-positioned assets," he said. The purchase follows Interra's recent acquisitions of the historic Esperson complex and Memorial Pointe, underscoring its aggressive growth strategy in Houston.

Despite facing challenges with a vacancy rate nearing 26 percent in the third quarter, properties like Remington Square are faring better due to their newer construction. Class A office space posted significant absorption in the third quarter, while Class B space struggled.