O

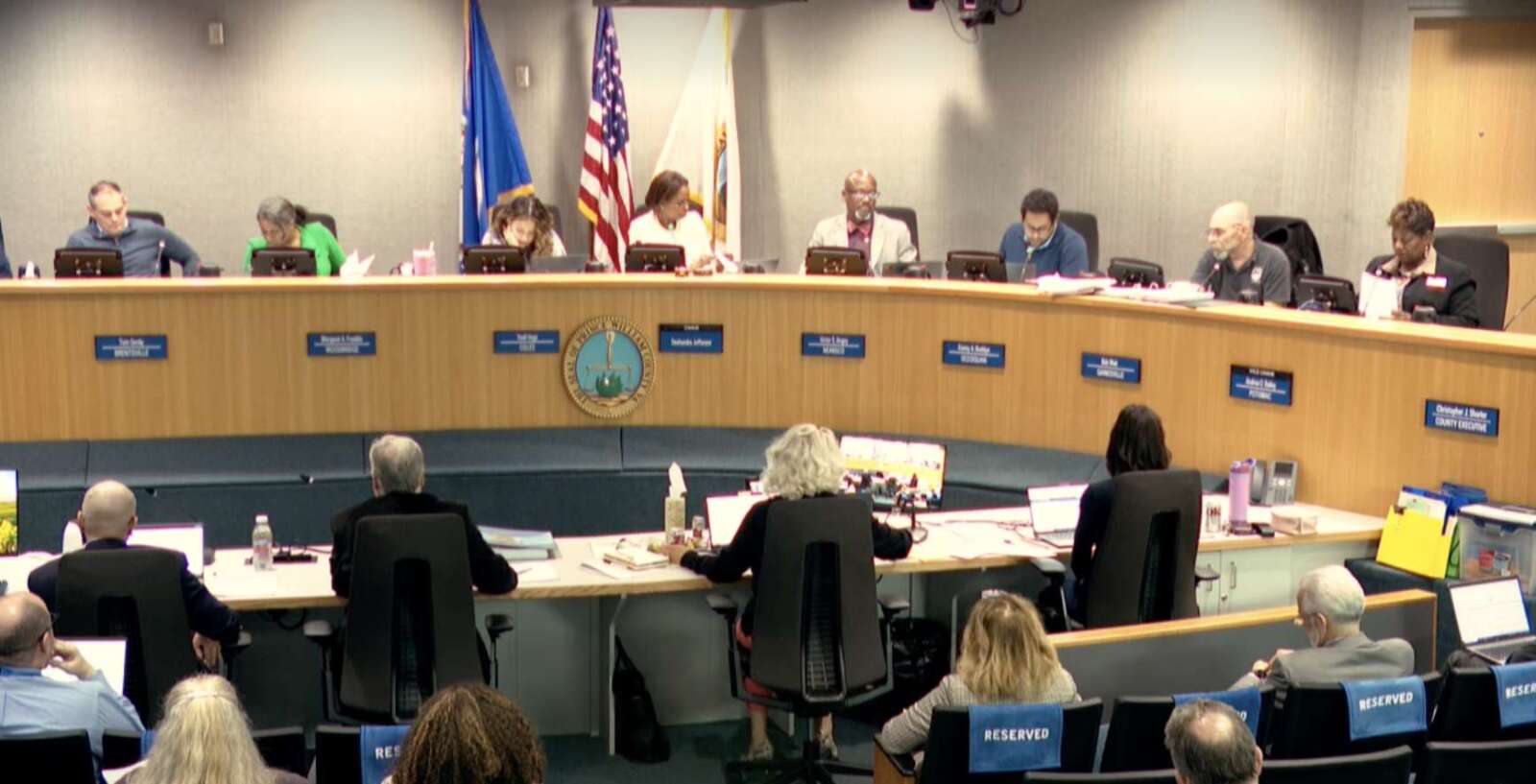

n April 15, 2025, the Prince William Board of County Supervisors converged for a pivotal budget markup session, where they fine-tuned the fiscal year 2026 budget and tax rates. The outcome was a delicate balance between providing relief to taxpayers and addressing pressing financial concerns.

A key decision was reducing the real estate tax rate from the proposed 92 cents per $100 of assessed value to $0.906, with some supervisors advocating for an even lower rate of 88 cents. Supervisor Yesli Vega emphasized the need for tangible tax relief, citing the struggles of residents living paycheck-to-paycheck.

However, others like Supervisor Andrea Bailey cautioned against drastic reductions, emphasizing the uncertainty of national economic trends and the importance of fiscal prudence. Supervisor Bob Weir proposed leveraging revenue from data centers to alleviate the burden on residential and commercial taxpayers.

The Board ultimately adopted a moderate approach, with Chair DeShundra Jefferson advocating for incremental tax decreases while also exploring opportunities to expand the commercial tax base through increased data center activity. The vehicle tax was reduced by 10 cents per $100 of assessed value, resulting in a $13.1 million revenue decrease, and the meals tax was decreased from 4% to 3%, yielding a $5.7 million reduction.

To offset these losses, the Board voted to increase the computer equipment and peripherals (C&EP) tax to $4.15 per $100 of assessed value, generating an additional $18 million in revenue. Supervisor Margaret Franklin expressed concerns about the impact on small businesses, highlighting the need for targeted relief measures.

Throughout the session, the Board also made various budget additions and deletions, including eliminating funds for Occoquan trails maintenance and allocating one-time funds for Williams Ordinary's historic preservation. The final fiscal year 2026 budget will be approved on April 22, 2025.