A

mong the familiar faces at Warriors games, one person often goes unnoticed: Brandon Shorenstein. He's a 39-year-old chairman and CEO of Shorenstein Properties, a real estate dynasty founded by his grandfather Walter. The company has owned a quarter of San Francisco's offices at its peak, but now it's struggling to stay afloat due to massive losses from distressed loans taken out during the previous decade. Since the pandemic, nearly $1 billion in loans have come under distress, forcing the company to cut 10% of its workforce and sell off several key properties.

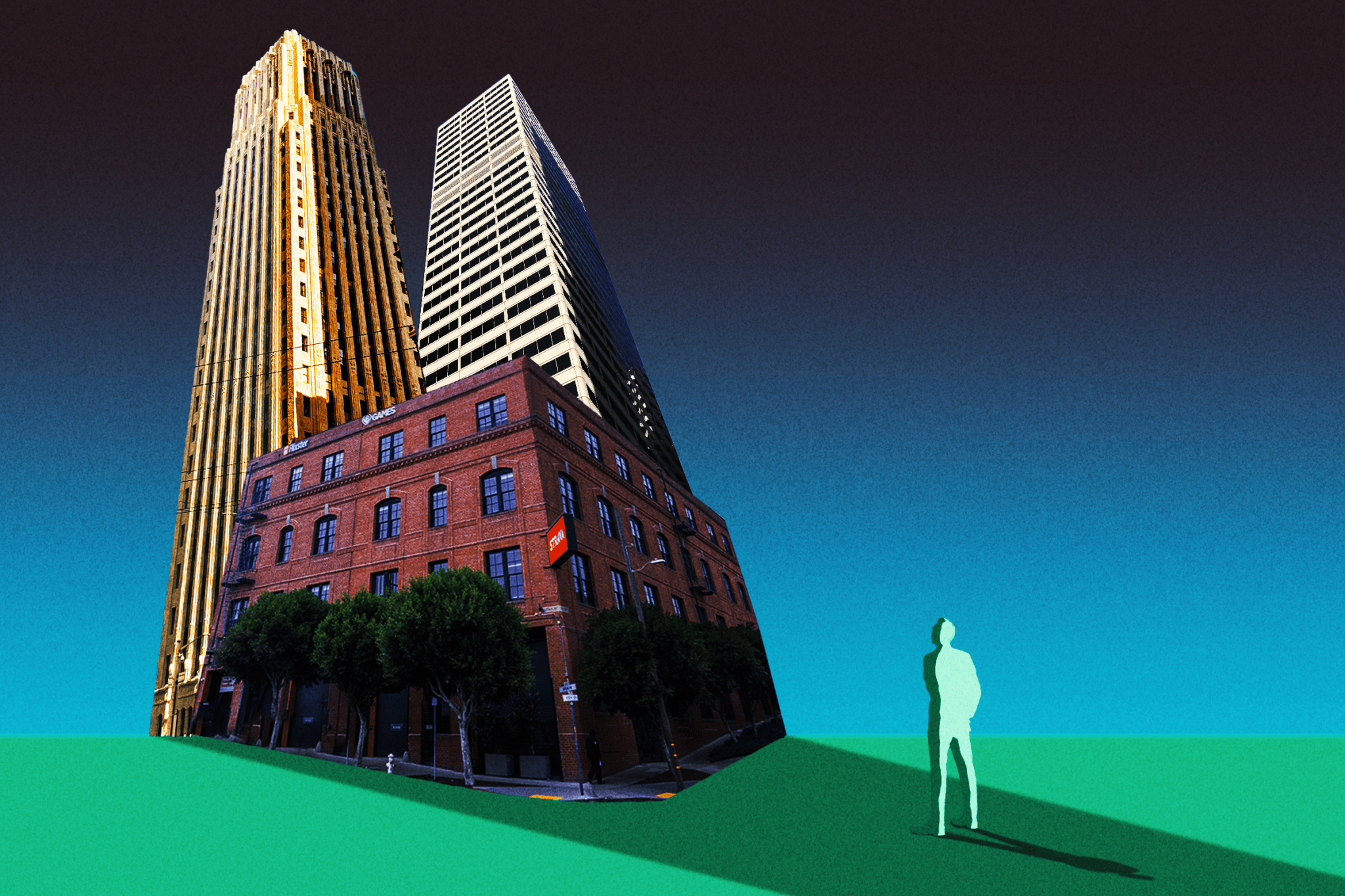

The list of Shorenstein Properties' struggles is long: firesales or seizures in Los Angeles, Minneapolis, New York, Philadelphia, Chicago, Houston, Denver, and Seattle. In San Francisco, lenders took control of a family asset at 208 Utah St., and another property, 45 Fremont, is being marketed for sale after the company defaulted on a $347-million loan.

Brandon's father, Douglas, built the business into a national empire in the 1990s, but he died of pancreatic cancer in 2015. Brandon took over at just 34 and has been criticized for continuing to purchase office buildings during the pandemic, exacerbating the company's problems. He declined to comment on this story through a spokesperson.

Industry sources describe Brandon as hard to pin down, preferring to meet at Chase Center or the Meadow Club rather than in his office. Despite his efforts to turn things around, Shorenstein Properties is still reeling from its mistakes. Even peripheral assets owned by the company are being seized, including an office building at 208 Utah St.

The Shorenstein name carries significant weight in San Francisco, with Brandon's grandmother founding the Asian Art Museum and his aunt owning the Curran Theater. However, Brandon has not taken on a public mantle of leadership like his predecessors, and his reputation is now tarnished by his company's struggles. His grandfather, Walter, was known for being a tough and influential figure in San Francisco real estate, but Brandon's approach has been more cautious.

Under Douglas' leadership, the company pursued investors outside of their traditional circle, starting the first Shorenstein Realty Investors fund in 1993. This strategy helped push the company to new heights and added to its clout. However, as time passed, the company's buying strategy became riskier and more speculative, leading to significant losses.

Brandon has made some mistakes during his tenure, including continuing to invest in offices despite the pandemic. He has also been criticized for not speaking up or taking responsibility for the company's problems. Industry sources describe him as deferential at first after his father's death but increasingly assertive as he's grown into the role. Despite this, Shorenstein Properties is still struggling to recover from its mistakes and may be on the verge of a major overhaul.